DASH (Dash) Token Price & Latest Live Chart

2026-01-23 09:26:34

What is DASH (Dash)?

Dash is an open-source blockchain and cryptocurrency designed with a clear focus on real-world payments and usability. The name “Dash” originates from Digital Cash, reflecting the project’s long-term vision of becoming a fast, low-cost, and user-friendly global payment network. Launched in 2014 as a fork of Litecoin, Dash has since evolved far beyond its origins, developing a distinct technical architecture and governance model that differentiates it from Bitcoin and other early cryptocurrencies.

Rather than positioning itself solely as a store of value, Dash emphasizes everyday transactional use. Its protocol-level innovations address long-standing issues such as slow confirmation times, high fees, and governance inefficiencies. Key features include a two-tier network structure, incentivized masternodes, InstantSend for near-instant transaction settlement, ChainLocks for rapid blockchain finality, and optional privacy through PrivateSend. Together, these elements make Dash one of the most established payment-oriented blockchains in the crypto ecosystem.

Source: Dash

How does DASH (Dash) work?

Dash is best understood as a two-tier blockchain architecture that combines proof-of-work block production with an incentivized service layer. On the first tier, miners secure the network and produce blocks using the X11 PoW algorithm. On the second tier, Dash introduces masternodes—specialized full nodes backed by economic collateral (1,000 DASH) that provide advanced network services. Masternodes are not merely nodes that relay blocks; they are a dedicated, incentive-aligned layer designed to deliver features that matter for payments, which is fast settlement, stronger double-spend protection, optional privacy, and structured governance. By moving these capabilities into the protocol and funding them through network economics, Dash aims to deliver payment-grade UX without relying on off-chain workarounds.

For transaction experience, Dash’s flagship feature is InstantSend, which enables near-instant transaction locking. The important distinction is that InstantSend is not simply faster confirmations. It is a mechanism where the masternode layer can lock a transaction quickly, reducing the practical feasibility of a double-spend during the critical window where merchants or counterparties need immediate assurance. This matters because pure PoW networks typically require multiple block confirmations to reach an economically meaningful security threshold, which introduces friction for retail payments or any use case where goods or services are delivered immediately.

On the security side, ChainLocks is one of Dash’s most differentiating protocol innovations. ChainLocks provides rapid block finality by having the masternode network collectively “lock” the first-seen valid block at a given height. In practical terms, this makes reorganizations extremely difficult and significantly raises the cost and complexity of majority attacks. For PoW networks, reorg risk is not purely theoretical—especially under conditions of hashrate concentration or declining miner incentives. ChainLocks adds a second, collateral-backed security layer on top of PoW, improving confidence that once a block is accepted, it becomes effectively immutable in real time.

Dash’s privacy feature, PrivateSend, is optional and based on CoinJoin-style mixing. It works by breaking funds into standard denominations and mixing them across multiple rounds, making it harder for observers to link inputs to outputs on-chain. A key strategic choice is that Dash does not enforce default network-wide anonymity. Instead, it offers privacy as a user-selected mode. This design attempts to balance cash-like privacy with broader usability and regulatory adaptability across jurisdictions and service providers.

Beyond payments, the Dash project has been expanding into a broader Web3 stack through Dash Platform. The platform is built around two primary components, which are DAPI (a decentralized API layer) and Drive (a decentralized data storage and validation system). DAPI abstracts node access into developer-friendly interfaces, allowing applications to interact with the network without the operational burden of running full infrastructure. Drive introduces data contracts that define application schemas and enables masternodes to validate application data with consensus-level guarantees, delivering verifiable query responses. In effect, Dash is positioning itself not only as “digital cash,” but as an infrastructure layer that can support payments plus identity, and data-centric applications with a more Web2-like developer and user experience.

DASH (Dash) market price & tokenomics

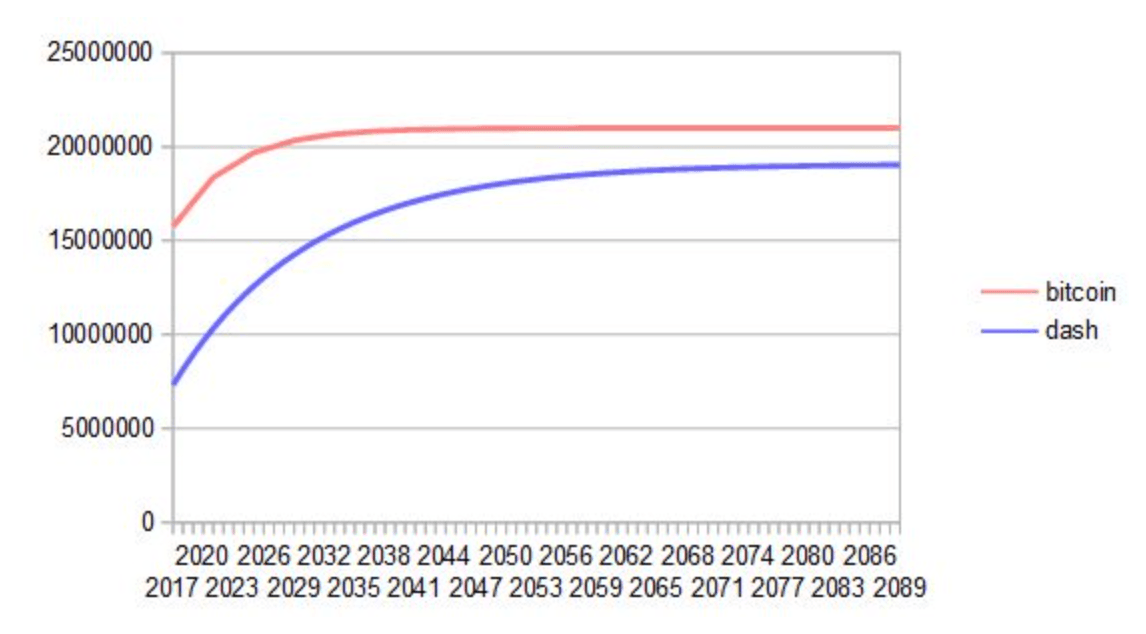

Dash’s tokenomics are designed around long-term network sustainability rather than short-term supply shocks or aggressive scarcity narratives. DASH has a theoretical maximum supply of approximately 18.9 million coins, with the exact final number depending on how the decentralized treasury allocation is utilized over time. Instead of Bitcoin’s four-year halving cycle, Dash employs a gradual emission reduction model, lowering block rewards by roughly 7% every 210,240 blocks (about 383 days). This smoother deflation curve helps stabilize miner incentives and reduces abrupt security or participation risks associated with sharp reward cuts.

Bitcoin vs. DASH coin emission rate, source: Dash

Block rewards in Dash are distributed among three participants: miners, masternodes, and the decentralized treasury. This structure enables Dash to function as a self-funding DAO, continuously allocating resources to protocol development, infrastructure, marketing, and ecosystem growth through on-chain governance. From a long-term perspective, this internal funding loop reduces reliance on external capital and mitigates governance centralization around a single organization or investor group.

Historically, DASH’s price action has closely followed broader crypto market cycles. During the bull market peak of May 2021, DASH experienced significant upside volatility, followed by a prolonged consolidation phase throughout the 2022–2023 market correction. Dash’s valuation is better assessed through structural indicators such as payment adoption, masternode participation, and the progress of the Dash Platform, rather than isolated price levels at specific points in time.

Why do you invest in DASH (Dash)?

Investors tend to focus on Dash not because it represents the latest narrative or a high-growth experimental sector, but because of its relative completeness as a blockchain system. Dash is one of the few networks that has operated stably for many years, actively used on-chain governance, and demonstrated real-world payment adoption. In regions affected by high inflation or limited access to banking services, Dash has been used for peer-to-peer transfers and merchant payments, providing a degree of real demand validation rather than purely theoretical utility.

The masternode model also introduces a hybrid economic structure between PoW and PoS. Running a masternode requires long-term capital commitment and participation in governance, which can reduce circulating supply volatility and give DASH characteristics of a yield- and governance-enabled asset rather than a purely speculative token. More recently, Dash Platform has become a key variable for investors. If the platform succeeds in attracting developers and enabling applications that integrate payments, data, and identity on a single network, Dash’s value proposition could extend beyond payments into broader application-layer utility. This potential structural shift is a central reason long-term investors continue to monitor the project.

Is DASH (Dash) a good investment?

Whether DASH is a good investment depends largely on how investors interpret its positioning. From a risk perspective, Dash is not an early-stage or highly experimental project; its core protocol and governance model have been operating for years, and its technical roadmap emphasizes incremental improvement rather than radical redesign. As a result, Dash may offer stability, but it is less likely to deliver explosive short-term growth driven by narrative hype. At the same time, Dash faces real challenges, including regulatory scrutiny related to privacy features, increasing competition from other payment-oriented blockchains, and the early-stage nature of Dash Platform’s application ecosystem. These factors will play a decisive role in determining Dash’s medium- to long-term valuation.

Overall, DASH may be best suited as an infrastructure- and utility-oriented allocation within a diversified crypto portfolio. Its long-term potential is tied to sustained real-world usage, governance effectiveness, and the successful evolution of the Dash Platform, rather than short-term market sentiment or speculative cycles.

Find out more about DASH (Dash):

- Homepage

- Explorer: Dash Explorer

- Whitepaper

Explore the latest DASH (Dash) price and live chart, trade DASH on FameEX, and access real-time market data! Get started now with a seamless trading experience!

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.