FameEX Daily Technical Analysis | No Interest Rate Cut This Year! Fed Chair Powell Smashes Expectations, with Stock and Crypto Markets Plunging

2023-03-23 08:44:50

Yesterday, all major cryptos exhibited price depreciation with fluctuations between -8.28% and -3.20%. Despite the rise of 19.75%, XRP dramatically fell -8.28%, with the weakest trend. Conversely, DOGE showed a relatively strong trend, down -3.20%. BTC and ETH, two of the leading cryptocurrencies, fell -3.32% and -3.56%, respectively.

According to the 4-hour trading cycle depicted below, the price fell below the consolidation range of $26,578 and $28,472, dramatically increasing volatility. From the perspective of SMAs, the MA7 support went below the MA25 support, not displaying a long trend anymore. However, the long still dominated the medium- and long-term trends, and the short-term trend was taken by the short.

Overall, the market is slightly favorable to the long trend. Therefore, it is recommended to hold several long positions at present, and enter into further orders when the price has a pullback but is above the low point. Given that the current trend is in the transition period, it is recommended to stick to the stop-loss principle, not insisting on investment.

During yesterday's trading session, all three major U.S. stock indexes fell. The Dow Jones index fell -1.63%. The S&P 500 index implied a relatively weak trend, with a great loss of -1.65%. The Nasdaq index was strongest, sharply falling -1.60%. Meanwhile, two of the leading cryptos, BTC and ETH, fell -3.32% and 3.56%, respectively.

In this statement, the Federal Open Market Committee (FOMC) deleted the words "ongoing increases" and replaced them with "some additional policy firming", which was appropriate.

Powell said that in light of the banking turmoil, central bank policymakers were considering suspending interest rate hikes. However, the consensus to raise rates remained strong as recent data showed high inflationary pressure.

According to the CME's FedWatch tool, Fed officials saw slightly over 50% odds on raising rates by 0.25% at their May meeting. The market expected the federal funds rate to fall to around 4.18% in December, lower than previous expectations. Powell said at a press conference that a rate cut this year was not in the central bank's base case.

Besides, the Biden administration focused on stabilizing the banking system and improving public confidence, but had no intention of expanding deposit insurance coverage, said Yellen at a Senate hearing on Wednesday, sparking a collapse in regional bank stocks and dragging down the market index.

Over the past 24 hours, there has been a total of $183.723 million in long liquidations and $62.35 million in short liquidations, resulting in a net long liquidation of $121.373 million. In general, the change in the total amount of liquidations remained between $100 million and $200 million, while yesterday's total liquidations were slightly above that range, with signs of a gradual increase in investors' participation in the market.

The Fear & Greed index has slightly fallen to 62, still over the significant threshold of 50. This suggests that the market has become cautious optimism. However, due to the recent reversal of the market, it is recommended to observe the subsequent trend.

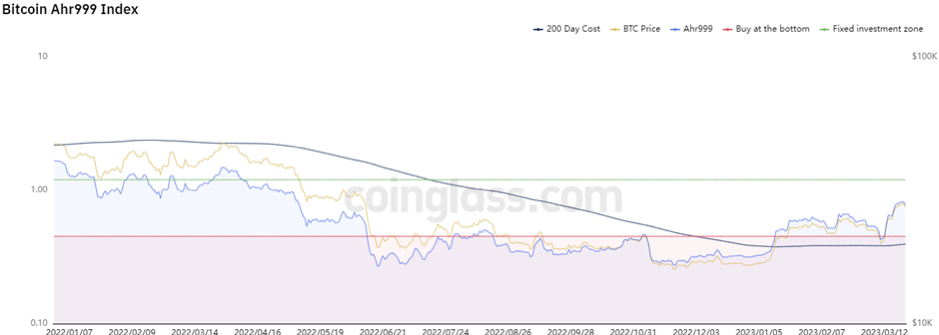

The Bitcoin Ahr999 index has modestly climbed to 0.82, which is above the support level of 0.45 but below that of 1.2. This shows that the short-term trend becomes strong, but the long-term trend is still a bear market. Therefore, It is not recommended to buy the dip in batches. However, purchasing small amounts through dollar-cost averaging (DCA) may be a viable strategy.

According to the above analysis, the market has become optimistic with a stable price trend. Therefore, we recommend periodically buying with a fixed amount and selling them gradually as the market rises.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.