Despite a $1.3B Paper Loss MicroStrategy Claims, It Has No Intentions to Cease Trading Bitcoin

2023-02-03 06:09:45The business reported a $34 million loss on its first-ever Bitcoin sale last quarter but said it did so to generate a tax loss.

source: business2community.com

MicroStrategy, a software analytics business, reported a paper loss on its Bitcoin holdings of over a billion dollars in 2022, but the company insists it has no intentions to cease trading the virtual currency.

On February 2, MicroStrategy disclosed its Q4 and year-end financial results for 2022, revealing that the reported impairment charges on its BTC holdings, net of profits on sale, were close to $1.3 billion for the whole 2022 financial year.

Despite the apparent losses, MicroStrategy's chief financial officer, Andrew Kang, stated on a call to discuss the company's earnings on February 2 that the company "may consider pursuing additional transactions that may take advantage of the volatility in Bitcoin prices, or other market dislocations, that are consistent with our long-term Bitcoin strategy."

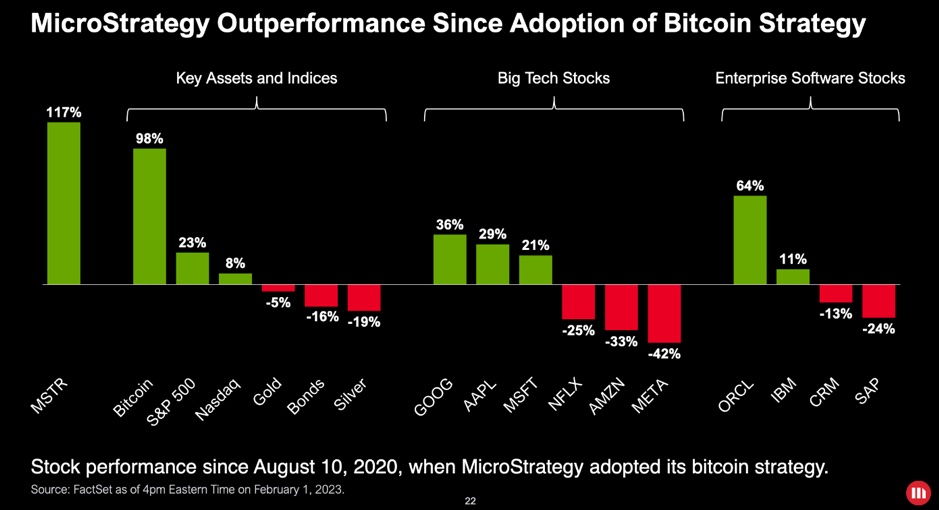

The success of Bitcoin is the most significant benchmark, according to MicroStrategy co-founder Michael Saylor, who stated as much during the conference call. The business monitors its stock performance against "a variety of other benchmarks."

Since MicroStrategy originally disclosed that it was purchasing Bitcoin in August 2020, Saylor continued, the company had "been able to outperform Bitcoin as an index" over that period.

Report on the performance of the MiscroStrategy stock price in Q4 in comparison to indexes, Bitcoin, and its rivals. Picture of MicroStrategy

Saylor stated that the company's stock has increased by 117% since August 2020 while Bitcoin has increased by 98%. He said, "The only true safe haven for an institutional investor is Bitcoin. Since Bitcoin is the only digital commodity that is accepted by everyone, it serves as your safe haven if you're an investor.

According to Kang, as of December 31, 2022, MicroStrategy controlled a total of 132,500 BTC, valued at $1.84 billion. 14,890 Bitcoins (BTC) were owned directly by the company, while the rest were held by MacroStrategy LLC, a subsidiary.

For the first time, the business sold some of its Bitcoin holdings late last year. Kang explained the trade, stating that the 704 BTC were sold to generate an estimated $34 million in tax losses. Even after the transaction, he said, "our net holdings climbed by 2500 Bitcoin over the quarter."

Reports show that MicroStrategy's total sales for the fourth quarter exceeded Wall Street projections and came in at $132.6 billion. It lost $21.93 per share in the fourth quarter.

Yahoo Finance statistic data prove that MicroStrategy's stock price has decreased by more than 4% as of the time of writing.

Disclaimer: FAMEEX declines all responsibility for any official opinions of FAMEEX on the data in this part or any related financial advice.