RIVER (River) Token Price & Latest Live Chart

2026-01-22 09:45:53

What is RIVER (River)?

River project is a decentralized finance infrastructure protocol built around the concept of chain abstraction. Rather than issuing a standalone stablecoin, River seeks to redefine how assets are securely utilized, scaled, and monetized across a fragmented multi-chain environment. Historically, cross-chain DeFi has relied on bridges or wrapped assets. And solutions that introduce persistent problems include reduced security, lower capital efficiency, and increased user complexity. River’s approach is not to optimize bridges, but to remove the need for bridging altogether.

Its core stablecoin, satUSD, is powered by an Omni-CDP (cross-chain collateralized debt position) architecture. Users can collateralize native assets such as BTC, BNB, or ETH on one chain while minting and using satUSD on another, with the collateral never leaving its original ledger. As a result, River functions as a multi-chain financial state layer, rather than a single-purpose DeFi application.

As stablecoins increasingly emerge as the core medium for global on-chain settlement and value transfer, competition among public blockchains is shifting from single-chain scale expansion toward a more structural contest around cross-ecosystem capital efficiency. The chain-abstraction stablecoin protocol River announced in early 2026 that it had secured $80 million equivalent strategic investment from TRON. The partnership focuses on cross-ecosystem asset minting, stablecoin yield products, and deep integration with DeFi protocols, using satUSD as a unified gateway to connect multi-chain assets with TRON’s stablecoin-centric financial network.

Through a chain-abstraction model in which collateral remains on its native chain while stablecoins are utilized on TRON, external assets can enter the TRON ecosystem to participate in lending, trading, and yield strategies without relying on traditional bridges. Combined with integrations across protocols such as SUN.io and JustLend DAO, this structure enables efficient lending–liquidity cycles within the ecosystem. As features such as Smart Vaults, Prime Vaults, and TRX-backed satUSD minting are progressively deployed, satUSD is positioned to become a core stablecoin component spanning trading, lending, and yield products.

How does RIVER (River) work?

River’s design philosophy centers on state synchronization rather than asset transfer. Its Omni-CDP framework modularizes three core DeFi components: collateral custody, debt accounting, and liquidity usage. Collateral remains on the chain, which offers optimal security or yield—such as Bitcoin-aligned layers or Ethereum—while debt states and stablecoin issuance are synchronized across execution layers via cross-chain messaging. This allows users to access DeFi ecosystems without repositioning their underlying assets.

Source: RIVER official website

On the yield side, River introduces PrimeVault and SmartVault. PrimeVault automates the conversion of BTC or ETH into satUSD and deploys it across multi-chain yield strategies. SmartVault integrates stablecoin staking, protocol fees, and DeFi composability into automated, no-liquidation strategies, positioning satUSD as a yield-bearing base asset rather than a passive medium of exchange.

RIVER (River) market price & tokenomics

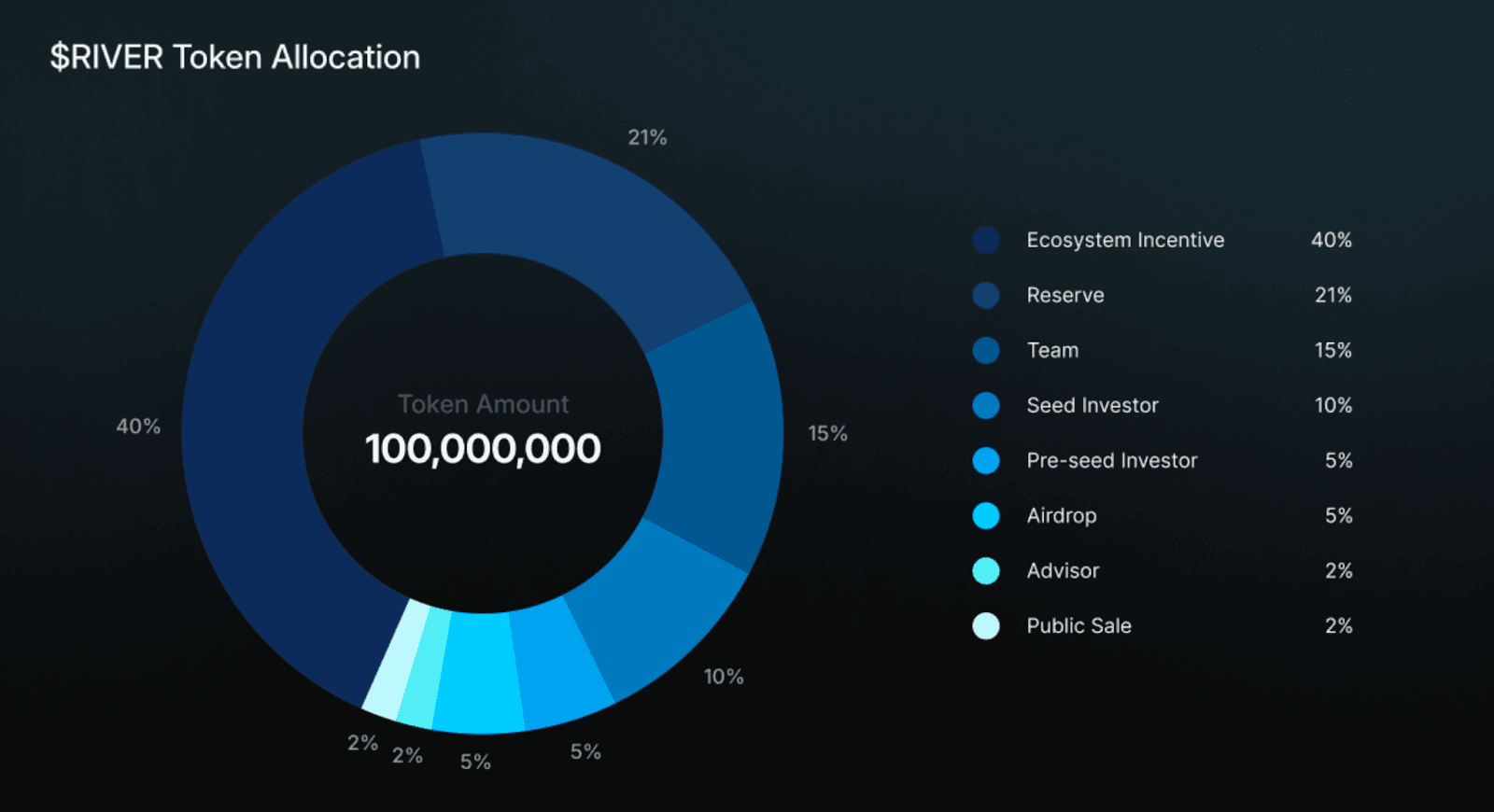

RIVER’s tokenomics are designed with a clear long-term infrastructure focus. With a total supply of 100 million tokens, the largest allocation is reserved for community and ecosystem incentives, while the remainder is distributed among the foundation, investors, and the team under multi-year linear vesting schedules.

A defining feature is the time-weighted conversion of River Points into RIVER tokens. Points can be converted over an approximately 180-day window, with conversion ratios increasing over time. This mechanism discourages early dumping and concentrates ownership among long-term participants aligned with the protocol’s growth. RIVER’s long-term value is better assessed through its governance role, staking utility, and importance within a cross-chain stablecoin infrastructure.

Why do you invest in RIVER (River)?

The investment thesis for RIVER is not centered on short-term price volatility, but on its potential role as foundational infrastructure for multi-chain DeFi. As blockchain ecosystems proliferate, the structural limitations of single-chain stablecoins become increasingly apparent, positioning chain abstraction as a long-term architectural trend.

River’s key advantage lies in its design philosophy of synchronizing state without moving assets, structurally reducing systemic risk. Combined with yield-enabled vaults, satUSD becomes a composable, capital-efficient asset. If multi-chain DeFi continues to expand, protocols like River could evolve into critical financial primitives.

Is RIVER (River) a good Investment?

As an emerging project, River faces challenges related to cross-chain security, competitive dynamics, regulatory uncertainty, and real-world adoption. That said, River addresses a genuine structural problem rather than a transient narrative. For long-term investors, RIVER represents a structural bet on the future of multi-chain finance, with its ultimate value determined by satUSD adoption, protocol security, and its ability to become a standard component of multi-chain DeFi stacks.

Find out more about RIVER (River):

- Homepage

- Explorer: Etherscan, Bscscan, BaseScan

- Whitepaper