FameEX Weekly Market Trend | February 22, 2024

2024-02-26 09:58:55

1. Market Trend

From Feb. 19 to Feb. 21, the BTC price swung from $50,625.00 to $52,985.00, with a volatility of4.66%. The prior analysis noted the necessity of pullbacks, advising traders not to hastily adopt bullish positions. Patience is advised to await buying opportunities at lower levels. Despite Bitcoin briefly surpassing $53,000, it swiftly retraced to around $50,500. The current and future trends of Bitcoin align with the previous analysis:

1. A notable pullback, with the retracement nearing the MA120 line (around $48,500).

2. Sideways movement (utilizing time to consolidate, rectifying various indicators and candlestick patterns).

If situation 1 arises, purchasing around $48,500 could yield profits. Alternatively, if situation 2 unfolds, waiting for Bitcoin to consolidate above $53,000 (a new uptrend channel) before trading is recommended. This cautious approach may still lead to profitable outcomes. Hence, it’s wise to patiently await market direction rather than hastily entering trades.

Considering the current BTC daily chart, the likelihood of the second scenario is high. However, it’s crucial to approach the market cautiously and not be misled by surface indicators. Observing market changes before trading is advisable. Traders may recognize similarities with past trends around $43,000, where BTC stabilized before initiating an uptrend. Despite encountering false breakouts, it eventually surpassed the $50,000 mark. Similarly, stability above $53,000 is necessary for a new uptrend channel to form. Therefore, investors should be cautious as there may be multiple false breakouts during this process. It is advisable to review the behavior around $43,000 and learn from that experience.

Source: BTCUSDT | Binance Spot

Between Feb. 19 and Feb. 21, the price of ETH/BTC fluctuated between 0.05548 and 0.05789, a 4.34% range. In the previous analysis, it was noted that there’s currently only a position from a buy-in at 0.05400, falling short of the desired additional position level (0.05650). Recently, ETH/BTC has displayed a clear upward trend, steadily ascending along the MA7 and MA20 with concurrent volume and price increases. Moreover, the price has reached the additional position level (0.05650), with the highest touching near 0.05800. Hence, 0.57800 will be the second additional position level, and investors can buy in when it reaches this level. Holding coins for a rise will be the main theme for ETH/BTC in the foreseeable future.

Based on overall analysis, the current BTC market is experiencing a temporary pause, with retracement and sideways movement becoming the two possible directions for BTC in the near term. It’s unlikely to see continued upward momentum in the short term. Overall, the probability of sideways movement outweighs that of retracement. If this scenario unfolds, altcoins will have significant room for development. Therefore, during this period, it’s crucial to focus on high-quality altcoins, as early positioning may yield good profits. ETH may potentially take over the baton from BTC and lead the market upward, so it’s essential to monitor ETH’s price movements closely. Fundamentally, the overall market funds continue to remain in a net inflow state.

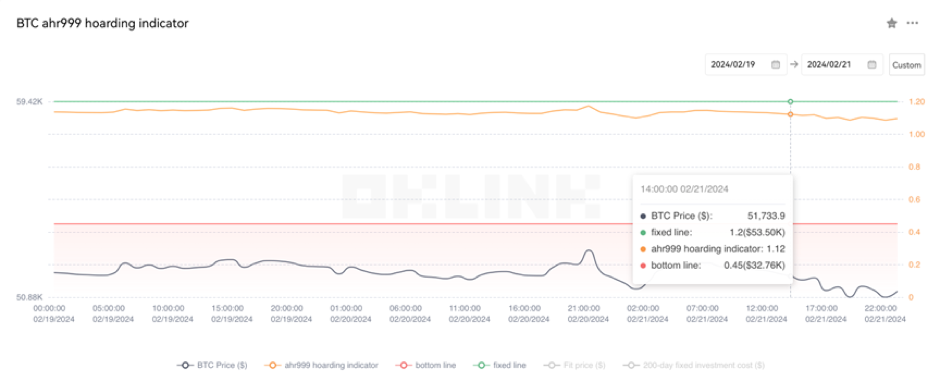

The Bitcoin Ahr999 index of 1.12 is between the buy-the-dip level ($32,760) and the DCA level ($53,500). Therefore, it is advised to purchase popular coins via DCA.

2. Perpetual Futures

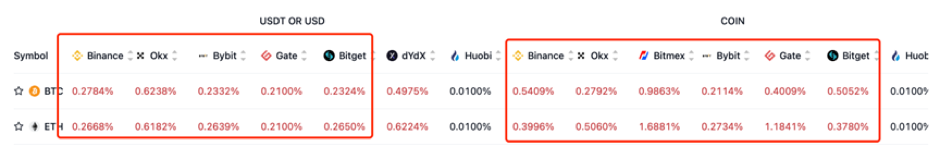

In general, the 7-day cumulative funding rates for the popular coins across major exchanges are positive, indicating that long leverages are relatively high.

In the recent period, the BTC contract open interest remained unchanged, contrasting with a rise in open interest for ETH contracts.

Exchange BTC Contract Open Interest:

Exchange ETH Contract Open Interest:

3. Industry Roundup

1) On February 19, South Korea considered allowing the issuance of spot Bitcoin ETFs.

2) On February 19, the market capitalization of WLD surpassed $1 billion, reaching a historical high.

3) On February 19, Japan sought to permit certain venture capital firms to invest directly in cryptocurrency and Web3 startups.

4) On February 20, the total market capitalization of stablecoins surpassed $140 billion.

5) On February 20, BlackRock intensified its promotion of spot Bitcoin ETFs.

6) On February 20, CME Group will launch Euro-denominated micro Bitcoin and Ethereum futures on March 18.

7) On February 21, Huobi HK submitted a virtual asset trading platform license application to the Securities and Futures Commission of Hong Kong.

8) On February 21, there were fewer than 10,000 blocks left until the Bitcoin halving.

9) On February 21, the Hong Kong Monetary Authority issued guidelines for companies providing cryptocurrency custody services.

10) On February 21, Bitcoin exchange balances dropped to their lowest point since April 2018.

11) On February 21, BlackRock’s IBIT holdings surpassed 120,000 BTC.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.