FAMEEX Daily Highlights | Brazilian president signs crypto bill into law

2022-12-23 07:27:55Top Trending Crypto News Today

Alameda CEO Caroline Ellison Pleads guilty but is Cleared of all Chargeshttps://www.fameex.com/en-US/news/alameda-ceo-caroline-ellison-pleads-guilty-but-is-cleared-of-all-charges

According to a newly released confidential plea bargain, Caroline Ellison, the CEO of Alameda Research, admitted guilt on seven counts of fraud. Ellison will be subject to a $250,000 fine and seizure of any assets she acquired with FTX funds in exchange for cooperating with law enforcement.

Twitter adds BTC and ETH price indexes to search function

https://cointelegraph.com/news/twitter-quietly-adds-btc-and-eth-price-indexes-to-search-function

Twitter has added a new crypto feature that enables users to search the price of Bitcoin (BTC) and Ether (ETH) simply by typing their names or tickers into the search tab. Twitter Business said that it expects to expand its coverage of symbols and improve user experience "in the coming weeks."

Brazilian president signs crypto bill into law

https://cointelegraph.com/news/brazilian-president-signs-crypto-bill-into-law

According to the text of the bill, Brazil’s residents will not be able to use cryptocurrencies like Bitcoin as legal tender in the country. However, the newly passed law includes many digital currencies under the definition of legal payment methods in Brazil. It also establishes a licensing regime for virtual asset service providers and sets penalties for fraud using digital assets.

Daily Crypto Market Analysis - Growing and Forecast

In the last 24 hours, the long liquidations were 18.19M USDT and the short liquidations were 16.22M USDT, leaving 1.97M USDT worth of net short liquidations. The total liquidations is slightly higher than that of the day before yesterday, but still stays at a low level, reflecting the lack of investors’ participation in the market and the correction of the market.The Fear & Greed index climbed slightly to 28, still below 30. The number has been around 25 most of the time in the last 4 months, showing that the investors’ confidence is yet to be recovered. But on the other hand, the market has been relatively stable, instead of slipping further.

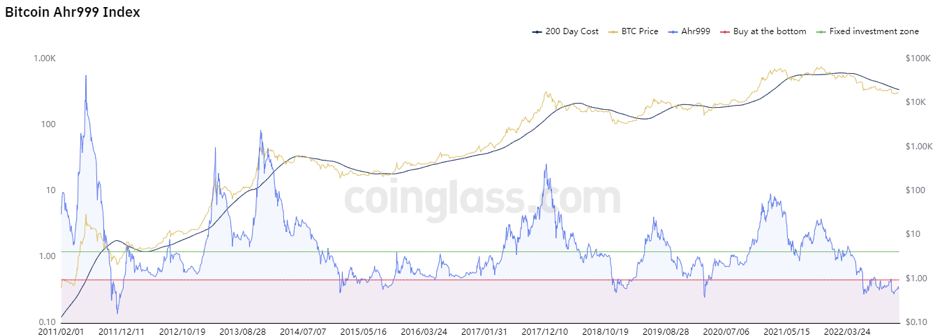

Bitcoin Ahr999 stays at 0.32, below the bottom line 0.45 and the DCA line 1.2. The numbers reflect that the bear market will last for a long time. Judging from the information above, the prices are still at the bottom zone.

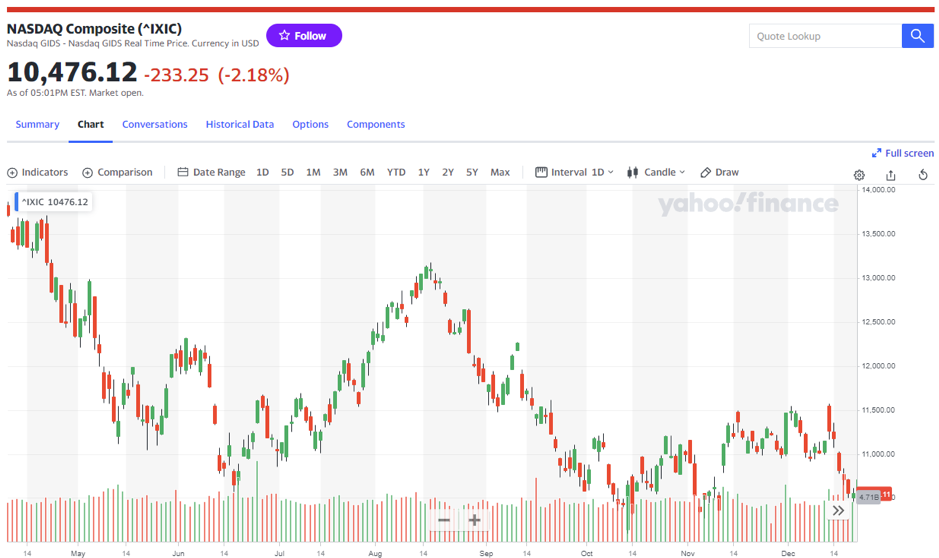

In the last trade day, the three major U.S. stocks all went down. DJI is the strongest one, down by 1.05%. S&P 500 is down by 1.44%. And the NASDAQ is the weakest, down by 2.18%. The two main cryptos, BTC and ETH grew slightly by 0.16% and 0.37%.

From the beginning of December, DJI, S&P 500 and NASDAQ have gone down by 4.5%, 6.3% and 8.7% separately. It’s possible that these three indexes will end the 3-year record of continuous growth and will be the worst annual performance since 2008.

According to the economic statistics, the last week saw the number of people applying unemployment compensation close to the lowest record. The robust labor market will offer sufficient reason for the Fed to deploy an austerity policy. In addition, the increased spending promotes its GDP increase to 3.2%. Key inflation indexes are also up slightly.

The prices of mainstream cryptos rebounded yesterday, ranging from 0.11% to 4.96%. The DOGE is the strongest, up by 4.96%. BTC and ETH increased 0.16% and 0.37% separately, helping to stabilize the market.

Judging from the 4-hour timeline, the BTC price attempted to go down below 16559, but thanks to the strong support, the price rebounded to near MA9 and MA25, which is believed to be the key price recently. Taking the past experience into consideration, the trade volume will drop significantly during the Christmas holiday, plus the fact that the price has been in a narrow zone, so this tendency will last provided that no surprise will occur.

Disclaimer: The information provided in this section is for informational purposes only, doesn't represent any investment advice or FAMEEX's official view.