cryptocurrency etf list grows as new funds launch in 2025

2025-10-17 08:47:16

You see the cryptocurrency etf list get bigger in 2025. New funds like the 3iQ XRP ETF and Purpose XRP ETF started in June. Each fund has millions in assets under management. SEC approvals for Bitcoin and Ethereum exchange-traded funds made more people interested. More people now want to join in. The cryptocurrency etf list now brings in both retail and institutional investors. These investors want safe ways to buy digital assets. You see that the cryptocurrency etf list has options for easy entry. It also gives more liquidity. The cryptocurrency etf list helps bring stability and makes crypto more accepted. When you look at the cryptocurrency etf list, you find more choices. You also get better access to the market.

| ETF Name | Launch Date | Assets Under Management |

|---|---|---|

| 3iQ XRP ETF | June 17, 2025 | C$175.27 million |

| Purpose XRP ETF | June 18, 2025 | C$82.27 million |

- The cryptocurrency etf list gives you more ways to invest in digital assets.

- Exchange-traded funds help you join the crypto market with less risk.

cryptocurrency etf list 2025

new crypto etfs

You see many new crypto etfs appear in 2025. The launch of crypto etfs this year has set records for both the number of funds and the amount of money invested. In just one week, cryptocurrency ETPs attracted $3.17 billion in inflows. The total inflows for 2025 have reached $48.7 billion, which is higher than all of 2024. This shows that more people want to invest in digital asset etfs and trust these products.

Here are some of the most notable crypto etfs launched in 2025:

| ETF Name | Launch Date | Assets Under Management | Notable Features |

|---|---|---|---|

| REX-Osprey XRP ETF | September 2025 | $67 million | Surpassed IVES in first-day trading, strong regulatory approval. |

| REX-Osprey DOGE ETF | September 2025 | N/A | Launched with XRP ETF, part of a wave of new etf launches. |

| Grayscale CoinDesk Crypto 5 ETF | September 2025 | $749 million | First multi-asset crypto ETP in the US, tracks five major cryptocurrencies. |

You can see that listing new crypto etfs now covers more coins and strategies. The REX-Osprey XRP ETF and REX-Osprey DOGE ETF both launched in September. The Grayscale CoinDesk Crypto 5 ETF became the first multi-asset crypto ETP in the US. These new etfs give you more ways to join the market.

major etf launches

The largest etf launches in 2025 have changed how you invest in crypto. You find more choices, from single-asset funds to complex products. Bitcoin and Ethereum spot etfs have seen the highest trading volumes. Bitcoin etfs recorded weekly inflows of $2.67 billion and month-to-date inflows of $5.13 billion. Ethereum etfs saw weekly inflows of $338.3 million and month-to-date inflows of $1.07 billion. These numbers show that spot etfs attract a lot of attention.

In 2025, the market has seen a record inflow of funds, with ETF inflows surpassing $1 trillion, indicating strong investor confidence. This year’s flows have been so furious that every month has run at roughly 3.5 times the usual seasonal average, suggesting a significant expansion in the diversity of cryptocurrency ETFs and the inclusion of various asset classes.

You also see more digital asset etfs with different investment strategies. Some spot etfs hold the actual coins, like bitcoin or ether. Others use futures contracts. Many new etfs compete by lowering fees, often around 0.20% to 0.25%. Some funds even offer leverage, which can increase both risk and reward.

multi-asset and index crypto etfs

You now have access to multi-asset and index crypto etfs. These funds help you invest in a group of coins instead of just one. The Grayscale CoinDesk Crypto 5 ETF is a good example. It tracks the five largest cryptocurrencies and gives you broad exposure in one product. This launch marks a big step for digital asset etfs in the US.

You may notice that demand still remains high for single-asset products, like bitcoin and ether etfs. At the same time, multi-asset etfs are growing fast. These new etfs help you avoid the hassle of managing many wallets. They also let you diversify your investments with less effort.

- More than 800 new etfs launched in 2025, beating last year’s record.

- September alone saw over 115 new releases, a monthly record.

- Nearly one-third of all etfs launched this year have a leverage component, showing a trend toward more complex asset classes.

You also see new funds for coins like litecoin etf and other altcoins. The market now offers both single-asset and multi-asset choices. This gives you more control and flexibility.

If you want to invest in crypto, you now have many options. The launch of new crypto etfs, including spot etfs and multi-asset funds, makes it easier for you to join the market. The largest etf launches and the growing list of digital asset etfs show that the market keeps expanding. You can expect even more choices as the year goes on.

sec etf approval trends

regulatory changes

In 2025, the sec made big changes to how it approves etfs. The sec made new rules that help crypto etfs launch faster. These rules make things clearer for everyone. The sec now uses new listing standards for commodity-based ETPs, including ones with crypto assets. This makes it easier to list new funds. Each etf does not need its own sec approval anymore. This means you do not have to wait as long.

| Regulatory Change | Description |

|---|---|

| Approval of new generic listing standards | The sec made new rules for commodity-based ETPs, including crypto ones, so the listing process is faster. |

| Elimination of separate sec approval | The new rules mean each crypto ETP does not need its own sec approval, just like regular ETFs. |

| Removal of key obstacles | The order takes away old rules that stopped new spot crypto ETPs, making it easier to get to market. |

The sec’s choice to stop needing 19b-4 filings means approvals are quicker. Now, new crypto etfs can get approved in 75 days instead of 240 days. This helps new funds start sooner and gives you more options. Bloomberg experts think over 100 new crypto etfs will launch next year. You can expect a big increase in new etfs.

pending approvals

There are many crypto etf applications waiting for approval. The sec is looking at 92 applications right now. Solana and XRP are two of the most popular. Solana has 8 filings, and XRP has 7. This shows a lot of people are interested. The last chance for Solana’s new filings is in October 2025. People think XRP spot etfs will get approved soon, with a 95% chance by the end of the year. Grayscale’s Cardano etf has a final sec deadline on October 26, 2025.

There are five etf applications with sec deadlines between October 10 and 16, 2025. Two Stellar applications are being reviewed quickly. Six XRP filings are under review from October 18 to 24, 2025.

Big companies like BlackRock, 21Shares, and Grayscale want new approvals too. You will see more rules and more choices as the sec reviews these applications. The market is moving faster now. You have more ways to buy digital assets than ever before.

impact of etf launches

investor reactions

People feel different about crypto after new etf launches. Many investors feel safer now. These products make buying and selling easier. The total value of cryptocurrencies is over $4.5 trillion in 2025. Bitcoin’s price is close to $124,700. This growth happened because more people joined the market. Both regular people and big companies started investing after new etfs.

- People are still careful. Many want to trust the market again after past problems.

- Experts like Tim Sun think this careful feeling may stay. It depends on how the economy does.

- Crypto etfs will soon have over $1 trillion in assets.

- In October 2025, $180 billion went into etfs. This shows more people like passive investing.

- Spot Bitcoin and Ethereum etfs brought in lots of money from big companies. This makes it easier to buy and sell.

- New staking etfs and altcoin products give you more choices.

You can now buy more types of digital assets. More etf launches mean you can spread out your investments. Big companies add more money to the market. This helps prices stay steady. The BTC 30-day volatility is going down. This means the market is getting calmer.

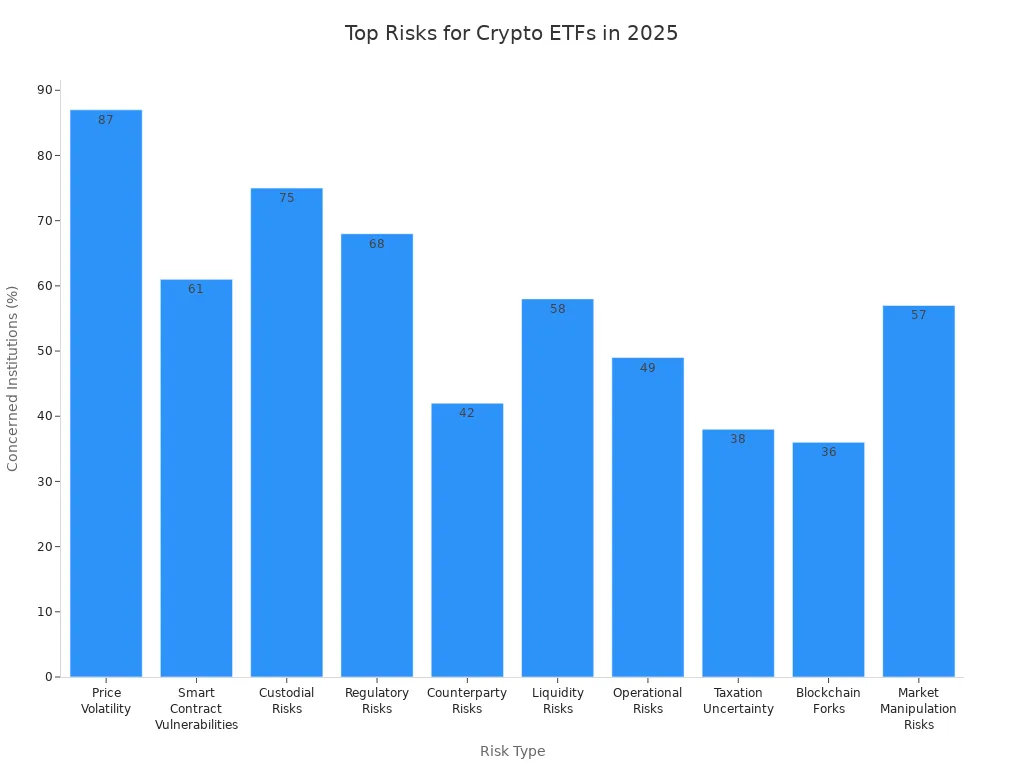

risks and opportunities

Every new investment has risks. The new etf launches in 2025 give you many chances. But you should be careful. Here is a table that shows what big companies worry about most:

| Risk Type | Percentage of Concerned Institutions |

|---|---|

| Price Volatility | 87% |

| Smart Contract Vulnerabilities | 61% |

| Custodial Risks | 75% |

| Regulatory Risks | 68% |

| Counterparty Risks | 42% |

| Liquidity Risks | 58% |

| Operational Risks | 49% |

| Taxation Uncertainty | 38% |

| Blockchain Forks | 36% |

| Market Manipulation Risks | 57% |

- Crypto prices can change fast. This can cause big losses.

- Hacks and scams still happen. Billions were lost last year.

- Market manipulation can change prices, especially for small coins.

There are also new chances. More etf launches let you invest in more coins and ideas. Big company investments and new technology help the market grow. You can now spread your investments across cryptocurrencies and tokenized assets. The market volume could reach $3 trillion this year. This gives you more ways to grow your money.

Tip: Always learn about each etf before you invest. Check for rule changes, fees, and what assets are included.

You can now find more types of cryptocurrency ETFs in 2025. The SEC made it easier for new funds to start. This means you have more choices and better ways to invest.

- The first U.S. spot XRP ETF shows people trust crypto more.

- More altcoin ETFs and new products help you spread out your money.

- Experts think there will be more new ideas and more people using crypto around the world.

| Advancement Type | Description |

|---|---|

| Staking Rewards | Some ETFs might soon give staking rewards for extra money. |

| Institutional Adoption | More pension funds and big investors are joining the market. |

| Regulatory Developments | New rules could let you see even more altcoin ETFs. |

You should look for new products, learn about the risks, and keep up with changes as the market gets bigger.