FameEX Today’s Crypto News Recap | February 13, 2026

2026-02-13 03:58:43

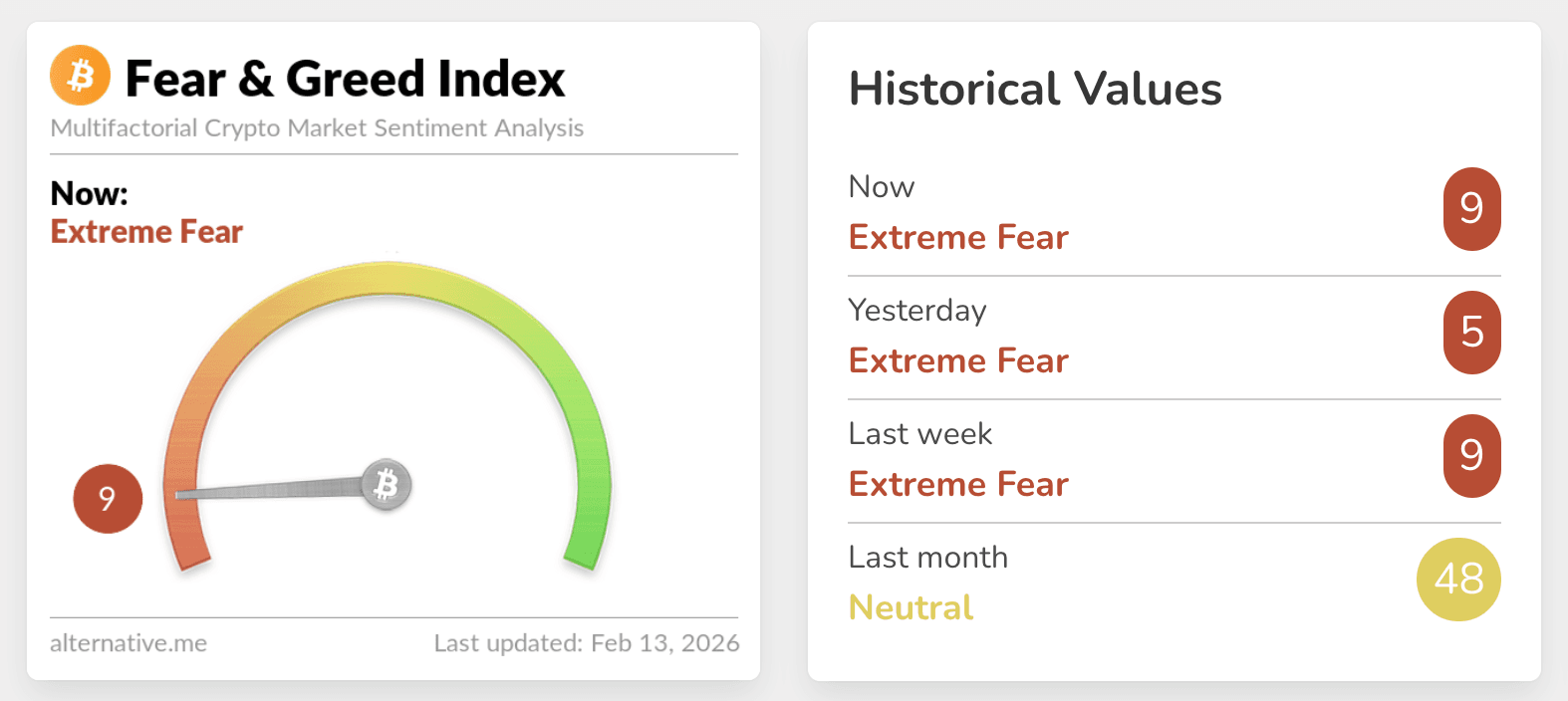

The Federal Reserve proposes a crypto margin framework, the Aptos ecosystem launches a protocol stablecoin, and Bitcoin funding rates turn negative, which reflects parallel developments in regulation, infrastructure, and derivatives market structure Today’s crypto market continues to move in a conservative and structurally consolidative rhythm. Bitcoin traded below the $67K level while showing characteristics consistent with an onchain capitulation structure, where long-term holder distribution coincided with derivatives deleveraging. This dynamic made price rebounds resemble position rebalancing rather than trend expansion. The Crypto Fear & Greed Index remained in Extreme Fear territory. This signals that capital behavior is centered on leverage reduction and exposure control, with market attention focused on risk absorption and liquidity management. Ethereum repeatedly tested support near $1,900 as large participants continued adding to long positions, yet those positions remain in floating loss territory. This indicates that high-leverage exposure is being repriced alongside broader market repair. Network-wide liquidation activity stayed elevated, and short-term price movements were driven more by forced unwinds and portfolio reshuffling than by fresh directional demand. Sector capital rotated selectively, but the broader market narrative remained anchored in structural repair and leverage release, suggesting that sentiment compression and risk digestion are still unfolding.

Crypto Markets Overview

The crypto market is currently operating within a classic structural compression phase. Bitcoin continues to function as a market anchor for conservative capital positioning, even as onchain data shows ongoing distribution from long-term holders, mirroring capitulation patterns seen in previous corrective cycles. The Crypto Fear & Greed Index reading of 9 confirms an Extreme Fear environment, reflecting cautious capital deployment focused on deleveraging, exposure trimming, and liquidity preservation. Over the past 24 hours, total liquidations reached approximately USD 255 million, with USD 180 million coming from long positions, highlighting persistent one-sided positioning pressure. Bitcoin and Ethereum long positions bore the majority of liquidation impact, underscoring how leveraged exposure is being passively reduced in a volatile environment. On the Ethereum side, large addresses accumulated additional long exposure during price pullbacks, bringing combined holdings to roughly 105,000 ETH, equivalent to about USD 204 million in notional value, though those positions remain in floating losses. This behavior suggests that institutional or high-risk participants are adjusting positions within a compressed market structure rather than making outright directional bets.

Source: Alternative

Bitcoin And Ethereum Range Volatility Driven By Leverage Reset

Bitcoin is currently forming a high-density liquidity band between $66K and $68K, an area that overlaps with both long and short liquidation triggers, making price action sensitive to leverage-driven back-and-forth testing. Onchain indicators continue to show phased distribution from long-term holders, resembling historical supply release patterns observed during capitulation periods, which dampens chase demand and keeps rebounds largely confined to liquidity refills. Ethereum’s repeated oscillation near $1,900 reflects a mix of large long additions and derivatives position rebalancing, producing elevated volatility without directional continuity. Liquidation metrics indicate that long pressure remains higher than short pressure, with forced unwinds actively reshaping short-term liquidity conditions. The price behavior of both assets aligns more closely with post-capitulation consolidation and portfolio repositioning rather than trend formation, emphasizing an ongoing cycle of leverage reset, risk absorption, and structural stabilization.

Key News Highlights:

Federal Reserve Proposes Crypto Derivatives Margin Framework

A working paper released by the US Federal Reserve proposes treating crypto assets as a distinct asset class within uncleared derivatives markets to establish tailored initial margin risk weightings. The paper argues that crypto volatility and market behavior differ materially from traditional financial instruments, making existing standardized margin models insufficient for capturing crypto-specific risk dynamics. The proposal separates crypto assets into floating and pegged categories and suggests constructing a benchmark index composed of multiple cryptocurrencies and stablecoins to better observe aggregate volatility patterns. This framework is intended to improve the calibration of margin requirements, so they more accurately reflect counterparty risk in real trading environments. The document emphasizes the critical role of initial margin systems in mitigating default and liquidation risk within derivatives markets, noting that crypto’s higher volatility necessitates larger collateral buffers. Market observers view the proposal as part of a broader regulatory effort to integrate crypto assets into established financial risk frameworks in response to growing participation and market scale.

Aptos Ecosystem Introduces Protocol-Native Stablecoin

The Decibel Foundation announced plans to launch a protocol-native stablecoin, USDCBL, ahead of the mainnet debut of its Aptos-based decentralized derivatives exchange. The stablecoin will serve as onchain collateral for perpetual futures trading, allowing the platform to internalize reserve-generated yield rather than relying on third-party issuers. According to the announcement, USDCBL will be issued using Bridge’s infrastructure and backed by a mix of cash and short-term US Treasurys to ensure full collateralization and issuance transparency. The exchange plans to operate using a unified cross-margin account model to improve capital efficiency and settlement consistency. During its testnet phase, the platform reported strong participation metrics, indicating sustained demand for onchain derivatives trading. Upon launch, users will convert existing stablecoins into USDCBL to access trading functionality. The foundation describes the stablecoin as core exchange infrastructure rather than a standalone retail asset, reflecting a broader industry trend toward ecosystem-aligned liquidity and settlement design.

Bitcoin Funding Rates Reflect Concentrated Short Positioning

Bitcoin derivatives funding rates have remained in negative territory, indicating that short positioning dominates futures markets. The 7-day average funding rate has turned negative, meaning short traders are paying longs, which signals a directional imbalance in positioning. Reports note that Bitcoin’s recent price declines coincided with derivatives adjustments, suggesting capital is being redistributed across leveraged exposure. Historical data shows that extended periods of negative funding often align with concentrated positioning and structural market stress. Onchain and liquidity indicators point to cautious capital flows, with stablecoin supply trends suggesting ongoing reallocation. Funding rates serve as a balancing mechanism between long and short participants in futures markets, offering insight into trader positioning and risk appetite. Market participants closely monitor these metrics to gauge derivatives structure and liquidity dynamics.

Trending Tokens:

- $PIEVERSE (Pieverse)

The Pieverse project has regained attention amid renewed focus on onchain payment infrastructure, as markets increasingly prioritize auditability and gasless transaction experiences, positioning it as a bridge between programmable settlement and real-world usability. The protocol is built around timestamped onchain invoices, receipts, and checks, framing payments as verifiable financial records rather than simple value transfers. A recent reward distribution mechanism tied to a major wallet campaign has reactivated user participation, demonstrating how incentive programs can accelerate experimentation and adoption of emerging payment rails. The structured claiming process reinforces operational transparency while signaling an intent to standardize auditable payment workflows. An upcoming token circulation milestone is further concentrating attention on liquidity formation and ecosystem onboarding. These elements place Pieverse within a class of payment infrastructure focused on compliance-friendly traceability and composability.

- $USAD (Paxos Labs)

USAD is attracting institutional attention as privacy-oriented stablecoin infrastructure gains strategic importance, with encrypted balances and shielded transaction logic repositioning stablecoins from simple settlement tools into confidential financial coordination layers. Its mainnet launch marks a milestone in embedding privacy by default within programmable payment environments, aligning with enterprise demand for transaction confidentiality without sacrificing auditability. The architecture supports configurable compliance frameworks, illustrating how privacy and regulatory alignment can coexist within the same execution layer. Market participants interpret this development as a signal that enterprise blockchain tooling is maturing beyond speculative applications. Its integration potential across payroll distribution, treasury management, and cross-border settlement further reinforces its positioning as operational financial infrastructure.

- $RVV (Astra Nova)

Astra Nova is gaining market attention through narrative-driven ecosystem expansion that combines Web3 gaming with cross-community intellectual property collaboration. A sci-fi storytelling initiative linking two established ecosystems demonstrates how shared worldbuilding can function as a coordination layer for user engagement. By embedding interactive narrative elements into its game universe, the project reframes token participation as part of a broader entertainment experience rather than a purely financial interaction. This model aligns with an industry shift toward experiential onboarding, where content becomes a gateway to ecosystem identity. Such collaborations can amplify network effects while preserving creative independence, and the integration of high-quality storytelling signals the maturation of Web3 gaming strategies beyond purely token-incentive mechanics.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.