FameEX Daily Market Trend | BTC Rebounds Back Into Its Trading Range as ETH’s Upgrade Becomes the New Market Focus

2025-12-04 09:07:46

As fear sentiment remains anchored in the mid-20s, BTC has rebounded toward approximately $93K, recovering from its early-week lows. Yet the broader crypto market cap continues to trade at a substantial discount to prior highs, underscoring that the rebound resembles a technical repair within a fear zone rather than a full sentiment reversal. Following the formal activation of the Fusaka upgrade, ETH has reclaimed levels above $3K, strengthening its fundamental narrative. Still, futures leverage and structural flows remain cautious, with investors opting for low-leverage positioning and structural rebalancing in response to macro uncertainty and regulatory signals. Overall, fear has not fully dissipated, but capital is beginning to reprice the market with greater discipline.

1. Market Summary

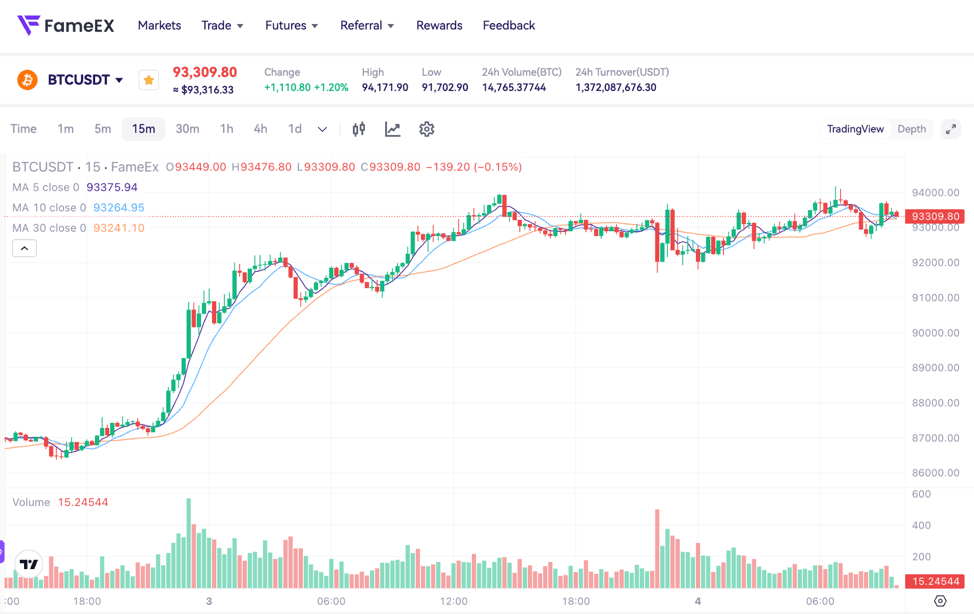

- BTC is oscillating near $93K, having recovered from a sharp pullback that briefly pushed prices toward $84K, though still trading at a meaningful discount to the prior peak above $120K. The market resembles a base-building range rather than a directional trend reversal.

- ETH reclaimed $3K and approached $3,200 after the completion of the Fusaka upgrade, outperforming BTC in the short term. Yet it remains roughly one-third below its all-time high, signaling that the fundamental premium from the upgrade is still in an early repricing phase.

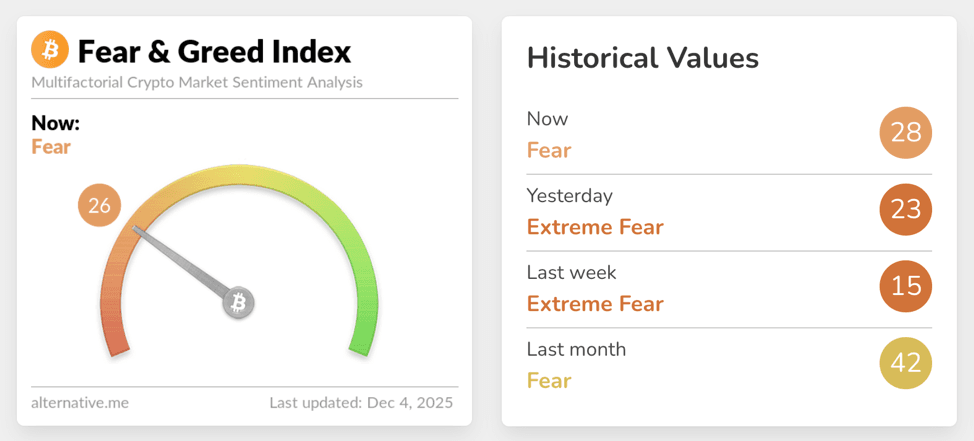

- The Fear & Greed Index currently sits at 26, down from 28 the previous day, remaining in the “Fear” zone. Although sentiment has improved relative to last week’s “Extreme Fear” reading of 22, it remains far from neutral territory. Risk appetite has not meaningfully recovered.

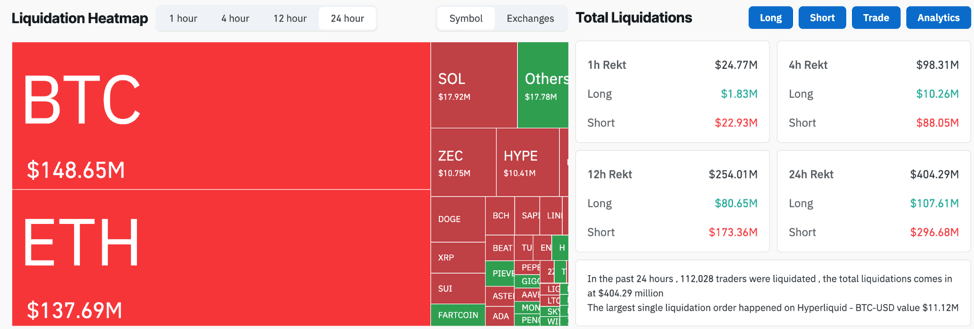

- Roughly 404 million dollars in total liquidations occurred over the past 24 hours, with short liquidations at approximately 297 million dollars, significantly exceeding the 108 million dollars in long liquidations. For both BTC and ETH, short-side liquidations exceeded 100 million dollars, indicating that the rebound was driven by the unwinding of overly pessimistic positions rather than new leverage inflows.

- At the macro level, weaker U.S. employment and consumer indicators, combined with uncertainty around AI capital expenditures and energy constraints, continue to weigh on sentiment. Still, expectations of future monetary easing are rising, supporting equities, gold, and digital assets. In contrast, crypto leverage appetite remains subdued, resulting in a split structure where fundamentals and liquidity expectations improve, but sentiment and positioning lag behind.

2. Market Sentiment / Emotion Indicators

The Fear & Greed Index is at 26, within the “Fear” band—slightly weaker than yesterday’s 28 but materially better than last week’s “Extreme Fear” reading of 22 and the low-20s observed last month. This pattern indicates that although prices have stabilized, investor positioning remains defensive. Deep drawdowns and heightened volatility have already forced excessive leverage out of the system, yet no new wave of greed-driven risk-taking has emerged. Investors prefer buying selectively on dips while keeping directional leverage contained. In essence, the index reflects fear moderated by rational capital flows, rather than panic or exuberance.

Source: Alternative

In the derivatives market, approximately 404 million dollars in liquidations occurred over the past 24 hours, with short-side liquidations about 297 million dollars, far exceeding long-side liquidations about 108 million dollars. During the rebound from recent lows, large concentrations of short leverage were squeezed. BTC saw roughly 42.73 million dollars in long liquidations and around 106 million dollars in short liquidations. ETH recorded about 22.09 million dollars in long liquidations and roughly 116 million dollars in short liquidations. The largest single liquidation event exceeded 11 million dollars on a major derivatives platform’s BTC perpetual contract. This short-dominant two-sided liquidation structure shows that price appreciation was primarily driven by the forced exit of bearish positions, not by new leveraged longs. While this reduces systemic risk from future cascade liquidations, it also implies that without sustained spot or ETF inflows, the rebound’s momentum may remain limited.

Source: Coinglass

Macro and regulatory developments further complicate sentiment. Recent data shows U.S. private-sector job cuts of approximately 32,000, with wage growth slowing, which supports expectations of monetary easing and improved liquidity conditions. This environment has helped equities, gold, and digital assets recover, providing a downside buffer for BTC and ETH. On the other hand, heightened uncertainty around AI-related energy consumption and capex, combined with warnings from major asset managers that energy will become the next global bottleneck for AI, weighs on outlooks. U.S. regulators have also signaled tighter controls on high-leverage ETFs, capping leverage at 2X, thereby restricting speculative demand for 3–5x products. Institutional views on crypto remain split, with some asset managers arguing that surging federal debt and weakening traditional hedging tools will accelerate institutional adoption of digital assets. Meanwhile, the same firm’s CEO described Bitcoin as an “asset of fear,” highlighting its sensitivity to geopolitical risk. Together, these dynamics define the current market narrative: structural adoption is progressing, but investors are hesitant to rebuild leverage before macro and regulatory signals become clearer.

3. BTC & ETH Technical Data

3.1 BTC Market

After a sharp decline from recent highs, BTC is now consolidating near $93K, rebounding from early-week lows near $84K. The market resembles a secondary consolidation phase following a downward shift in the high-time-frame range. Spot flows show that institutional interest via spot ETFs softened in November, yet recent sessions have seen gradual net inflows as prices stabilize. This suggests that long-term allocators are optimizing cost bases during fear-driven corrections rather than exiting the asset class.

In derivatives, BTC perpetual funding rates hover slightly above zero, far below the elevated premiums observed during strong directional bull cycles. Open interest has declined significantly from prior peaks, indicating that the market has not re-entered a high-leverage regime. Instead, positioning remains skewed toward moderate leverage paired with spot and ETF hedging. Technically, the $87K–$88K zone has become a critical support area where long and short flows intersect. Sustained consolidation above this band would allow the market to accumulate energy for a potential upside break; however, a breakdown accompanied by weakening funding rates would raise the risk of a renewed downward trend.

3.2 ETH Market

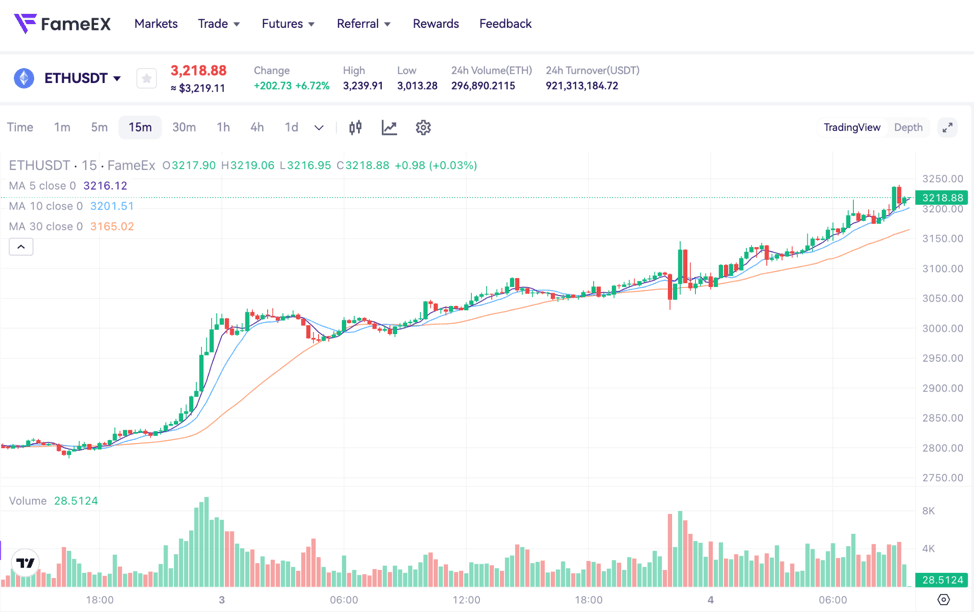

Following the Fusaka upgrade’s activation on mainnet, ETH reclaimed $3K and advanced toward the $3,200 range, outperforming BTC in the short term while still trading one-third below its historical high around $4,900. PeerDAS, the upgrade’s core mechanism, is expected to deliver up to an eight-fold increase in data throughput for L2s and rollups while reducing transaction costs, bringing Ethereum closer to near-instant user experiences.

Derivatives indicators show that ETH open interest was significantly flushed out during the recent drawdown. Although OI has begun to rise modestly with prices, funding rates remain near neutral. This reflects a cautious stance as markets balance upgrade-driven optimism with recent price appreciation. Technically, $3K has flipped from resistance to support. A breakout above the $3,200–$3,300 zone would open structural upside toward $3,500–$3,800, whereas failure to sustain levels above $3K could lead to renewed beta compression versus BTC.

4. Trending Tokens

- LINEA (Linea)

LINEA is developed and operated by Consensys, positioning itself as a zk-rollup designed to preserve the Ethereum user experience while optimizing cost and throughput. The newly launched Linea Exponent program shifts the narrative from pure scaling infrastructure toward a self-sustaining L2 economy. The three-month competition ranks participants solely by verified user transactions and implements a dual burn mechanism with 20% burning ETH and 80% buying and burning LINEA, which directly links network usage to token value accrual. Near-term market focus will revolve around on-chain activity metrics and the expansion of the Linea DeFi ecosystem. If data confirms sustained growth in transaction depth and revenue capture, LINEA could emerge as a higher-beta beneficiary of the post-Fusaka scaling narrative.

- ZAMA (Zama)

ZAMA leverages fully homomorphic encryption (FHE) to build HTTPS for public blockchains, enabling smart contracts to operate with fully encrypted data and state. The upcoming Zama Public Auction will distribute 10% of the token supply through a sealed-bid Dutch auction where price is public, but bid size is encrypted, which mitigates strategic interference and front-running while reinforcing price fairness. With the mainnet expected to launch before the auction, the $ZAMA token will immediately function as the medium for encryption fees, staking, and delegation. This product-first, distribution-second model reduces speculative concentration and enhances fundamental demand. Should FHE adoption expand across stablecoins, settlements, trading, and governance, ZAMA’s role as a multi-chain confidentiality layer will strengthen materially.

- BOB (Build On Bitcoin)

BOB integrates Bitcoin and the EVM ecosystem to establish a foundational financial layer backed by native BTC collateral as the “Bank of Bitcoin” vision. Its three-phase roadmap spans hybrid chain architecture, BTC intents, and lending/payment use cases, aiming to position BTC as the dominant collateral asset for on-chain finance. Currently in Phase 2, BOB enables frictionless native BTC access across multiple chains via intents and SDK-based integrations, accumulating several hundred million dollars in TVL. With only around 0.3% of BTC currently deployed in DeFi, the long-term BTCFi market holds significant expansion potential if BitVM-based non-custodial bridging and native BTC collateral systems mature. For institutions in a high-rate environment, BOB represents a structural, yield-oriented infrastructure narrative rather than a cyclical speculative one.

5. Today Token Unlocks

- $CETUS: Unlocking 8.33 million tokens, with 0.96% of the circulating supply.

- $AI: Unlocking 17.38 million tokens, with 13.35% of the circulating supply as the largest unlock today.

6. Conclusion

The market remains in a phase of structural rebalancing within a fear zone. Sentiment is weak and leverage is subdued, yet spot and ETF flows are gradually accumulating at lower levels. Liquidation dynamics have shifted from long-dominant pressure to short-side unwinding, reflecting partial release of bearish positioning. Although macro and regulatory noise persists, improving liquidity expectations have prevented further deterioration. BTC is forming a base around $93K, while ETH’s structure has strengthened following the upgrade. This signals a shift from sentiment-driven trading toward structurally informed repricing. In the near term, conditions favor low-leverage positioning and structural allocation rather than momentum-driven breakouts. Only when fear metrics normalize, leverage rebuilds in a balanced manner, and spot inflows stabilize can the market develop the foundation for the next sustained trend.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.