Industry Analysis

What is the x402 Protocol? A New Standard Reshaping Internet Payment Protocol

Key Highlights

The x402 protocol is a new web-native payment standard built on HTTP/1.1’s long-reserved 402 “Payment Required” status code. Coinbase introduced x402 on May 6, 2025, and on September 23, 2025, Coinbase and Cloudflare announced the x402 Foundation to steward the open standard. The protocol is designed to automate micropayments for online resources using blockchain settlement, typically stablecoins such as USDC.

Amid the rapid development of the AI-agent economy, x402 provides the technical foundation for value exchange between machines. Its core value lies in embedding payment directly into the web protocol stack, opening new possibilities for Internet business models. This article examines x402 across five dimensions: technological evolution, project principles, application ecosystem, advantages and challenges, and development outlook.

The Origins of the x402 Protocol: From a Reserved Status Protocol to Commercial Applications

The x402 protocol traces its roots to the HTTP/1.1 specification published in 1997 (RFC 2068), which first defined status code 402 “Payment Required.” Importantly, the spec marked 402 as “reserved for future use,” and it saw little real-world adoption for decades due to the lack of reliable micropayment rails. This long-standing reservation reflected early designers’ foresight about web commercialization, while also highlighting a timing gap between technical feasibility and business needs.

Over the past two decades, the Internet’s business models have centered on advertising and subscriptions. Industry data indicates that global ad spending reached around US$1.1 trillion in 2024, with digital channels accounting for the majority; estimates for the subscription economy vary by methodology but place it in the hundreds of billions of dollars and growing. These models scaled access to online services, yet introduced structural issues such as privacy trade-offs, content homogenization, and uneven creator compensation. The x402 protocol provides a technical path to explore finer-grained, per-use pricing.

By 2025, improvements in blockchain infrastructure, the maturation of stablecoins, and the rise of the AI-agent economy converged to make per-request payments practical. Coinbase introduced x402 on May 6, 2025, and in September 2025, Coinbase and Cloudflare announced the x402 Foundation to steward the open standard—turning a long-reserved HTTP status into working plumbing for value exchange on the web. This marks a meaningful step in the evolution of Internet protocols from pure information transport toward value transfer.

Technical Principles of the x402 Protocol: A Blockchain-Backed Payment Integration Framework

The x402 payment flow is intentionally simple. When a client requests a resource, the server responds with HTTP 402 (Payment Required) to trigger payment. That response includes a machine-readable invoice—amount, accepted currency (often a stablecoin), destination, and other network parameters. The client then authorizes the payment in a compatible wallet and retries the same request with a signed payment payload attached in a payment header. If the server (or a facilitator acting on its behalf) verifies the authorization, it returns the resource. In short: Request → 402 with terms → Authorized retry → Access—a flow that avoids traditional web payment friction (create account, link your card, or fill in more details) and stays faithful to HTTP’s native semantics.

At the settlement layer, the reference v1 design commonly uses EIP-3009 transferWithAuthorization, which lets users sign an off-chain authorization that a facilitator can submit on-chain. This yields two key benefits:

(1) A “gasless” experience for end users (they don’t need to hold the chain’s native token)

(2) Strong safety properties via nonces and validity windows that provide replay protection.

Crucially, x402 employs a facilitator (relay) architecture to make large-scale commercial adoption practical. Facilitators handle verification, blockchain interaction/settlement, and simple APIs that resource servers call during the 402 → paid-retry cycle—significantly lowering integration complexity. In production, facilitators typically support USDC and other EIP-3009-compatible tokens on supported networks (e.g., Base), with broader token and network support expanding over time.

For cryptographic assurances, implementations use standard ECDSA-based signatures (EIP-712 typed data) so that payment authorizations are non-repudiable. Each payment carries anti-replay parameters—nonces, timestamps, and expiration windows—that are validated before access is granted. This preserves blockchain-level trust while meeting web-scale needs for low latency and high throughput.

Application Usages of the x402 Protocol: Multi-Scenario Adoption from the AI Economy to Digital Content

According to industry analyses from Gartner, machine customers—autonomous AI agents that buy goods and services—are expected to drive trillions of dollars in purchases and account for roughly 15–20% of revenue for many enterprises by 2030. This makes the AI-agent economy a natural fit for x402. The protocol provides a machine-native way for agents to pay per request, enabling AI systems to acquire training data, call APIs, and rent compute resources autonomously. For example, a research-oriented agent could use x402 to purchase time-boxed access to a specialist database and iteratively improve its models.

In today’s API markets, prepaid and postpaid subscriptions often misalign with granular usage and inhibit long-tail demand. By contrast, x402 supports pay-per-use with metering and settlement embedded in the HTTP flow. Early experiments from data and tooling providers illustrate how providers can price precisely at the request level and settle instantly, such as Firecrawl exposing per-call search/scrape endpoints via x402. This reduces friction for small and high-frequency transactions.

For digital media and creators, x402 offers a direct micropayment path that complements or substitutes for ads and bundles. Projects like Gloria AI have explored pay-per-article access using x402, while platforms such as tip.md platform integrate agent workflows so an AI assistant can tip on a user’s behalf. These pilots point toward new value-sharing models in human–machine collaboration, even as the broader ecosystem is still in an early, experimental phase.

Ecosystem Applications of the x402 Protocol: An Emerging Contender with Strong Potential

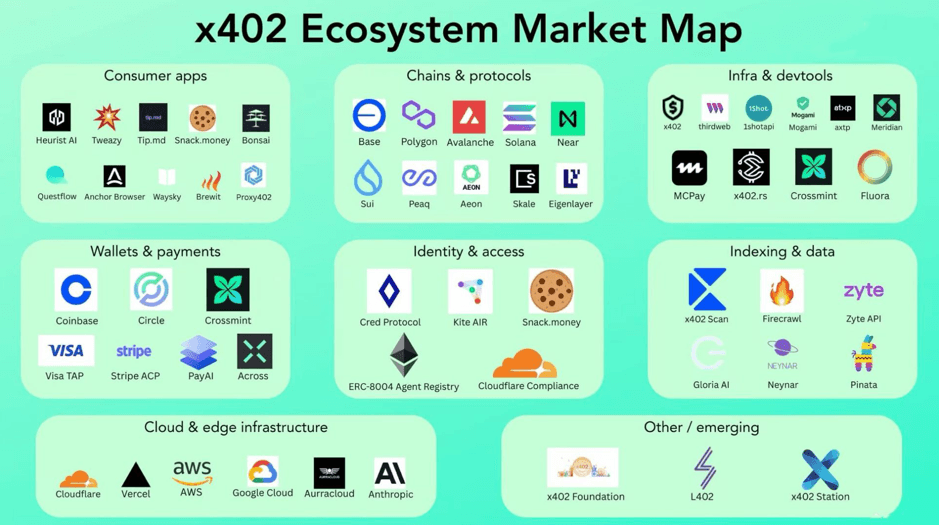

Since its introduction, the x402 protocol’s straightforward payment flow and broad applicability have attracted early interest across several layers of the stack—protocols and standards, infrastructure, core applications, and cloud services. The emerging ecosystem market map shows promising momentum for x402 as a next-generation payment rail. While it’s still early, the combination of HTTP-native design, stablecoin settlement, and agent-friendly workflows positions x402 as a credible contender to power pay-per-use experiences across APIs, data, and digital content.

x402 Ecosystem Market Map

1) Protocols & Standards Layer

This layer defines the “grammar” of the x402 ecosystem so AI agents can understand one another and transact. When paired with complementary agent standards, x402 opens a new path for web payments. For example, Google’s A2A initiatives focus on standardizing agent-to-agent communication; Anthropic’s MCP helps agents securely access tools and data; and Google’s AP2 (Agent Payments Protocol) targets on-demand service invocation and automated payments. Together with x402—which gives concrete meaning to HTTP 402—these efforts point toward interoperable, machine-native commerce.

2) Infrastructure Layer

If x402 defines “what” to do, infrastructure is “how” to do it. In practice, this includes facilitators/relays that verify payment authorizations and, when needed, submit settlements on-chain, plus SDKs and gateways that simplify server integrations. Services such as PayAI position themselves as multi-chain coordinators that help developers and agents validate payments and complete settlement with low latency—akin to “Stripe” or “Alipay” service.

In parallel, some blockchain projects are exploring native support for x402-style payments. For example, Kite AI is described as a Layer-1 focused on agent transactions, while Peaq targets the broader machine economy (DePIN), aiming to enable device-to-device automated payments. These efforts are early, but they illustrate how settlement layers may evolve to serve agent workloads.

3) Core Application Layer

This is where users and agents encounter real “products” and “services.” Here are several examples below:

- Heurist Deep Research positions itself as a Web3-native research assistant that can orchestrate multiple AI services; the pay-per-use model aligns naturally with x402.

- Daydreams has experimented with x402 to support per-generation or per-task inference workflows for LLMs.

- Firecrawl exposes web search/scrape and cleaning APIs and has showcased per-call access patterns that map well to x402’s pay-per-request model.

Together, these examples demonstrate how metered APIs, agent tools, and research/inference pipelines can adopt x402 for precise, transaction-level pricing.

4) Cloud Services

Major network and cloud providers are beginning to surface x402 in developer tooling and edge workflows. Coinbase and Cloudflare have announced this collaboration via the x402 Foundation to steward the open standard and support integrations. As those integrations mature, global distribution and edge verification can reduce latency and make per-request payments more practical at scale.

x402 Protocol Ecosystem Map

Competition and Challenges of the x402 Protocol: A Delicate Balance Between Technical Features and Commercial Applications

From both business and engineering perspectives, x402’s advantages fall into three categories. First, it reduces the economics of micropayments relative to traditional card rails. Second, it fits naturally into existing HTTP workflows, lowering integration overhead. Third, it natively supports automated, agent-driven transactions. Here are more details below.

1. Economic efficiency: Per-request settlement over stablecoin rails can be materially cheaper than traditional card networks (typically 2–3%), making true micropayments more viable.

2. Technical compatibility: Because x402 repurposes the standard HTTP 402 “Payment Required” status, it integrates cleanly with existing web infrastructure and developer workflows, which lowers merchant onboarding costs.

3. Automation: The protocol enables direct machine-to-machine value exchange without account creation, card binding, or form filling—laying essential groundwork for autonomous economic activity.

However, x402 still faces several challenges going forward:

- Performance trade-offs: Early implementations can involve multiple network interactions (challenge, verification, settlement), leading to end-to-end latencies in the hundreds of milliseconds per paid request. When an AI agent accesses many paid resources in parallel, those costs can compound and degrade user experience. Roadmaps for a v2 flow focus on reducing round-trip and optimizing the transport layer, but larger gains may also require architectural techniques such as batching, short-lived entitlements, or deferred settlement.

- Facilitator incentives: Many deployments rely on facilitators/relays to verify authorizations and, where needed, submit transactions on-chain. While this simplifies integration, it raises questions about fee models, incentives, and potential centralization. Long-term sustainability will depend on clear pricing, competition among facilitators, and transparent service guarantees.

- Token and standard support: In current practice, x402 most commonly uses USDC with EIP-3009 to enable gasless authorizations. Broader asset coverage (for example, ERC-2612 Permit flows and additional stablecoins) depends on token contract capabilities and ecosystem tooling. It is more accurate to say today’s implementations center on EIP-3009-compatible assets rather than strictly mandate them. For example, Tether—the issuer of USDT—has not made any public, primary statements confirming long-term support for EIP-3009.

- Regulatory considerations: x402 is a protocol; compliance obligations rest with implementers (merchants, facilitators, and wallets). Global rollouts must align with KYC/AML and payment rules that differ by jurisdiction. Frameworks such as the EU’s MiCA and evolving U.S. guidance on digital assets indicate that regulatory treatment is still developing and may impose licensing, reporting, and consumer-protection requirements on services that use x402.

Development Outlook for the x402 Protocol: From Technical Experimentation to Ecosystem Building

Based on public roadmaps and community discussions, a forthcoming v2 direction for x402 emphasizes three areas: (1) transport-layer abstraction so payments can attach to multiple communication patterns beyond basic HTTP; (2) greater scheme extensibility to allow custom payment logic and authorization methods; and (3) service-discovery mechanisms to simplify client configuration. While these improvements do not fully resolve foundational questions—such as long-term incentives for facilitators—they meaningfully increase the protocol’s practicality and flexibility.

The x402 ecosystem is still in the early transition from technical validation to broader commercial rollout. Developer activity and community interest are rising, but production deployments remain limited. Achieving network effects will likely require more “flagship” applications—such as Daydreams or Heurist Deep Research—to demonstrate clear commercial value and pull in upstream and downstream partners and investors.

From a go-to-market perspective, x402 faces a two-sided learning curve. Traditional web developers need approachable tooling and guidance for blockchain settlement, while the crypto community must adapt to conventional web-protocol paradigms—complete documentation, robust SDKs, and a growing catalog of case studies.

In the longer term, the x402 protocol value may concentrate in three areas: (1) Base settlement infrastructure (e.g., Base, Solana) benefiting from increased transaction flow as adoption grows; (2) Payment aggregators and facilitators (e.g., PayAI) emerging as key nodes that abstract multiple chains and tokens; and (3) Vertical solutions (e.g., Daydreams) achieving early product-market fit with pay-per-use models. Investors should focus on teams with technical defensibility and strong ecosystem integration, while carefully weighing technical risks and policy uncertainty as the protocol evolves.

From technical standard to business practice, x402 represents a significant step in the evolution of the Internet’s value. It revives a long-reserved HTTP status code and supplies payment infrastructure for human-machine collaboration and machine autonomy in the AI economy. Although challenges remain in performance at scale, facilitator economics, and compliance, x402’s technical direction and ecosystem openness position it as a credible component of the next-generation Internet architecture. As iteration continues and the ecosystem matures, x402 could play a meaningful role in reshaping how value is exchanged online.

How Ethereum’s Fusaka Upgrade Reshapes Its Scaling Blueprint

Ethereum mainnet is expected to activate the Fusaka upgrade at epoch 411392 on 3 December 2025. This hard fork touches both the execution and consensus layers. It introduces PeerDAS (EIP-7594), a series of Blob-Only Parameter (BPO) micro-forks to adjust blob-related parameters, and, on top of the already active 60 million block gas limit, it recalibrates overall block structure and cost boundaries. By design, Fusaka is not a simple upgrade that makes the chain faster through linear optimization. Instead, it explicitly positions Ethereum as a high-capacity settlement and data-availability layer for the rollup era, laying a more formalized technical foundation for a modular architecture and the long-term goal of approaching 100,000 TPS.

Unlike prior upgrades, Fusaka is not a narrow patch aimed at a single bottleneck. It is the first upgrade that systematically encodes Vitalik’s Surge, Verge, and Purge roadmap into a single version. By using PeerDAS to expand the data space available to L2s, pairing it with history expiry and synchronization changes to lower long-run node operating costs, and adding BPO as a mechanism for repeated capacity adjustments in the future, Ethereum can scale over the coming years via many small, predictable, and auditable steps, rather than relying on infrequent, high-risk, large-scale hard forks.

For markets, the right way to judge Fusaka is not by asking how much TPS does it add on day one, but by assessing whether, in a world where rollups already dominate actual usage, Ethereum can secure its role as the core settlement and data layer of this new architecture without compromising decentralization and security and whether ETH, through fees, burn and staking yield, can continue to capture the economic upside of network growth.

What Is the Fusaka Upgrade?

The Fusaka upgrade is a major hard fork scheduled to go live on the Ethereum mainnet on 3 December 2025. Its name combines the internal codenames for the execution-layer upgrade (Osaka) and the consensus-layer upgrade (Fulu), underscoring that this release spans both layers. From a technical perspective, Fusaka is not a single new feature, but a bundle of interlocking protocol changes. Peer Data Availability Sampling (PeerDAS) was introduced via EIP-7594 as the core component, a Blob-Only Parameter (BPO) fork mechanism that can be invoked at a higher frequency, a recalibration of gas and block limits, extended history expiry, and a set of auxiliary changes around proposer lookahead, key standards, and synchronization flows.

The primary goal of Fusaka is to increase the volume of data the Ethereum mainnet can safely support without raising hardware requirements for validators and full nodes. This allows rollups to publish transaction data to L1 more frequently and at lower cost, improving the overall usability of the ecosystem. In parallel, Fusaka uses history pruning and consensus-layer refinements to make validator sync times and storage costs more sustainable over the long term. By introducing BPO as a parameterized way to tune blob capacity, Ethereum, for the first time, gains the ability to pursue many small, demand-driven capacity increases instead of relying on low-frequency, high-impact hard forks to reset its scaling envelope.

1. Fusaka’s Role and Structural Impact in Ethereum’s Scaling Roadmap

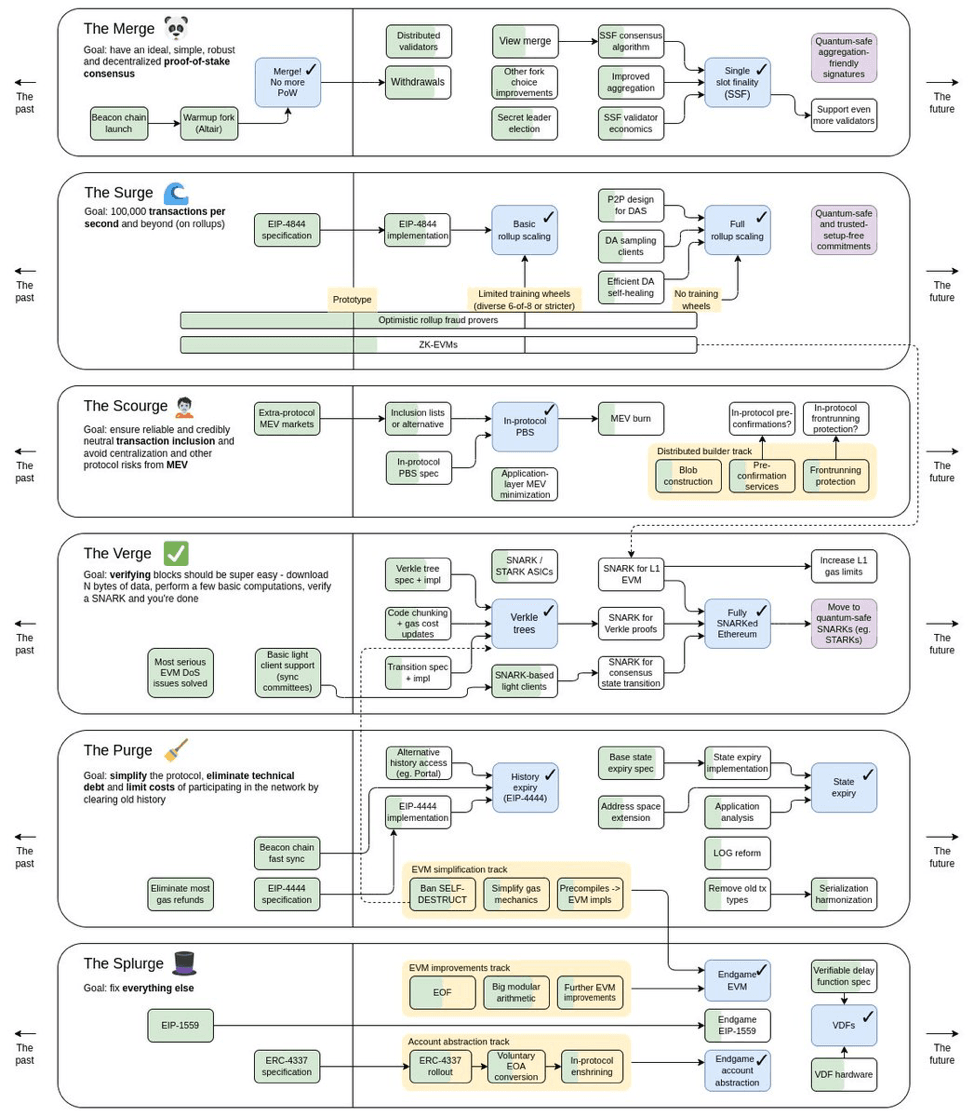

To understand the strategic position of Fusaka, it is necessary to look at how previous key upgrades have prepared the ground for the current roadmap.

The Merge in 2022 migrated Ethereum’s consensus from proof-of-work (PoW) to proof-of-stake (PoS), sharply reducing energy consumption and embedding security and economic incentives into the staking system. This gave the protocol a more stable foundation in terms of energy costs, long-run inflation control, and institutional adoption. The subsequent Shapella upgrade enabled stake withdrawals and turned staking from a one-way lock into a configurable yield instrument, allowing professional validators, institutional custodians, and restaking protocols to build multilayered markets on top of the PoS base.

In 2024, the Dencun upgrade introduced blobs via EIP-4844, creating a temporary data channel dedicated to rollups. This marked the transition from “L2-first” as a philosophy to “L2-first” as a resource allocation rule embedded in the protocol. L1 would no longer aim to host all activity directly, but instead focus on secure settlement and data availability. In May 2025, the Pectra upgrade further improved user ergonomics and validator composition through account abstraction and adjustments to staking parameters, making Ethereum more flexible and extensible both on the user side and in the staking market.

Prior to Fusaka, however, these upgrades still looked like parallel engineering tracks on the roadmap. Each addressed specific issues in consensus, withdrawals, data channels or account models, but they did not yet coalesce into a single, coherent scaling narrative. Fusaka is different in that it concentrates three major axes into a single moment in time. Along the Surge axis, it uses PeerDAS and blob parameter tuning to raise L2 data throughput; along the Verge/Purge axis, it relies on history expiry and sync optimizations to compress node load and curb unbounded growth of state and history; and on the execution layer it leverages the new 60 million gas limit and related EIPs to redraw the boundaries for per-block computation and data. In other words, Fusaka is the first genuine inflection point where Ethereum moves from one local fix at a time to integrating resources around a long-term roadmap. This signals that the protocol is starting to think in terms of full-stack architecture rather than isolated modules.

Ethereum roadmap, source: Vitalik’s Tweet

2. How Fusaka Redefines Ethereum’s Scaling Model and Settlement-Layer Role

Among all the changes, PeerDAS, specified in EIP-7594, is the core engineering pillar of Fusaka. PeerDAS is a peer-to-peer data availability sampling protocol that allows nodes to download only fragments of block data and, through sampling and erasure coding, gain high confidence that rollup data has been fully published. This stands in sharp contrast to the prior model, in which nodes had to download entire blobs.

Structurally, this has two major implications. First, it decouples network-wide data throughput from the download and storage ceiling of an individual node, easing the burden on each participant and ensuring that taking part in consensus does not equate to shouldering the full data load. Second, it opens up space for systematically increasing the number of blobs in the future, allowing Ethereum, over a multi-year horizon, to raise the data bandwidth and blob capacity available to L2s multiple times without each step requiring a risky, large-scale hard fork.

This is also why the Blob-Only Parameter (BPO) fork mechanism exists. BPO is deliberately scoped to touch only a small set of blob-related parameters, such as the target number of blobs, the maximum, and the adjustment factor in the fee mechanism. That design allows the protocol to perform high-frequency, low-amplitude adjustments. From a governance and risk-management perspective, this is closer to tuning interest rates in monetary policy than rewriting the entire rule set. Ethereum can thus fine-tune blob supply in response to L2 demand, network load, and client performance in a more granular and responsive way.

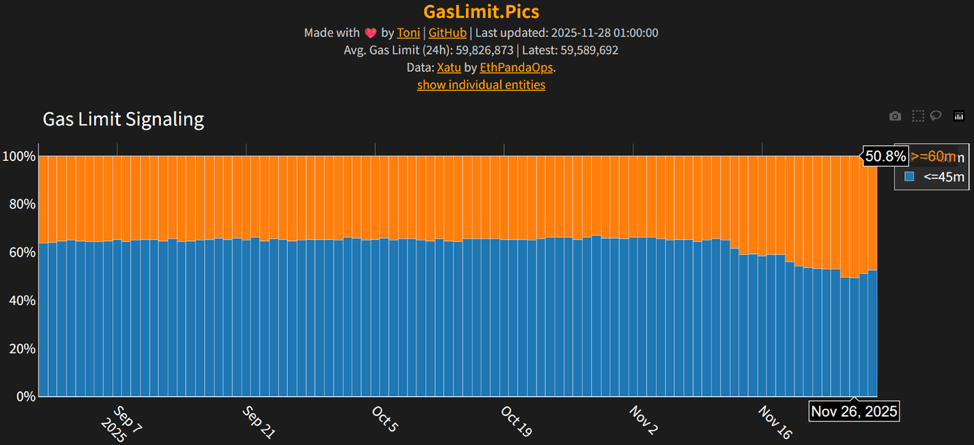

At the same time, the underlying execution layer has already undergone a significant structural change ahead of Fusaka. In November 2025, Ethereum’s block gas limit was raised from 45 million to 60 million, the highest level in nearly four years. This shift was not unilaterally triggered by core developers, but was activated once more than 510,000 validators had consistently signaled support, crossing the threshold defined in the protocol. Behind this change was nearly a year of community advocacy (for example, the “Pump The Gas” initiative), client-level optimizations, and repeated testing of safety margins.

Ethereum raises gas limit to 60 million, source: MetaEraHK’s Tweet

From a macro perspective, Fusaka matters not simply because it makes L2 data cheaper, but because it simultaneously reshapes Ethereum’s operating model on two fronts. On one side, it flattens and stabilizes the cost curve for rollup data submission, enabling expansion within a more predictable fee band. On the other hand, via the combination of the gas-limit increase and related EIPs, it establishes a more sustainable, gradually upgradable growth path for L1 execution and data capacity.

3. Analyzing Fusaka’s Role and Impact in Ethereum’s Long-Term Scaling Strategy

For rollups and upper-layer applications, Fusaka’s immediate effect is a repricing of data costs and capacity boundaries. Multiple analyses suggest that once PeerDAS is live and the first BPO fork has been executed, data fees for high-frequency L2s such as derivatives platforms, on-chain games and social protocols could fall by roughly 40 to 60% over time. This is not a trivial slight discount on gas, but a substantive expansion of the product design envelope.

In the DeFi sector, lower data costs can support more granular liquidation logic, higher-frequency auditing, and risk management frameworks. For gaming and social applications, more on-chain or rollup-level interactions can be moved away from centralized servers, improving verifiability and transparency of asset ownership and state transitions. For new rollups, a lower fixed cost of entry means more specialized L2s are likely to emerge, differentiating themselves through fee structures and UX, and intensifying competition across the rollup landscape.

From the perspective of ETH’s economic model, Fusaka introduces a mixture of positive and negative forces. On the positive side, if lower rollup costs successfully drive higher aggregate settlement volume, more transactions will ultimately be finalized and have their data published on Ethereum. This would increase blob-fee revenue and base-fee burn, reinforcing the more usage, tighter supply deflationary narrative. On the other hand, if users primarily perceive cheaper fees on some L2s at the front end and overlook the fact that all of this activity ultimately settles back to Ethereum L1, short-term market sentiment may underestimate the degree to which Fusaka supports ETH’s long-term value capture.

The deeper point is that Ethereum does not aspire to be a monolithic high-throughput smart-contract chain. It aims to be a global settlement and data layer with ETH as the native asset and rollups as the scaling shell. Fusaka is the first upgrade that makes this narrative verifiable in terms of actual throughput, data structures, and fee markets, rather than leaving it as a theoretical TPS target in a roadmap slide.

4. From PeerDAS to BPO: Fusaka’s Critical Role in the Scaling Process

Every scaling decision is, fundamentally, a redistribution of risk across different dimensions. From the standpoint of nodes and validators, the introduction of PeerDAS and history expiry lowers the amount of data each node must store and download over time, potentially reducing the time and hardware requirements needed to sync to the latest state. In theory, this helps preserve a sufficiently broad and diverse validator and node set.

However, as successive BPO forks gradually increase blob capacity, the bandwidth burden and operational complexity on the data-producer side will inevitably rise, concentrating more responsibility on operators with robust infrastructure and high-quality network connectivity. If the protocol and client implementations do not clearly define what hardware and network profile remains sufficient for ordinary home nodes to participate safely, the practical outcome of scaling could be to entrench the relative importance of large validators and infrastructure providers, undermining decentralization in certain scenarios.

The EIPs in Fusaka that touch on history expiry, block-size caps and DoS resistance are, in effect, attempts to balance on this boundary. On one side, they aim to free up as much space as possible for rollups and complex transactions, giving the application layer room to experiment. On the other hand, they limit per-transaction gas usage and adjust the cost of specific precompiles to prevent a single heavyweight computation or malicious payload from congesting an entire block.

Within this architecture, institutional staking providers and large validator clusters generally view Fusaka as a structural positive. More predictable data throughput, clearer history-management and storage boundaries, and aligned gas and block limits all make it easier to plan medium- to long-term capex, opex and risk capital deployment. At the same time, this raises the bar for governance and transparency. If future scaling debates or network-stress events occur, the community is likely to focus its scrutiny on the very operators and client teams that hold a disproportionate share of operational weight.

5. How Fusaka Advances Ethereum Toward a Modular Settlement Layer: Impact and Outlook

After Fusaka, the next major waypoint on Ethereum’s roadmap is the Glamsterdam upgrade, currently expected in 2026. Early plans indicate that Glamsterdam will introduce enshrined proposer-builder separation (ePBS) at the protocol level, reshaping roles and power dynamics within the MEV supply chain, and block-level access lists (BALs) to improve state-access efficiency and prepare for higher-frequency, larger-scale execution workloads.

Fusaka can be understood as the data and capacity upgrade, while Glamsterdam focuses on who builds blocks and how execution is orchestrated. If both land as designed and interact as intended, Ethereum could move from a regime of version-based upgrades to one of mechanism-based, continuously adjustable scaling frameworks, allowing it to recalibrate the trade-offs between decentralization, security and performance across market cycles and technology shifts.

Over the longer term, Fusaka can be seen as the turning point that moves Ethereum from the aspirational 100,000 TPS phase into the phase of actual settlement-layer capacity sufficient to support a rollup ecosystem and high-frequency applications. It redefines the division of responsibilities between L1 and L2, and reframes how ETH captures value in this modular architecture. The goal is no longer to host all activity directly on L1, but to keep high-frequency interaction and computation on L2 while using ETH as the unit of account and settlement, with final clearing and data anchoring happening on L1.

Against this backdrop, the real significance of Fusaka is not as a short-term price catalyst, but as a clear structural signal that Ethereum is deliberately reshaping itself, in a measured and governable way, into a piece of global, institution-grade public settlement and data infrastructure.

Conclusion

The Fusaka upgrade marks Ethereum’s transition from patching individual bottlenecks to adjusting the overall architecture. In recent years, Merge, Shapella, Dencun, and Pectra have each addressed foundational issues in consensus, security, withdrawals and data channels. Fusaka is the first upgrade to integrate scaling (Surge), node lightness (Verge) and history cleanup (Purge) in a single release, allowing Ethereum to advance capacity, efficiency and sustainability at the protocol level in a coordinated way.

On the data side, PeerDAS and BPO provide rollups with lower data-publication costs and a more predictable capacity growth curve, enabling L2s to scale toward a user experience closer to Web2 while supporting high-frequency financial, gaming and social applications. On the execution side, the 60M gas limit and related EIPs redefine the feasible density of computation and data per block, ensuring that L1 can handle higher loads while remaining verifiable and accessible to a broad validator set. From a long-term governance and engineering perspective, the layered design introduced with Fusaka signals a shift away from reliance on occasional large hard forks toward a more manageable, forecastable, multi-stage scaling cadence.

For ETH as an asset, Fusaka’s impact will not be instantaneous, but its structural implications are clear. If reduced L2 costs translate into higher activity and settlement demand, blob and base-fee consumption will provide a more durable source of value capture, strengthening ETH’s dual role as settlement currency and security collateral. While higher bandwidth requirements and infrastructure pressure could, in some scenarios, heighten centralization risk, Fusaka also introduces clearer, more quantifiable node-burden and governance boundaries, giving the network a better chance to grow within a controlled decentralization envelope.

Ultimately, the importance of Fusaka does not lie in how much it can boost TPS on its own, but in how it reshapes Ethereum’s trajectory: security-first, rollup-centric scaling, parameter-driven governance and ETH as the sovereign asset. The upgrade moves Ethereum from being merely scalable in theory to being sustainably scalable in practice, and it lays the engineering groundwork for Glamsterdam and deeper changes envisioned on the roadmap. If the past five years were about laying the foundation for the modular era, Fusaka is the turning point that pushes Ethereum into its next, more mature phase.

FAQ

Q1: Will end users notice immediate changes once Fusaka is upgraded?

In the short term, the most tangible changes for end users will likely come from lower fees and reduced congestion on major L2s, especially during peak periods when confirmation delays and fee spikes should moderate. However, these effects typically will not fully materialize on day one. They tend to emerge over weeks and months as rollups adjust their fee policies and data-submission patterns. For most users, Fusaka should be viewed as a structural upgrade that lays the groundwork for the next several years of scaling, rather than a single event that instantly doubles TPS.

Q2: Does the Fusaka upgrade change ETH’s medium to long-term investment narrative?

Fusaka does not alter ETH’s core role as Ethereum’s native asset and sovereign currency, but it does strengthen the linkage between network growth and ETH demand. If lower rollup costs drive sustained increases in settlement volume and on-chain activity, then blob fees and base-fee burn will become a more structural feature of ETH’s economics, sharpening its profile as both “settlement fuel” and a long-term store of value tied to protocol usage.

Q3: Does Fusaka meaningfully increase centralization risk in the trade-off between decentralization and scaling?

Fusaka reduces the amount of history and data any single node must retain and download, which in principle supports a larger and more diverse node set. However, as subsequent BPO forks raise blob capacity, the importance of high-bandwidth, professionally operated infrastructure will grow. If the protocol and client teams do not proactively define reasonable hardware baselines and maintain transparency and openness in governance, future scaling debates could amplify concerns about latent centralization risks. Fusaka itself does not directly centralize the network, but it makes ongoing calibration between scaling and decentralization an even more central topic for Ethereum’s roadmap going forward.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.

Impact of Tether (USDT) on Crypto Market: Driving Bull Market Force or Major Risk?

In the crypto market, stablecoin Tether (USDT) surpassed Bitcoin and Ethereum to top the trading list with a 24-hour trading volume of $50,757,412,596. Its 24-hour trading volume to market capitalization ratio is as high as 57.66%. This data indicates that Tether (USDT) is not only one of the most popular tokens but also unrivaled in the field of crypto circulation.

From Securitization to Stablecoins: How Real-World Assets Are Rewiring Global Capital?

Introduction – Why RWA is Back?

In 2025, it will become common to open a crypto wallet and see a portfolio that looks more like a private bank statement. A Hong Kong investor might show tokenized BlackRock U.S. dollar bonds, tokenized gold, and a fractional interest in U.S. commercial real estate — all tradable, programmable, and globally accessible in a way traditional finance cannot replicate.

This is the essence of Real-World Assets (RWA) from the tokenization of financial assets such as Treasuries, credit and money-market instruments, as well as real-world commodities, equities, real estate and more. Theoretically, tokenization unlocks 24/7 global liquidity, faster settlement, universal access and deep DeFi composability. In reality, the picture is more complex but no less transformative.

Today, non-stablecoin RWA on public blockchains sits around the mid-$30 billion, up from low-single-digit billions only a couple of years ago. When stablecoins that economically tokenize cash and short-term Treasury exposure are included, on-chain RWA effectively surpasses $300 billion. Tokenized Treasuries alone have ballooned to nearly $9 billion, growing several-fold year-on-year.

Yet adoption comes with contradictions. Some flagship RWA products boast billions in AUM but only a few dozen holders. Many non-Treasury RWA categories, such as real estate, art, carbon, receivables, remain tiny and illiquid. Regulatory frameworks across the U.S., EU, Hong Kong, Singapore and China remain fragmented.

Still, macro forces provide a powerful tailwind. Higher rates made traditional DeFi yields uncompetitive. Geopolitical tensions in East Asia and global supply-chain fragmentation increased demand for stable stores of value. Cross-border businesses and households increasingly rely on tokenized dollars and tokenized Treasuries to store wealth outside local banking systems. RWA is no longer a speculative narrative — it is becoming the primary interface between traditional capital and public blockchains.

Key Takeaways

- RWA has become a multi-tens-of-billions on-chain sector, driven primarily by tokenized Treasuries and private credit, while stablecoins act as the foundational liquidity layer.

- The real innovation is not “new assets,” but building better global rails for existing ones — letting cash-flowing, low-volatility assets plug into DeFi composability.

- Over the next 3–5 years, growth will expand into private credit, commodities, equities, energy, minerals and even GPUs, but success hinges on regulation, market structure and legal enforceability.

1. Why RWA? TradFi Frictions & Tokenization Benefits

Traditional financial markets are efficient at scale but deeply inefficient at the edges, especially for global users, smaller institutions and long-tail assets. Several structural frictions explain why RWA has returned to the spotlight:

1) High Minimums, Accreditation & Gatekeeping

Institutional funds, bond vehicles and private credit structures often require six-figure tickets, strict residency rules or accreditation. Millions of global investors simply cannot access high-quality dollar yield or stable credit products.

2) Geographic Silos & Regulatory Fragmentation

Treasuries feel different depending on where you live. A Korean corporate, a Brazilian exporter and a Vietnamese entrepreneur navigate different capital-control and banking bottlenecks. Cross-border settlement remains slow and expensive.

3) Slow Settlement, Complex Custody

Even in advanced markets, settlement cycles take days, involving custodians, transfer agents, emails and reconciliations. Operational risk is high, costs are nonlinear and everything breaks across time zones and holidays.

4) Illiquid Long-Term Assets

SME invoices, receivables, consumer loans and smaller real-estate assets cannot be securitized cost-effectively using legacy infrastructure. Despite having stable cash flows, they sit idle in spreadsheets.

2. How Tokenization Helps?

Tokenization doesn’t magically solve the underlying economics — but it changes the rails the assets move on.

1) Machine-Readable Ownership

A token represents a clearly defined claim in a legal wrapper (SPV, trust or fund). It behaves like an ERC-20 or ERC-1400 token: it can settle instantly, plug into DeFi, sit in a wallet or be wrapped into structured strategies.

2) Global Distribution

A properly structured RWA token can be held by anyone who passes KYC/AML and meets investor criteria. This is vital in regions facing geopolitical uncertainty. In East Asia, businesses and individuals increasingly use stablecoins and tokenized Treasuries as “digital dollars” for savings, settlement and capital mobility.

3) Capital Efficiency Through DeFi

Once on-chain, a yield-bearing asset can double as collateral. MakerDAO famously derived the majority of its revenue from RWA during parts of 2022–2023. Tokenized Treasuries and private credit now anchor yield strategies, lending markets and structured products.

4) Making Long-Tail Assets Financeable

A single invoice in Milan is not worth securitizing. But 10,000 invoices pooled into a Centrifuge SPV, tokenized, rated, and financed globally becomes viable capital-market activity.

RWA is not about inventing new assets; it is about placing existing assets into a programmable, borderless financial system.

3. Seven Major RWA Categories & the Rise of Tokenized Treasuries

The RWA landscape spans dozens of asset types, but seven dominate the current cycle.

1) Private Credit

Private credit is the largest non-stablecoin RWA category, covering SME loans, trade finance, consumer credit, HELOCs and more. Platforms like Figure and Centrifuge offer yields in the 8–15% range, slicing pools into senior/junior tranches. Capital markets become shorter and more transparent.

2) Tokenized U.S. Treasuries & Money-Market Funds

The breakout category. Tokenized Treasuries have surged to nearly $9 billion. Products include:

- BlackRock BUIDL — institution-only, high-compliance, SOFR-linked yield.

Ondo OUSG / USDY — global distribution, multi-chain support and DeFi integrations. - Circle USYC — yield-bearing USDC sibling with daily NAV.

- VanEck VBILL — multi-chain, T-bill fund with broad accessibility.

These assets now function as the on-chain risk-free rate.

3) Tokenized Commodities (Led by Gold)

Tokenized gold has become the most mature commodity RWA segment. Products like XAUt and PAXG map 1:1 to vaulted bullion and benefit from macro trends — record-high gold prices, strong central-bank demand and inflation hedging narratives.

4) Tokenized Public Equities & ETFs

Still relatively small, but growing. Platforms issue tokenized versions of S&P 500 ETFs or individual tech stocks. Liquidity remains thin and regulatory hurdles high, but programmability and global access provide long-term potential — especially for private-equity and pre-IPO shares.

5) Tokenized Real Estate

Despite enormous TAM, only a few hundred million dollars are tokenized today. Platforms like RealT, Propy and Lofty offer fractional ownership, rental-income distribution and low minimums. The bottleneck is not technology but legal title, valuation and local regulation.

6) Stablecoins (Tokenized Cash & T-Bills)

Stablecoins are, economically, the largest RWA category — over $300B across USDT, USDC and others. They form the transaction layer, while tokenized Treasuries form the savings layer of on-chain money markets.

7) Emerging Alternative RWAs

Growing interest in tokenized carbon credits, renewable-energy flows, data-center/GPU output, mineral royalties and other non-traditional assets. Forecasts see RWA expanding into several trillion dollars by 2030.

4. Market Landscape & Ecosystem Participants

Understanding RWA requires mapping the multilayered ecosystem across TradFi, DeFi and regulation.

1) Asset Originators

These include banks, asset managers, credit funds, fintech lenders and real-estate SPVs. They originate and manage the underlying assets — the real economic engine.

2) Tokenization Platforms & RWA-Native Chains

Platforms like Securitize, Ondo, Figure and Centrifuge handle issuance, compliance and reporting. RWA-focused L2s like Plume and yield layers like R2 aggregate Treasury and credit exposure into single programmable assets. Cross-chain infrastructure such as LayerZero and Circle’s CCTP — plus omnichain stablecoins like USDG0 — allow assets to flow across ecosystems.

3) Distribution Channels

- Regulated exchanges offering compliant access.

- CEXs integrating RWA for trading and collateral.

- DeFi protocols enabling loans, leverage and liquidity pools.

- Wallets and fintech apps are surfacing RWA as simple savings products.

5) Regulators & Policy

- The EU’s MiCA provides a template for tokenized securities and stablecoins.

- The U.S. GENIUS Act lays the groundwork for regulated dollar-backed stablecoins.

- Hong Kong, Singapore and the UAE push pro-tokenization frameworks.

China’s recent caution toward RWA in Hong Kong shows geopolitical constraints remain real.

The direction is clear that conservative RWA will receive clarity first; complex or retail-focused RWAs will take longer.

5. RWA Projects in the Market

Four projects illustrate how RWA is evolving across different layers.

Figure – Tokenized HELOCs

Figure digitizes the entire HELOC lifecycle using the Provenance blockchain. Borrowers get approvals and funding in days, while investors access transparent, floating-rate credit. The firm has originated tens of billions and established a strong presence in U.S. consumer credit tokenization.

Source: RWA.xyz

Centrifuge – DeFi Infrastructure for Private Credit

Centrifuge enables originators to tokenize SME loans, invoices and receivables into senior/junior tranches. These integrate directly with DeFi protocols. Centrifuge’s multi-chain architecture and DeFi-native transparency shorten traditional capital-market supply chains.

Tokenized Treasuries – BUIDL, Ondo, USYC

BUIDL focuses on institutions; OUSG and USDY bring Treasuries to global users; USYC adds daily NAV and deep banking ties. Together, they form the most successful RWA category to date, enabling on-chain risk-free yield and large-scale institutional adoption.

Plume, USDG0 & R2 – The Yield Layer

Plume aggregates RWA products and embeds them into native DeFi flows. USDG0 provides compliant omnichain liquidity. R2 targets global users needing stable, cross-border yield — bundling T-Bills and private credit into automated yield strategies.

6. Key Challenges & Risks

Despite progress, RWA faces several structural constraints.

1) Liquidity Illusions

Tokenization does not create liquidity. Illiquid assets (single properties, bespoke loans) remain illiquid. Some real-estate tokens trade only once per year, with wide spreads. Only standardized, high-demand assets like Treasuries achieve deep on-chain liquidity.

2) Regulatory Fragmentation

Most RWAs are securities. Transfer restrictions, KYC, residency rules and cross-border limitations fragment liquidity. Enforcement still relies on courts, trustees and custodians — not smart contracts.

3) Market-Structure Gaps

RWA trading is fragmented across DEXs, ATSs and OTC. Few professional market makers specialize in RWA due to limited historical data. Valuation remains opaque for heterogeneous assets.

4) Smart-Contract, Oracle & Concentration Risks

RWA inherits crypto risks while also adding custodial and legal risks. A single custodian failure, oracle issue or regulatory action can affect thousands of token holders. Stablecoins illustrate how scale introduces systemic considerations.

7. Outlook & Conclusion

RWA is neither a passing bubble nor an inevitable trillion-dollar juggernaut — but it is evolving into a foundational layer for global finance. Tokenized assets have grown from experiments to tens of billions of dollars. Forecasts project RWA reaching between $2–4 trillion by 2030, with more aggressive scenarios exceeding $10–16 trillion. Growth will continue first in conservative categories: Treasuries, private credit, money-market instruments and regulated stablecoins. Longer term, RWA will not replace traditional markets. Instead, traditional markets will start using blockchain rails for distribution, settlement and programmability. DeFi will become a liquidity engine for compliant, cash-flowing assets. And stablecoins, paired with tokenized Treasuries, will function as the two-tier digital monetary base of crypto-native economies.

FAQ

Q1: Is RWA just securitization on a blockchain?

A: Partly, yes. The legal substance often resembles traditional securitization or fund interests. The innovation lies in distribution and programmability — tokens settle instantly, plug into DeFi, and enable global access.

Q2: How can regular DeFi users access RWA safely?

A: Use well-audited platforms and regulated issuers that disclose underlying assets clearly. Tokenized Treasuries and high-quality credit pools are common entry points before exploring more niche assets.

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. For more information, please refer to here. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.

What is Blockchain?

Blockchain technology is the technology for storing transactional records, called blocks, of the public in several databases, called chains, in a network connected by peer-to-peer servers. These storages are usually called 'digital ledgers.'

Azuki: The Fastest Growing NFT

Azuki was first announced on January 12, 2022, and is an Ethereum-based profile picture project. This application was developed by four Los Angeles-based individuals who call themselves Chiru Labs. There are 10,000 anime-style PFP, each with their own unique characteristics and visual style.

Learning crypto terminology

Crypto rookies must feel the scenario very familiar: you try to google every hashtag that you don’t understand and finally find the # is a silly inside joke out of nowhere. If you want to be part of the crypto community, you should know those jokes but not everyone of them are silly.

Mother’s Day is Coming, Why Not Cryptos?

Elon Musk gave her mother Dogecoin as a gift last year, and we have selected the top five cryptocurrencies for your mother's day gift.

The era of investing in Meme

The Korean wave has swept the world for more than a decade and it is unwittingly described as a kind of cultural phenomenon only. Squid Game coin is yet another example of how South Korean cinema and showbiz have an enormous influence in other aspects of lifed. The dystopian series Squid Game turns out to be an lauded masterpiece, vividly depicting the cruel and twisted perspective of capitalism while Squid Game coin ended up as a rug pull scam.

What is Cryptocurrency?

Cryptocurrency are decentralized, digital, encrypted methods of exchange. Unlike the U.S. Dollar, Euro and other fiat currencies, the value of a cryptocurrency isn't managed by a central authority.