FameEX Daily Market Trend | BTC Tests $87K Over the Weekend as ETH Leads Deleveraging

2025-12-08 07:22:40

After several consecutive weeks of Extreme Fear, today’s crypto market narrative again centers on structural price rebalancing driven by rate-cut positioning and leveraged unwinding. BTC briefly broke below $88K into the weekly close, retesting the $87K–$86K support zone, while ETH became the primary locus of deleveraging pressure with more than $172.16M in liquidations over 24 hours. Meanwhile, the probability of a 25 bps Federal Reserve rate cut in December has approached 90%, and traditional financial institutions and major banking groups are increasingly integrating crypto asset products, making macro liquidity and regulatory posture the key variables shaping the next phase of market structure.

1. Market Summary

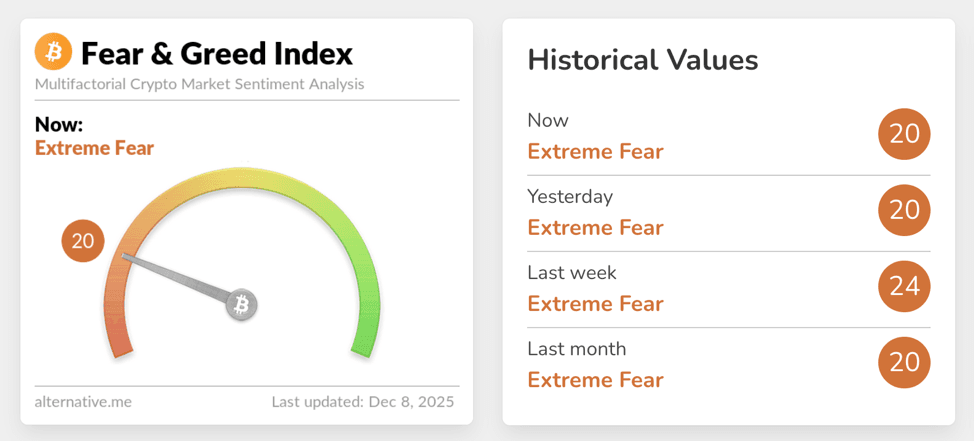

- The Fear & Greed Index has remained at 20 for multiple days, reflecting persistent Extreme Fear and depressed risk appetite.

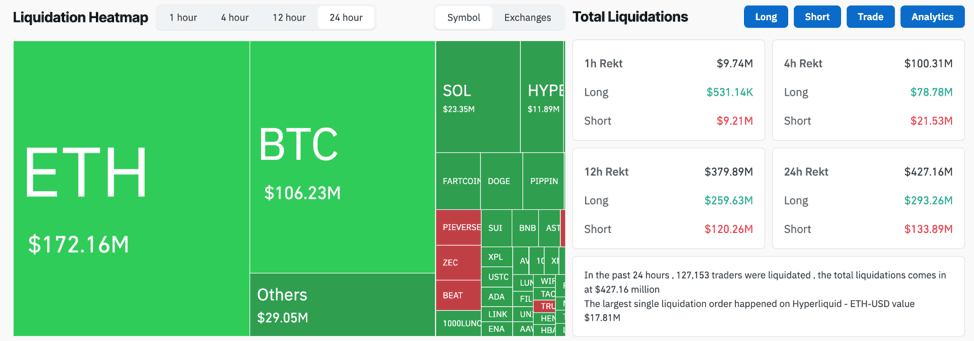

- Total liquidations reached approximately $427.16M over 24 hours, with ETH accounting for around $172.16M and BTC for roughly $106.23M, indicating deleveraging has shifted toward ETH.

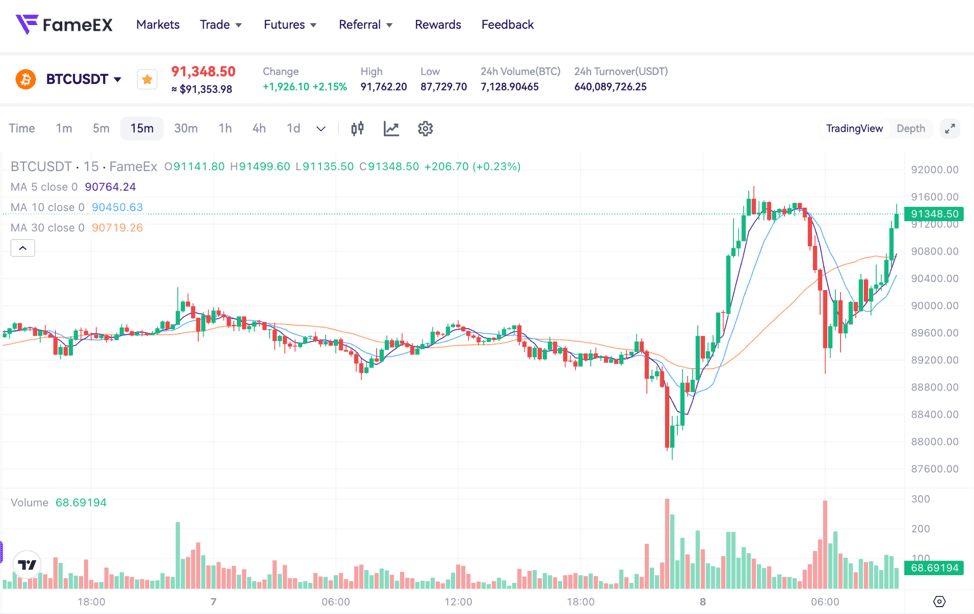

- BTC again tested levels below $88K over the weekend, with key technical support at $87K and $86K, while near-term resistance remains at $92K.

- In the ETF and institutional, U.S. spot BTC ETFs hold approximately 1.332M BTC on-chain, representing around 6.67% of total supply, and large asset managers now hold more than 2% of total supply.

- On the macro and regulatory fronts, the probability of a 25 bps Fed cut in December stands near 86%, while major European banks have launched in-app crypto trading services, signaling an accelerating structural integration between traditional banking systems and the crypto market.

2. Market Sentiment / Emotion Indicators

The Fear & Greed Index remains anchored at 20, and the market has been in Extreme Fear for several consecutive weeks, indicating that sentiment has yet to recover from the prior sharp drawdown. While prices are holding within a higher range, risk appetite and leverage demand continue to contract. Spot and longer-term capital remain more patient than shorter-term traders. For many professional participants, such prolonged Extreme Fear resembles a slow-burn capitulation rather than a single panic event, preserving optionality for either trend continuation or reversal later on.

Source: Alternative

In derivatives liquidations, 127,153 traders were liquidated over the past 24 hours, totaling approximately $427.16M, with long liquidations of about $293.26M and short liquidations of $133.89M, indicating that the current adjustment continues to be driven primarily by long-side deleveraging. Liquidation heatmaps show ETH liquidations around $172.16M—well above BTC’s $106.23M—with other tokens totaling approximately $29.05M, underscoring that leverage remains concentrated in major assets. A single $17.81M ETH perpetual position became the largest individual liquidation of the day on a major derivatives platform, illustrating that in thinner liquidity periods, large highly leveraged positions can amplify volatility and trigger price dislocations exceeding typical expectations.

Source: Coinglass

Macro attention centers on the upcoming Federal Reserve rate decision. According to CME FedWatch data, the probability of a 25 bps December cut is roughly 86.2%, with expectations for cumulative easing early next year continuing to strengthen. Combined with a rebound in global M2 indicating that liquidity conditions are more accommodative than in recent months. Capital support for risk assets including BTC has improved. At the same time, Canada’s tax authority continues expanding investigations into crypto user data, while France is advancing a framework that classifies certain crypto assets under unproductive wealth taxation, indicating a regulatory transition from permissibility toward structured oversight and taxation. European banking groups introducing in-app BTC, ETH, SOL, and USDC trading and traditional asset managers accelerating tokenized fund products further reinforce the institutional positioning of crypto as a recognized asset class.

3. BTC & ETH Technical Data

3.1 BTC Market

BTC experienced a rapid pullback over the weekend, dropping roughly $2K from local highs, briefly breaking below $88K and retesting $87K. Market focus has returned to $86K as the final structural support for bulls. In derivatives, BTC’s global 8-hour average funding rate stands near 0.0027%, reflecting a mildly positive but largely neutral stance, with positive-negative divergence across major platforms indicating two-sided sentiment rather than one-sided leverage build-up. Over 24 hours, BTC liquidations totaled roughly $106.23M that significantly lower than ETH suggesting leverage imbalances are not concentrated in BTC and positioning remains more event-driven and basis-linked. Technical traders largely view $92K as the structural resistance. A sustained reclaim above this level following the FOMC meeting would open the path toward retesting $100K, while a break below $86K could trigger deeper liquidity discovery in the $80K zone.

3.2 ETH Market

ETH has borne a disproportionately large share of deleveraging pressure, with approximately $172.16M in liquidations over 24 hours that is substantially higher than BTC highlighting the accumulated long-side leverage built up in prior sessions. The global 8-hour average funding rate sits near 0.003%. Though still positive, it has cooled significantly from earlier overheated conditions, with some platforms even turning slightly negative, indicating simultaneous short hedging and selective long positioning. A whale on a major derivatives venue opened roughly 54,000 ETH in long positions at around $3,048, with a notional size of about $166M, currently showing only marginal unrealized gains. A drop back below $3,000 could place renewed pressure on such high-leverage large positions. On-chain conditions remain calm, with Ethereum gas fees around 0.409 Gwei, suggesting activity levels are stable and that recent moves are primarily leverage-driven rather than fundamental stress. Overall, ETH is in a phase of progressive leverage unwinding and structural adjustment. If price can stabilize within the $3,000–$3,100 range and attract more definitive spot demand, ETH may again demonstrate higher elasticity relative to BTC once market direction becomes clearer.

4. Trending Tokens

- NIGHT (Midnight Network)

The Midnight Network narrative represented by NIGHT centers on redefining privacy and identity infrastructure through a fourth-generation blockchain architecture. Distribution mechanisms such as Glacier Drop and Scavenger Mine have widely dispersed NIGHT across ecosystems and communities, reducing concentrated holdings by institutions or venture investors. Its economic model emphasizes cooperative economics and cross-ecosystem interoperability, aiming to position Midnight as a “Layer-2 for all chains,” enabling programmable privacy layers without requiring users to migrate assets or change their existing workflows. The roadmap—Hilo, Kūkolu, Mōhalu, and Hua—outlines a clear progression from token distribution and genesis block formation to mainnet scaling and Hybrid DApps deployment, moving from a federated structure toward decentralization. For medium- to long-term investors, the key lies in whether the network can establish commercially viable applications in privacy compliance, identity management, and cross-chain coordination while cultivating developer and user demand over the next one to two years.

- STABLE (STABLE)

STABLE jointly developed by a traditional exchange and a stablecoin issuer that is a Layer-1 chain using USDT as native gas, explicitly designed as an infrastructure layer for payments and capital markets. It supports smart contracts operating directly at the stablecoin layer and offers gas-free user interactions and native fiat on- and off-ramps, aiming to minimize friction between crypto payments and traditional financial systems. Through the USDT0 mechanism, StableChain enables bridge-less cross-chain transfers, reducing the structural risks of conventional bridging and liquidity fragmentation. Market-wise, STABLE launched with Day-1 integrations across wallets, payments, FX, neobanks, custody providers, and interoperability frameworks, positioning it to onboard institutional capital from inception. If stable adoption grows across cross-border payments, compliant settlement, and on-chain financial infrastructure, STABLE may emerge not just as another general-purpose chain but as a foundational layer in the stablecoin infrastructure narrative.

- TCT (Tectum)

Tectum positions itself as a high-performance distributed ledger protocol, using proprietary technologies such as HashDrive and HashSwap to achieve extremely high throughput and instant state updates without compromising security. Its core design isolates heavy transaction-related data from the consensus layer, storing only hashed, encrypted, and signed summaries at each stage to dramatically reduce bandwidth and storage load. This layered architecture and rapid hashing mechanism aim to break the traditional trade-off that higher security requires lower speed, enabling Tectum to support high-frequency payments, instant settlement, and large-scale event data logging. Recently, the team announced a 12-month lock of 100% of the TCT liquidity pool, reducing near-term liquidity extraction and project-side selling pressure which is an incrementally supportive signal for short- to mid-term market stability. Ultimately, Tectum’s differentiation depends on whether its high-performance ledger can prove commercially viable in real-world scenarios, including exchange infrastructure, institutional settlement systems, and Web2 enterprise event tracking.

5. Today Token Unlocks

- $TNSR: Unlocking 17.69 million tokens, with 1.77% of circulating supply.

- $NUUM: Unlocking 31.19 million tokens, with 3.12% of circulating supply.

- $BFT: Unlocking 22.99 million tokens, with 2.30% of circulating supply as the largest unlock today.

6. Conclusion

Overall, the market remains in a transitional phase characterized by high-level consolidation, subdued sentiment, and accelerated leverage adjustment. BTC continues to oscillate between $87K–$92K, holding near historical highs, yet funding and liquidation data indicate that long-side leverage is no longer excessively crowded, with positioning becoming more event-driven and two-sided. ETH remains the focal point of deleveraging, with large liquidations and cooling funding rates clearing prior leverage build-up, while low gas fees and steady spot demand help maintain its medium-term structural integrity.

On the macro front, rising rate-cut expectations, an expanding global money supply (global M2 rebound), and accelerating institutional adoption of blockchain infrastructure are improving liquidity conditions. Conversely, tax enforcement, wealth-tax proposals, and tighter compliance frameworks are introducing structural headwinds. These opposing forces create a push-pull environment between easing liquidity and tightening regulation.

For professional investors, this phase favors a structural approach to risk assessment that selectively accumulates assets with strong narratives and fundamental support in the aftermath of Extreme Fear and leveraged unwinding, while managing leverage and liquidity risks ahead of potential year-end trends and the onset of a new cycle in 2026.

Disclaimer: The information provided in this section is for reference only and does not represent any investment advice or the official views of FameEX.