ACU (Acurast) Token Price & Latest Live Chart

2026-01-30 12:09:34

What is ACU (Acurast)?

Acurast is a decentralized compute network built on edge devices, with smartphones forming the primary execution layer of the system. Rather than replicating the centralized cloud computing model, Acurast fundamentally rethinks how computation is sourced, trusted, and coordinated by leveraging globally distributed consumer hardware secured by modern cryptographic and hardware-based security primitives.

Source: Acurast Doc

Smartphones in the Acurast network are not treated as low-grade or opportunistic resources. Instead, they are abstracted as secure compute units equipped with Trusted Execution Environments and Hardware Security Modules to enable confidential and verifiable execution. This architectural choice allows Acurast to support workloads that require strong guarantees around data privacy, correctness, and auditability, including confidential AI inference, automated execution strategies, zero-knowledge proof generation, and sensitive data processing.

ACU is the native utility and governance token of the Acurast network. Its role extends beyond simple fee payment, functioning instead as a coordination asset that aligns incentives among compute providers, developers, and capital participants. Through the ACU token, Acurast embeds economic security, resource allocation, and onchain governance into a single system. This enables a decentralized compute market governed by its participants rather than centralized operators. In this sense, Acurast positions computation itself as a community-governed digital public good.

How does ACU (Acurast) work?

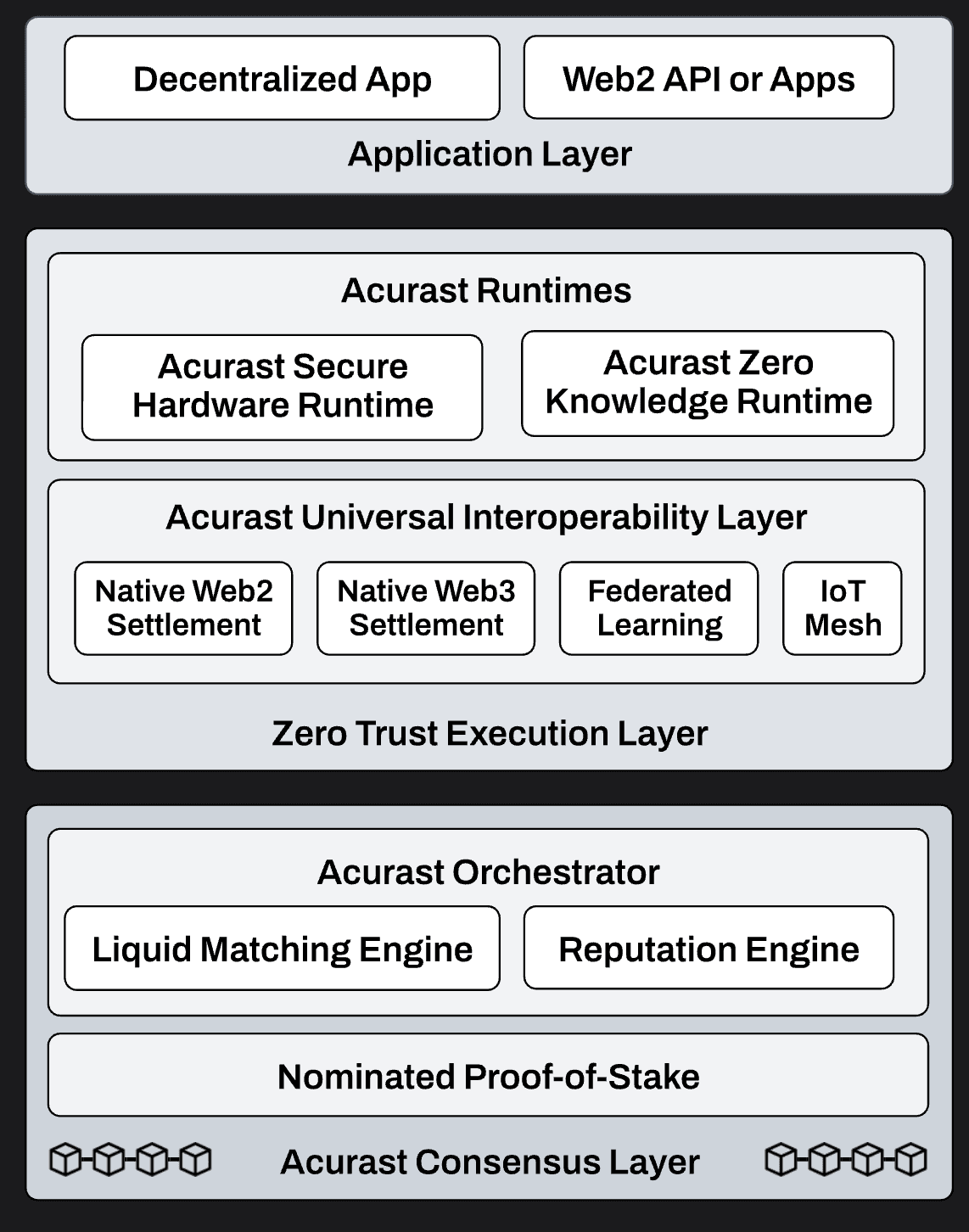

Acurast operates through a modular, layered architecture consisting of a coordination and consensus layer, an orchestration layer, and a distributed execution layer composed of smartphones. The Acurast Orchestrator serves as the network’s core scheduling and matching engine, dynamically pairing developer-defined deployments with available processor resources based on performance, security, and availability criteria.

Acurast Architecture, source: Acurast Doc

Developers submit deployments specifying execution logic, scheduling parameters, and output destinations. These deployments are matched, executed within secure environments, and returned with verifiable results. From the developer’s perspective, this abstracts decentralized compute into a serverless-style execution model, reducing friction relative to traditional peer-to-peer compute markets while preserving decentralization.

Economically, Acurast separates fee flows from reward flows. Developers pay execution costs as on-chain gas fees, primarily to maintain resource discipline and service quality. Compute providers earn rewards predominantly through protocol-level reward pools, with successful execution increasing their benchmark weight and, consequently, their share of staking and compute rewards. This design tightly couples real computational contribution with long-term economic incentives. ACU is deployed natively on the Acurast network and made available across multiple blockchain ecosystems. This enables liquidity and accessibility while maintaining its central role in network operations, staking, and governance.

ACU (Acurast) market price & tokenomics

From a supply perspective, ACU has an initial total supply of 1 billion tokens and operates under a fixed 5% annual inflation model. This inflation is not designed as a short-term growth incentive, but rather as a sustainable security budget intended to support long-term network operation. By committing to a predictable inflation schedule, Acurast aims to ensure continuous availability of verifiable compute resources without relying on ad hoc subsidies or external funding sources. This design choice positions ACU closer to an infrastructure security asset than a speculative utility token.

Inflation distribution is explicitly functional in nature. The majority of newly issued tokens are allocated to mechanisms tied to Staked Compute, reinforcing economic security and incentivizing reliable compute provision. Additional portions are directed toward benchmark-based compute rewards and consensus maintenance roles, while the remainder flows into the on-chain treasury to fund protocol upgrades, ecosystem development, and governance-directed initiatives. Collectively, this allocation structure emphasizes reliability, sustainability, and long-term network health over short-term participation metrics.

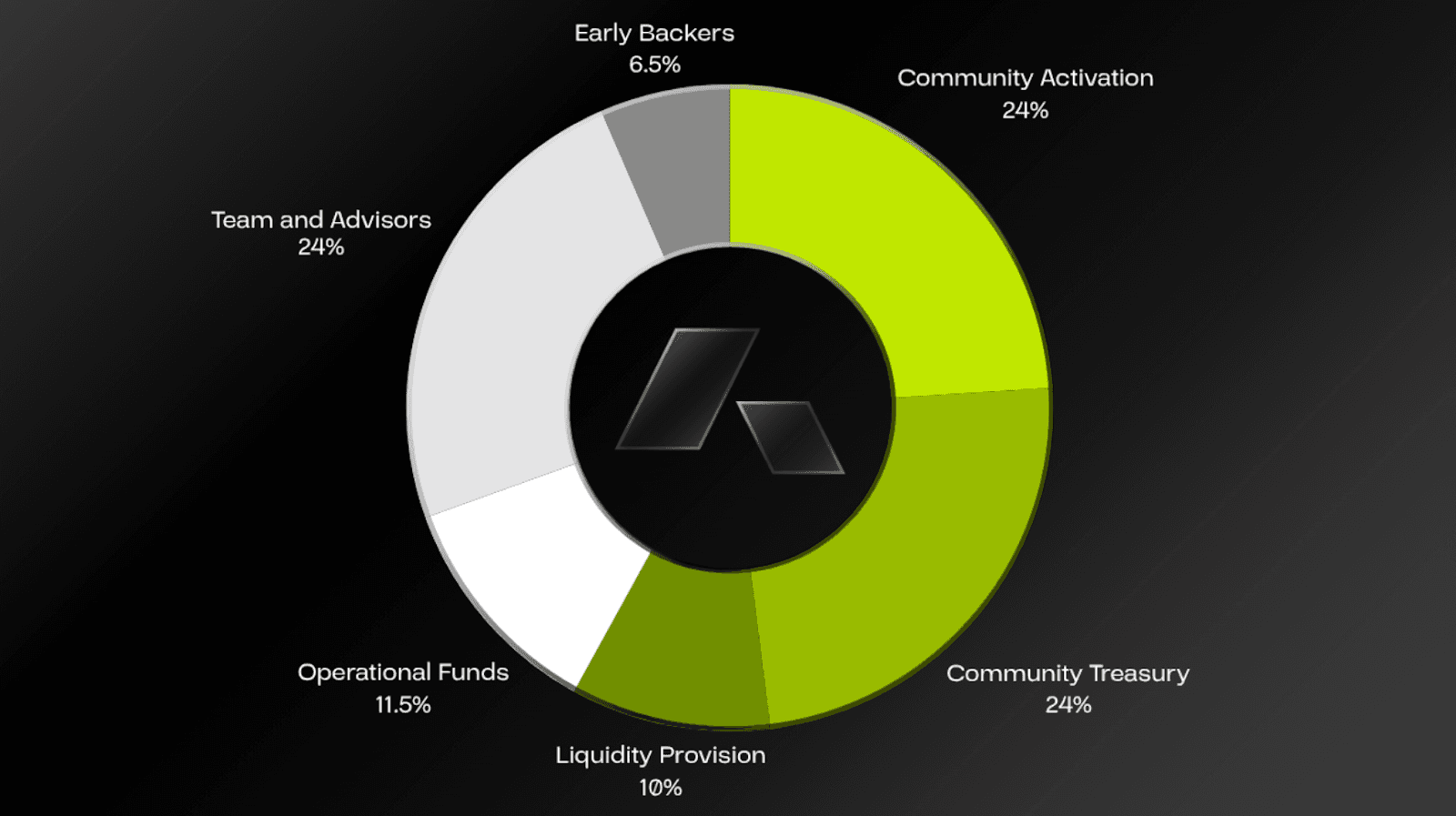

Genesis allocation further clarifies the project’s long-term orientation. Token supply is distributed across community activation programs, a community-governed treasury, operational funding, liquidity provisioning, team and advisor incentives, and a relatively small allocation to early backers. The comparatively low share assigned to early investors reflects an intentional effort to limit supply concentration and reduce the risk of capital-driven dominance in governance and secondary markets during the network’s formative period.

ACU Token Allocation, source: Acurast Doc

Token vesting and release mechanics play a critical role in shaping ACU’s medium-term circulating supply. Team and advisor allocations are subject to extended lockups followed by linear vesting schedules, aligning contributor incentives with the protocol’s long-term adoption trajectory. Operational funds follow similarly structured release mechanisms, reducing the likelihood of abrupt supply shocks while market depth is still developing. In parallel, the cACU-to-ACU conversion framework separates early contribution recognition from immediate liquid supply, allowing the network to reward participation without accelerating sell-side pressure in the post-TGE phase.

Why do you invest in ACU (Acurast)?

From an investment perspective, the appeal of the ACU project does not stem from a single narrative or short-term catalysts, but rather from the structural trends it is positioned to capture. On the supply side, smartphones are the most ubiquitous computing devices globally. This gives Acurast an exceptionally high theoretical scalability ceiling. As long as the network can sustain device availability and execution reliability, the potential size of its compute pool could significantly exceed that of most decentralized networks reliant on specialized hardware.

On the demand side, Acurast seeks to abstract decentralized computing into a service that can be readily consumed by general developers, lowering technical barriers through its deployment and orchestration mechanisms and extending usability beyond purely crypto-native applications. If demand for privacy-preserving computation, automated tasks, and distributed AI workloads continues to expand, Acurast is well-positioned to serve as a core execution layer for these use cases. By coupling actual compute execution, staking-based economic security, and governance rights, ACU anchors token demand not solely in speculative expectations but partially in concrete network usage. This positions ACU closer to an infrastructure-like asset rather than a conventional application token.

Is ACU (Acurast) a good investment?

Whether ACU can ultimately be considered a sound investment depends on Acurast’s ability to translate its technical architecture and economic design into stable and predictable service quality. Edge-based computing inherently faces challenges such as heterogeneous device performance, connectivity variability, and operating system constraints, all of which may affect adoption for enterprise-grade or high-frequency workloads. If execution reliability cannot be maintained while scaling the network, its competitive positioning will be constrained.

Therefore, ACU is better viewed as an allocation to the long-term adoption of decentralized compute infrastructure rather than as a speculative instrument driven by short-term price movements. In assessing its investment merits, greater emphasis should be placed on the growth of effective active compute nodes, real deployment activity and resource consumption, and whether the incentive mechanisms consistently reward genuine contribution rather than merely superficial participation.

Find out more about ACU (Acurast):

- Homepage

- Explorer: Etherscan

- Whitepaper

Explore the latest ACU (Acurast) price and live chart, trade ACU on FameEX, and access real-time market data! Get started now with a seamless trading experience!

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.