AUCTION (Bounce Finance) Token Price & Latest Live Chart

2026-02-02 09:45:02What is AUCTION (Bounce Finance)?

AUCTION is the native token of the Bounce Finance ecosystem, and Bounce itself is designed not as a simple auction application but as decentralized and onchain auction DeFi infrastructure. Traditional auctions have long struggled with trust and efficiency issues because rule enforcement, fund custody, and settlement are controlled by centralized intermediaries. Participants are typically unable to verify execution logic and must accept outcomes at face value. Bounce addresses this by encoding auction rules, execution conditions, and asset distribution directly into smart contracts, allowing bidding and settlement to occur onchain with full verifiability.

Image source: Auction

In crypto markets, asset issuance and allocation are often more contentious than trading itself. When supply is limited or liquidity is thin, real time trading mechanisms are vulnerable to frontrunning and automated strategies, producing outcomes that deviate from collective market intent. Auctions allow participants to submit price willingness within a shared rule set and time window, followed by deterministic settlement. Bounce modularizes these auction mechanisms so they can be applied to token launches, NFT sales, scarce asset pricing, and community distributions where fairness and transparency are critical.

With the release of Bounce V3 in 2023, the protocol introduced an Auction as a Service (AaaS) architecture. Auctions are no longer confined to Bounce’s own interface but can be embedded into external applications as backend services. This shift reduces reliance on platform specific traffic and enables auctions to be used across a broader range of workflows, including brand campaigns, gaming economies, and enterprise asset processes.

How does AUCTION (Bounce Finance) work?

Bounce operates through programmable auction rules executed entirely by smart contracts rather than centralized services. Different auction formats address different market needs, with open bidding suited for competitive and scarce assets, descending price mechanisms facilitating rapid price discovery, and sealed bidding reducing the impact of information leakage. These formats are configurable rather than static, allowing auctions to be tailored to asset characteristics and allocation objectives. In practice, auction creators define parameters and deploy contracts, while participants interact through wallets to submit bids or funds. All actions are recorded onchain, and once the auction concludes, settlement and distribution are executed automatically according to predefined logic. This approach ensures consistency and predictability. This allows participants to understand outcomes in advance without relying on discretionary enforcement.

AUCTION primarily functions as a governance and coordination asset within this system. Token based mechanisms support long term engagement such as governance participation and ecosystem alignment, rather than incentivizing purely transactional behavior. This flexibility allows AUCTION to support multiple product modules without degrading user experience or overconstraining adoption. The introduction of Auction as a Service further reduces friction. External products can integrate Bounce auction contracts without building proprietary infrastructure, while retaining transparent onchain settlement. Auctions thus become reusable infrastructure across applications, strengthening the linkage between AUCTION and overall ecosystem usage.

AUCTION (Bounce Finance) market price & tokenomics

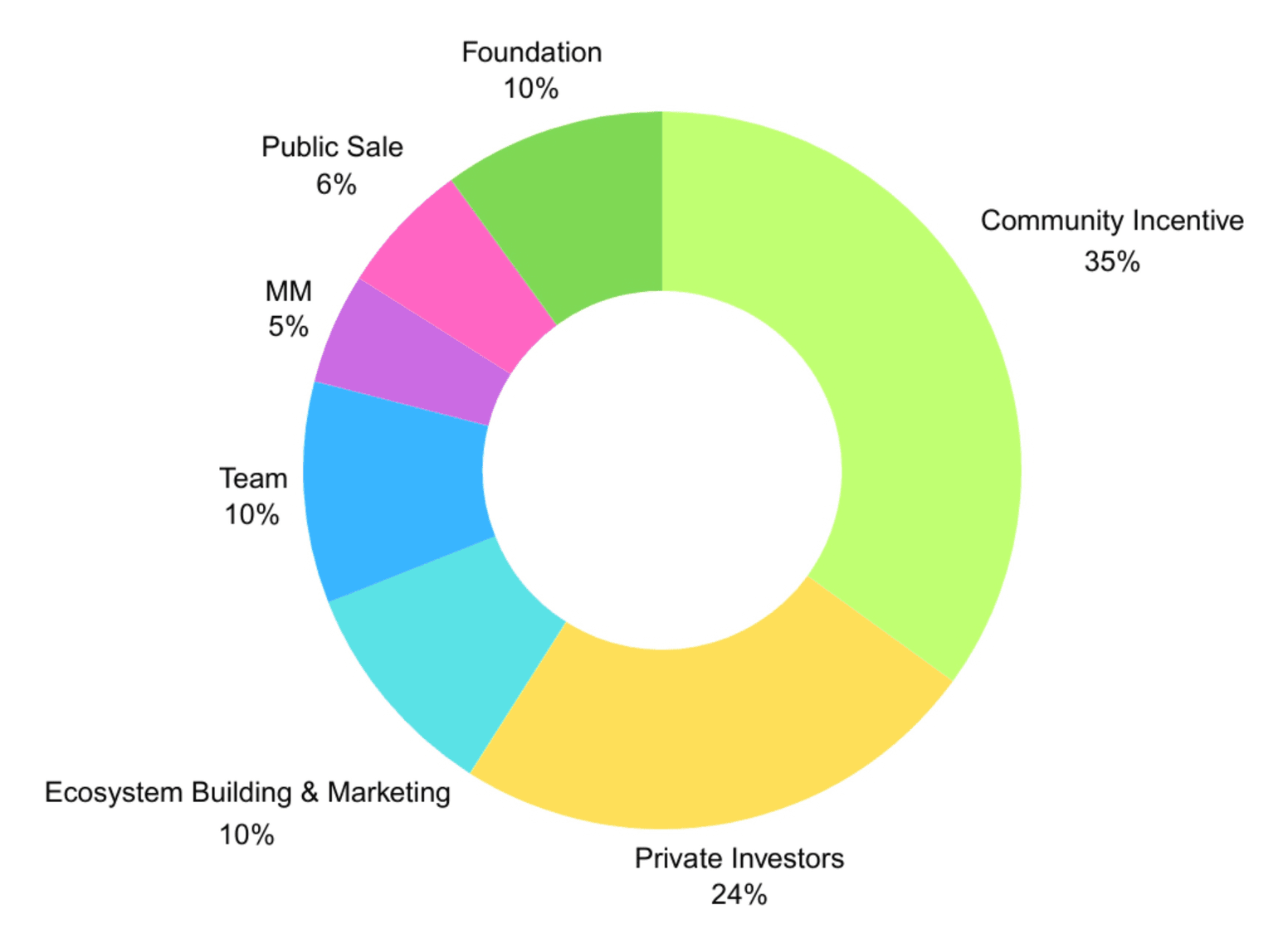

AUCTION features a fixed maximum supply of 10,000,000 tokens, providing a clear long term supply boundary. This design limits dilution uncertainty and allows valuation to focus on demand dynamics rather than inflation mechanics. A supply cap alone does not drive appreciation, but it establishes a stable framework for pricing usage growth.

To maintain long term relevance, data should be interpreted within a defined temporal context. From a demand perspective, AUCTION benefits most when functional usage outweighs speculative activity. Governance participation, protocol usage, and service aligned incentives generate more durable demand signals. Auction as a Service supports this transition by enabling recurring service based usage that anchors token value to real adoption.

AUCTION Distribution, source: Bounce Doc

Over the long term, AUCTION represents more than access to a single feature. It reflects whether market participants choose onchain auctions as a trusted distribution mechanism. As demand for transparent and verifiable allocation increases, the sustainability of Bounce’s infrastructure and its ability to maintain secure, credible execution across chains will determine whether AUCTION evolves from a narrative driven token into a durable infrastructure asset.

Why do you invest in AUCTION (Bounce Finance)?

AUCTION carries investment relevance because it represents an entire class of onchain allocation and price discovery demand rather than a single application use case. In crypto markets, distributing assets without centralized intermediaries in a verifiable and reasonably fair manner has remained a persistent challenge. While real time trading offers speed, it often produces distorted pricing and uneven allocation under conditions of limited liquidity or concentrated demand. Auctions provide an alternative path by allowing markets to converge on prices within predefined rules. AUCTION reflects the potential adoption of this auction based infrastructure.

Another important factor is Bounce’s decision to offer auction capabilities as a service. When auctions move beyond one off events or platform specific features and become reusable components embedded across products and workflows, demand sources diversify. AUCTION demand can then emerge not only from token launches or NFT cycles, but also from brand distributions, gaming economies, community governance processes, and enterprise asset workflows. This diversification reduces reliance on any single market phase and anchors value more closely to real usage.

Is AUCTION (Bounce Finance) a good investment?

Whether AUCTION is a good investment ultimately depends on whether onchain auctions achieve broader and sustained adoption as a market mechanism. A fixed supply structure provides a stable valuation framework, but long term performance remains tied to real usage. If auction activity is confined to narrative driven periods, demand will remain episodic and price volatility will follow. If Auction as a Service enables recurring integrations and repeated use across workflows, demand shifts toward a service based profile. For assets of this nature, short term price movements are less informative than structural usage signals. These include consistent growth in auction volume, expanding participation across addresses, and the emergence of use cases from multiple industries and application contexts. When such indicators persist across market cycles, the token gains a more durable value foundation.

Therefore, AUCTION is better approached as a long horizon observation rather than a momentum driven trade. Its upside and risk are tied to the same variable, whether auction infrastructure becomes meaningfully embedded in how digital assets are distributed. Sustained expansion in usage depth and breadth would allow AUCTION to increasingly behave like an infrastructure aligned asset rather than a purely narrative driven token.

Find out more about AUCTION (Bounce Finance):

- Homepage

- Explorer: Etherscan, Ethplorer, Bscscan

- Whitepaper

Explore the latest AUCTION (Bounce Finance) price and live chart, trade AUCTION on FameEX, and access real-time market data! Get started now with a seamless trading experience!

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.