Stablecoins Must Be Programmable to Block CBDCs

2023-04-25 06:34:55Stablecoins have a significant advantage over central bank digital currencies because decentralization makes programmability possible.

Source: www.dailyreckoning.com.au

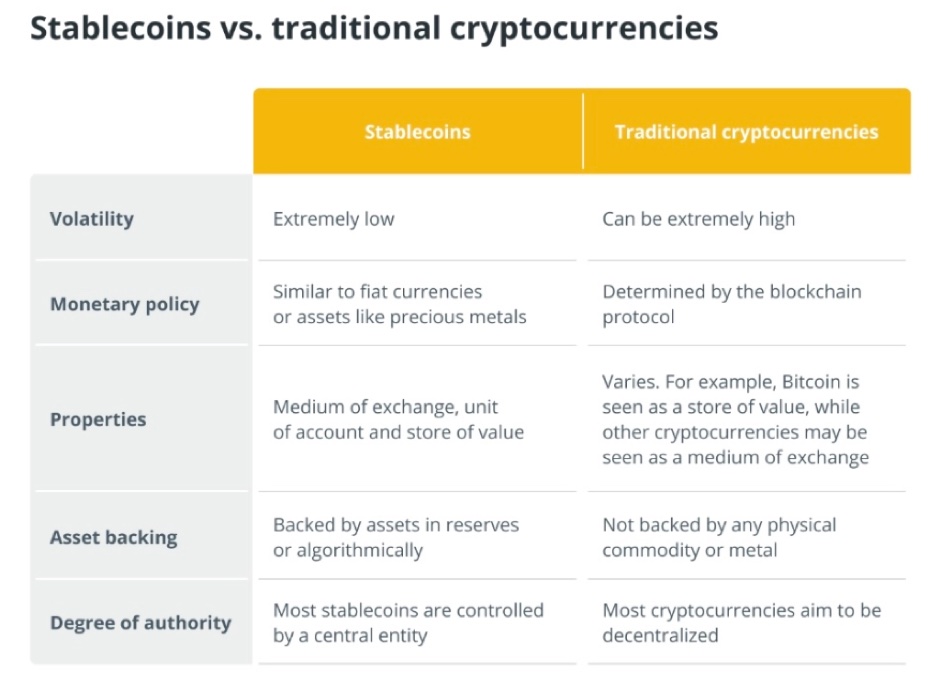

Central bank digital currencies (CBDCs) and stablecoins seem to be two sides of the same proverbial coin when it comes to offering steady value. However, cryptocurrency stable assets might offer completely distinct use cases, making CBDCs uncompetitive.

Smart contracts that automate and give money new functions are the key to programmability. Programmability enables asset backing and decentralization, which are not feasible with the CBDC designs used today. Instead of competing with CBDCs, developers could take use of the programmable opportunities that reliable assets provide.

The existing monetary system, according to stable-asset issuers, may be improved largely in three ways. Stable assets, in the first place, can assist in lowering the costs of conventional financial activities like remittances and decentralized borrowing/lending via decentralized finance (DeFi).

CBDCs Will Result in Unrestricted Government Power

Citizens in hyperinflation-affected nations employ reliable assets to safeguard their income and maintain payments, such as in Venezuela using the Reserve protocol. Some of the stablecoins may be used for payments that are more focused on anonymity. These three steady asset uses fit within the parameters of the current financial system. It is important to note that CBDCs might theoretically address the issues that stablecoins do.

Utility Assets Are Used to Back Assets

The majority of reliable asset backing today is mostly based on traditional finance. In other words, all of their reserves are financial assets. Financial assets like commercial paper, US dollars, and US Treasury support Tether and USD Coin. USDC, Bitcoin, Ether, and other reliable assets support Dai. However, stable assets can also contain their reserve assets with more immediate use that aren't frequently a part of the financial system, including unique real-world assets.

Additional features are produced as a result, promoting reliable asset use cases in the real world that CBDCs are unable to carry out.

Source: cointelegraph.com

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.