Best Canadian Cryptocurrency Exchange Options for Investors

2025-10-01 10:25:16

If you want to pick the best Canadian cryptocurrency exchange, you have many options. Bitget, Kraken, Crypto.com, Bitunix, Bitstamp, Coinbase, Binance.US, BitMEX, and PrimeXBT are top choices. You should look at rules, safety, and how simple each trading platform is. Many Canadians started crypto trading this year. New rules now change how exchanges work. Check how these rules affect you and the exchanges:

| Type | Description |

|---|---|

| Regulatory Monitoring | Rules help build trust and make investors feel safe. |

| Securities Laws | Crypto trading follows laws about securities. This can make some people unsure about joining. |

| AML Compliance | Exchanges must follow anti-money laundering rules. This changes how they do business. |

Best Canadian Crypto Exchanges 2025

Top Picks Overview

There are many choices for Canadian crypto exchanges. In 2025, some top picks are Bitget, Kraken, Crypto.com, Bitunix, Bitstamp, Coinbase, Binance.US, BitMEX, and PrimeXBT. Each platform has something special for Canadians. You may want a simple app, strong safety, or low costs. Some platforms help beginners. Others have tools for skilled traders.

Here is what makes these exchanges different:

- Bitget and Kraken have advanced trading and global liquidity.

- Crypto.com and Coinbase are easy for new users.

- Bitunix and Bitstamp offer many coins and good compliance.

- Binance.US and BitMEX have low fees and deep markets.

- PrimeXBT lets you use margin trading and fast trades.

You can pick the best Canadian cryptocurrency exchange by matching your needs with what each platform gives.

Unique Features

Let’s look at some special features on top Canadian crypto exchanges. The table below shows what makes each platform unique and who should use it:

| Exchange Name | Unique Features | Best For |

|---|---|---|

| Coin Exchange Canada | Easy design, clear fees, fast deposits, cold storage | Beginners and experienced traders |

| NDAX | Low fees, many cryptocurrencies, advanced trading | Traders who want more options |

| Bitbuy | Pro Trade for experts, Express Trade for beginners, great support | New users and advanced traders |

| Kraken | Margin trading, futures, strong security record | Advanced traders |

| Coinbase | Simple interface, learning tools, staking | Beginners |

| Shakepay | No trading fees, cashback Visa card, fast Bitcoin and Ethereum purchases | Mobile users |

Tip: Canadian investors want safety, low fees, and rules that protect them when choosing a Canadian cryptocurrency exchange. Always check these things before you sign up.

The best Canadian crypto exchanges have different benefits. Some focus on safety and rules. Others give you more coins or better prices. Choose the platform that fits your needs and goals.

Exchange Comparison

Security & Regulation

If you want a safe crypto exchange in Canada, look for strong security and good rules. Kraken and Bitget use cold storage and two-factor authentication. These exchanges follow strict rules from Canadian authorities. Your money stays safe because of these protections. Most top exchanges also give insurance for digital assets. Good security means less risk for your crypto. Rules help keep your money safe and build trust.

- Kraken and Bitget: Strong security, strict rules, insurance.

- Coinbase and Crypto.com: Regular checks, good compliance, user safety.

- Bitstamp and Bitunix: Good history, follow Canadian rules.

Fees & Pricing

Trading fees can change how much money you make. Some exchanges have low trading fees. Others charge more for each trade. You should look at trading fees before you pick a platform. Here is a quick guide:

| Exchange | Trading Fees | Minimal Trading Fees | Extra Costs |

|---|---|---|---|

| Bitget | Low | Yes | Withdrawal fees |

| Kraken | Medium | No | Deposit fees |

| Crypto.com | Low | Yes | Network fees |

| Bitstamp | Medium | No | Conversion fees |

| Coinbase | High | No | Service fees |

Tip: To save money, choose an exchange with low trading fees.

Supported Coins

You want many coins for more choices and better liquidity. High liquidity lets you buy or sell fast. Bitunix and Bitstamp have lots of coins. Bitget and Binance.US also offer high liquidity and many trading pairs. More coins give you more ways to grow your portfolio.

- Bitunix: Over 100 coins, high liquidity.

- Bitstamp: Many coins, good liquidity.

- Binance.US: Lots of coins, high liquidity.

User Experience

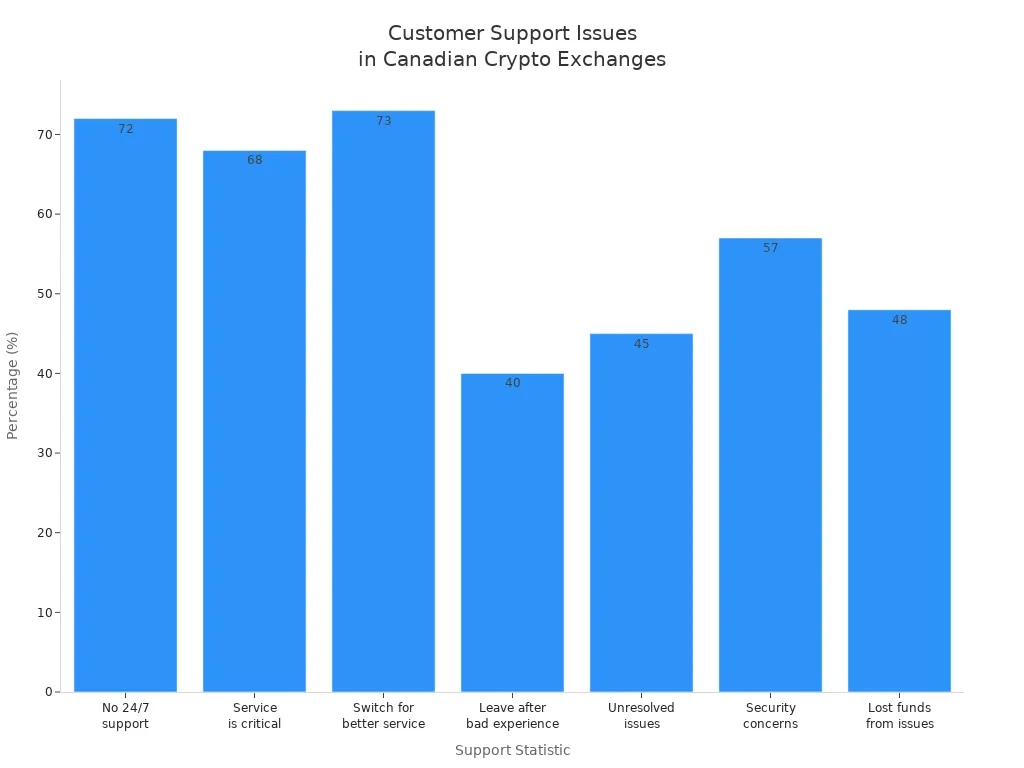

User experience is important when you trade. You want a simple app, quick deposits, and good support. Most Canadian exchanges are easy to use. But customer support can be hard to get. Did you know 72% of platforms do not have 24/7 support? Many traders change exchanges for better service. If you have a security problem, fast help matters. Here is a table that shows how support affects traders:

| Statistic | Value |

|---|---|

| Platforms lacking 24/7 support | 72% |

| Traders citing customer service as critical | 68% |

| Traders willing to switch for better service | 73% |

| Traders leaving after one bad experience | 40% |

| Unresolved support issues among investors | 45% |

| Users needing support for security concerns | 57% |

| Traders losing funds due to account issues | 48% |

If you want the best Canadian cryptocurrency exchange, look for good support and easy navigation. Fast help can protect your money and make trading safer.

Exchange Reviews

Bitget

Bitget has low fees and easy copy trading. The app is simple for new users. Many Canadians like the mobile app and clear design. Bitget is known for low costs and helpful tools. You can follow top traders and copy their trades. This helps you learn faster.

Here’s what is good and what is not:

| Advantages | Disadvantages |

|---|---|

| Low fees | Not many ways to use regular money |

| Good copy trading tools | KYC can be slow when busy |

| Easy to use app and mobile | Fees for taking out money can be confusing |

| Some products are not in all regions |

Tip: Bitget is good if you want low fees and copy trading. But you may have trouble with deposits and withdrawals.

Kraken

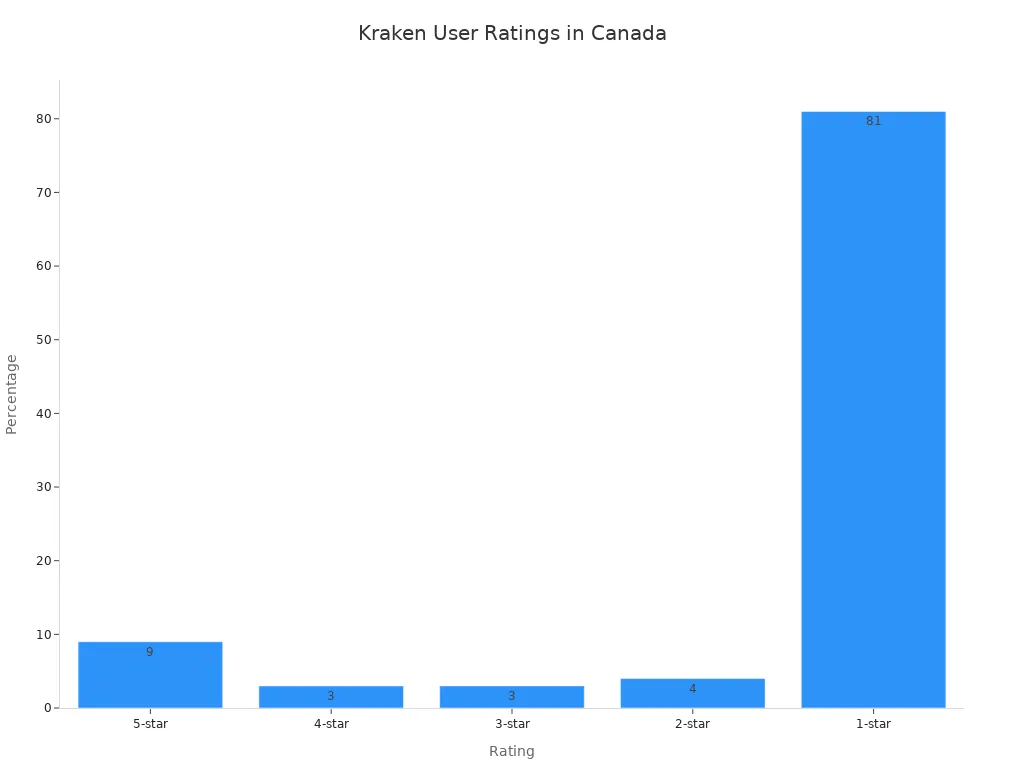

Kraken is known for strong security and lots of coins. You can use advanced trading like margin trading. Kraken follows strict rules to keep your money safe. Many Canadians trust Kraken for safety and its long history.

But users have mixed feelings. Most say support and account access are problems. Here is how Canadians rate Kraken:

| Rating | Percentage |

|---|---|

| 5-star | 9% |

| 4-star | 3% |

| 3-star | 3% |

| 2-star | 4% |

| 1-star | 81% |

Kraken has strong security and good liquidity. But support can be slow. If you want safety and advanced trading, try Kraken.

Crypto.com

Crypto.com is popular for Canadians who want a simple app. It has strong security and follows rules. You can buy, sell, and earn rewards with many coins. Crypto.com also gives you a Visa card to spend crypto.

Here is how Crypto.com keeps your money safe:

| Aspect | Details |

|---|---|

| Regulatory Compliance | Registered in Ontario, working on licenses in other places. |

| Security Measures | Strong insurance and follows world rules. |

You get peace of mind with good rules and insurance. If you want a safe start, Crypto.com is a good choice.

Bitunix

Bitunix has many coins and advanced trading tools. You can trade over 700 cryptocurrencies. It has copy trading and multi-window trading. Bitunix uses face recognition for extra safety. Fees are low, so you save money.

Here is what makes Bitunix special:

| Unique Selling Point | Description |

|---|---|

| Regulatory Compliance | Bitunix follows strong rules for a safe place to trade. |

| Wide Range of Trading Options | You can trade over 700 coins and many contracts. |

| Competitive Fees | Bitunix has low fees for futures and spot trades. |

| Advanced Trading Features | You get multi-window trading, copy trading, and face recognition. |

If you want lots of coins and cool tools, Bitunix is a top pick.

Bitstamp

Bitstamp is known for being safe and reliable. You get many coins and strong liquidity. The app is easy to use, so you can start fast. Bitstamp follows Canadian rules and has a good safety record.

You may like Bitstamp for its simple design and long history. Some users want more advanced tools, but most trust Bitstamp.

Coinbase

Coinbase is great for beginners. The app is simple and has learning tools. Many Canadians use Coinbase because it is easy to buy and sell coins. The platform is trusted, but some users say support is slow and accounts freeze.

- Complaints: Many users say support is slow. Some have frozen accounts.

- Praises: Support is faster since 2021. The help center answers many questions.

- Ratings: Coinbase gets about 4 stars, but has a 'D' from the BBB for support issues.

Note: Coinbase is good for a simple start. If you need fast help, try other exchanges.

Binance.US

Binance.US has low fees and high liquidity. Traders like deep markets and many coins. But Canadians cannot use Binance.US because of local rules. It also has fewer coins than the global Binance.

| Limitation | Description |

|---|---|

| Accessibility | Canadians cannot use Binance.US because of rules. |

| Services | Not much access to futures and margin trading. |

| Supported Cryptocurrencies | Fewer coins than the global Binance. |

If you live in Canada, pick another exchange. Binance.US is not allowed now.

BitMEX

BitMEX is famous for advanced trading and high leverage. You can use futures and margin trading with up to 250x leverage. BitMEX has strong security with multi-signature systems. But BitMEX is not in Canada and has fewer coins than other exchanges.

| Key Features | Drawbacks |

|---|---|

| Advanced trading with futures and margin | Not in Canada or some other places |

| High leverage (up to 250x) | Not many coins to trade |

| Strong security with multi-signature systems |

If you want advanced trading and high leverage, BitMEX is great if you can use it. Canadians need to pick another exchange.

PrimeXBT

PrimeXBT has fast trades and margin trading. You can trade crypto, forex, and more in one account. The platform is known for speed and advanced tools. Liquidity is strong, so big trades are easy. PrimeXBT is best for skilled traders who want more than just crypto.

New users may find it hard to use. If you want to trade many things and use leverage, PrimeXBT is a good choice.

Remember: Always check if the exchange works in your area before you sign up. The best Canadian cryptocurrency exchange depends on your needs, skills, and where you live.

Crypto Regulations in Canada

Regulation Overview

You may wonder how rules in Canada change your trading. Canadian officials see cryptocurrency as a commodity. It is not legal money. You pay taxes on money you make from crypto. Only half of your capital gains are taxed. If you earn money, you must report it. Crypto taxes can be hard to understand. Learn how to file crypto taxes before you start trading.

Canadian regulators want to keep investors safe. They also want new ideas to grow. They focus on registration and anti-money laundering rules. They want clear reports from exchanges. Rules are strict in Canada. For example, KuCoin got a CA$20 million fine. They did not report big or strange transactions. This shows Canada takes compliance very seriously.

Let’s see how Canada compares to other places:

| Region | Regulatory Approach | Key Features |

|---|---|---|

| Canada | Balanced focus on investor protection and innovation | Registration as MSBs, FINTRAC AML rules, scrutiny on exchanges |

| United States | Fragmented, mixed state and federal rules | SEC focuses on securities law, mixed compliance costs |

| European Union | Comprehensive MiCA framework | Strong stablecoin transparency, reserve requirements |

Canada’s rules help keep people safe. They also help new ideas grow. But new products may take longer to get approved than in the EU or U.S.

Compliance for Investors

You must follow rules when you use a Canadian crypto exchange. Every platform needs to register as a Money Services Business with FINTRAC. This helps stop money laundering. It keeps your money safe. You also need to do Know Your Customer checks. These checks prove who you are. They protect you from scams.

Here are the main steps for Canadian investors:

- Register with exchanges that follow MSB rules.

- Do KYC checks to show your identity.

- Make sure the exchange reports big or strange transactions.

The Ontario Securities Commission bans exchanges that are not registered. New rules need strong AML steps and KYC checks. If you skip these steps, you may lose your account. You could also get in trouble.

Tip: Always pick exchanges that follow Canadian rules. This keeps your money safe. It helps you avoid tax problems.

You must report money you make from crypto. You also report capital gains. Canadian tax rules apply to every trade. If you want to stay safe, learn about crypto taxes and how to file them. Following rules protects your investments. It keeps you out of trouble with the law.

How to Choose the Best Canadian Cryptocurrency Exchange

Key Factors

You need a crypto trading platform that fits you. First, look at what matters most. Here is a table to help you compare:

| Factor | Description |

|---|---|

| Security & Regulation | Does the exchange follow Canadian laws and protect your money? |

| Fee Structures | Are trading, deposit, and withdrawal costs clear and fair? |

| Usability | Is the platform easy to use on your phone or computer? |

| Customer Service | Can you get help quickly if you have a problem? |

| Reputation & Reviews | Do other Canadian investors trust the exchange? |

Always check if the exchange has strong liquidity. This means you can buy or sell coins fast. Prices do not change much when you trade. Good liquidity makes trading easier.

Tip: Read reviews from other Canadians before you sign up. Their stories can help you see what works and what does not.

Regulation & Security

Rules help keep your money safe. Canadian exchanges must follow strict laws. Check if the platform is registered with FINTRAC. Some exchanges hold your coins for you. These platforms need extra registration and must follow Bank of Canada rules. If you use fiat money, the exchange must meet more requirements.

| Custody Model | Regulatory Requirement |

|---|---|

| Non-custodial | FINTRAC registration may be enough if trades are instant. |

| Custodial | Needs more securities registration and Bank of Canada rules if client funds are held. |

| Fiat Involvement | Bank of Canada’s RPAA applies if fiat and client funds are involved. |

Pick a platform with strong security like two-factor authentication. Cold storage helps keep your coins safe from hackers. Always check how the exchange protects your personal data.

Fees & Support

Fees can lower your profits. Look for clear information about trading fees, deposit costs, and withdrawal charges. Some exchanges have low fees but charge more for taking out money. Compare fee structures before you choose.

You also want good support. If you have a problem, fast help is important. Check if the exchange offers 24/7 customer service. Reliable support can save you time and stress.

- Here’s how to pick a good crypto trading platform:

- Check regulation and security first.

- Compare liquidity and fees.

- Try the app to see if it is easy.

- Read reviews from other Canadians.

- Make sure support is easy to reach.

Note: Picking the right Canadian exchange helps you trade safely. You protect your money and enjoy better trading.

Getting Started

Account Setup

Ready to dive in? You need to create your account first. Pick a canadian exchange that fits your needs. Go to the website or download the app. Click “Sign Up” or “Register.” Enter your email and set a strong password. Some platforms ask for your phone number. Make sure you use real information. If you want to know how to register on a canadian crypto exchange, just follow the steps on the screen. Most exchanges guide you through each part.

Tip: Use a password that mixes letters, numbers, and symbols. This keeps your account safe.

Verification

After you set up your account, you need to verify your identity. This step helps keep everyone safe. You upload a photo of your ID, like a driver’s license or passport. Some exchanges ask for a selfie. You may need to enter your address. The platform checks your info. This can take a few minutes or a few hours.

| Step | What You Do | Why It Matters |

|---|---|---|

| Upload ID | Take a clear photo | Proves who you are |

| Add Address | Enter your details | Follows canadian rules |

| Take Selfie | Snap a quick photo | Stops fake accounts |

Funding

Now you can add money to your account. Choose how you want to fund it. Most canadian exchanges let you use Interac e-Transfer, wire transfer, or credit card. Go to the “Deposit” section. Pick your method and follow the instructions. Your money shows up in your account soon.

Note: Some funding methods cost more. Check the fees before you deposit.

First Trade

You’re ready to buy your first crypto! Go to the trading page. Pick the coin you want. Enter the amount. Click “Buy.” Review your order and confirm. You now own crypto. You can watch your balance grow or trade more coins.

Tip: Start small. Learn how the platform works before you make big trades.

ETFs & Alternative Options

ETF Overview

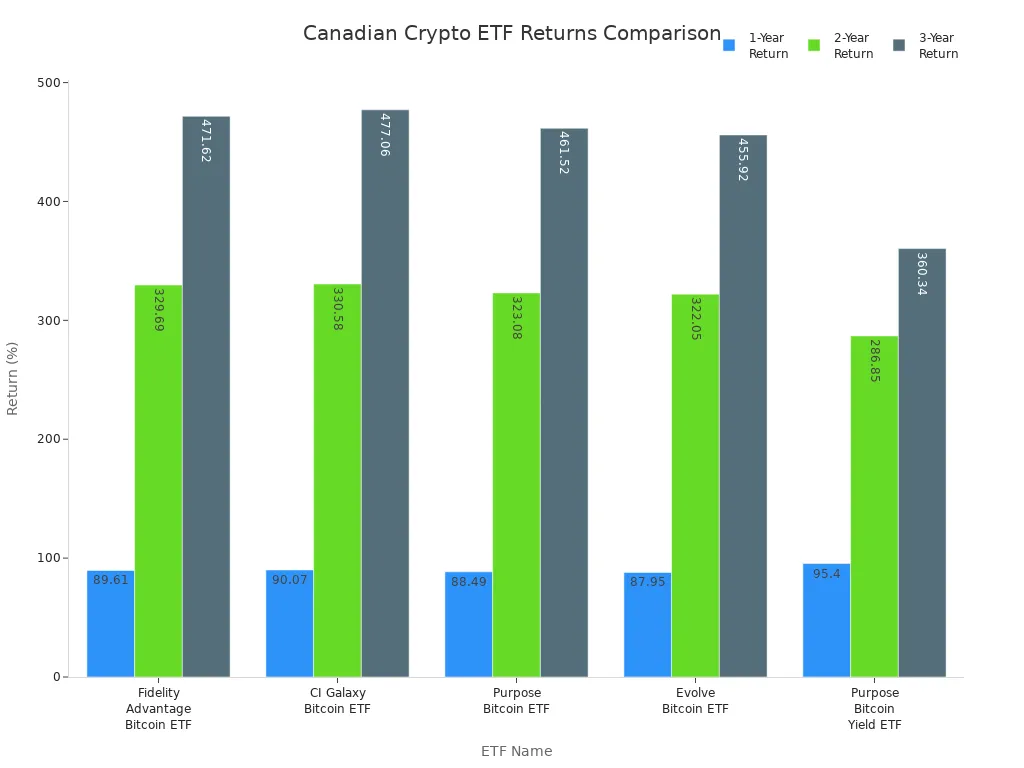

You might want to invest in crypto without using an exchange. Canadian crypto ETFs make this easy. These funds let you buy Bitcoin or other coins through your regular stock account. You don’t need to worry about wallets or private keys. Some popular choices include Fidelity Advantage Bitcoin ETF, Purpose Bitcoin ETF, CI Galaxy Bitcoin ETF, Evolve Bitcoin ETF, and Purpose Bitcoin Yield ETF.

Here’s a quick look at how these ETFs perform compared to direct trading. You can see their returns and fees in the table below:

| ETF Name | 1-Year Return | 2-Year Return | 3-Year Return | Management Fee | Management Expense Ratio |

|---|---|---|---|---|---|

| Fidelity Advantage Bitcoin ETF | 89.61% | 329.69% | 471.62% | 0.32% | 0.40% |

| CI Galaxy Bitcoin ETF | 90.07% | 330.58% | 477.06% | 0.40% | 0.69% |

| Purpose Bitcoin ETF | 88.49% | 323.08% | 461.52% | 1.00% | 1.31% |

| Evolve Bitcoin ETF | 87.95% | 322.05% | 455.92% | 0.75% | 1.53% |

| Purpose Bitcoin Yield ETF | 95.40% | 286.85% | 360.34% | 1.10% | 1.42% |

Pros & Cons

You might wonder if ETFs are better than trading on a canadian exchange. Let’s break down the good and bad sides:

Pros:

- You can buy and sell ETFs easily through your regular broker.

- You don’t need to manage crypto wallets or worry about losing keys.

- ETFs follow strict rules, so you get extra safety.

- You see clear fees and returns.

Cons:

- ETF fees can add up over time.

- You don’t own the actual coins, so you can’t use them for payments or transfers.

- ETF prices might not match crypto prices exactly.

- Some ETFs have higher costs than direct trading.

Tip: If you want simple investing and extra safety, ETFs are a smart choice. If you want full control and more coin options, a canadian exchange might fit you better.

You have many choices for a Canadian crypto exchange. Focus on regulation, security, and user experience before you decide. Think about your goals and how much risk you want. Check how taxes work for each platform. Taxes matter when you buy, sell, or earn crypto. Learn how taxes affect your gains and losses. Research more if you need help. Stay updated on taxes and new rules in Canada. You protect your money when you know the latest about taxes.

FAQ

What is the safest way to store my crypto in Canada?

You should use a wallet that keeps your coins offline, like a hardware wallet. Many exchanges offer cold storage. Always turn on two-factor authentication. Never share your passwords. Safety starts with you!

Do I have to pay taxes on my crypto trades?

Yes, you do. The government treats crypto as property. You must report gains and losses when you file taxes. Keep records of every trade. If you earn money, you need to pay taxes.

Can beginners use Canadian crypto exchanges easily?

Absolutely! Most platforms have simple apps and guides. You can start with small trades. Many exchanges offer learning tools and customer support. If you get stuck, help is just a click away.

How do I pick the best exchange for me?

Look for strong security, low fees, and easy navigation. Read reviews from other Canadians. Try the app before you trade. If you want help, check if the exchange offers good customer support.