FameEX Today’s Crypto News Recap | February 5, 2026

2026-02-05 06:32:57

US Treasury rejects crypto bailout hopes as Bhutan sells BTC and Payy launches a privacy Ethereum L2, reshaping onchain flows. Crypto markets traded in a structurally defensive regime where continued price weakness reflected mechanical deleveraging rather than broad panic selling. Bitcoin briefly dropped toward $70K, prompting capital to shift into preservation mode as traders prioritized margin stability and liquidity access over directional exposure. Ether remained constrained by derivatives positioning, where liquidation cascades and funding-driven adjustments suppressed rebound momentum and produced heavy tape conditions with limited chase demand. Exchange flows and whale repositioning activity pointed to portfolio rebalancing and risk compression rather than fresh expansion, with participants generally reducing position size and accelerating risk recalibration. The overall session resembled a balance sheet cleanup phase in which declining leverage, thinner liquidity pockets, and conservative inventory management combined to reinforce a defensive market structure.

Crypto Markets Overview

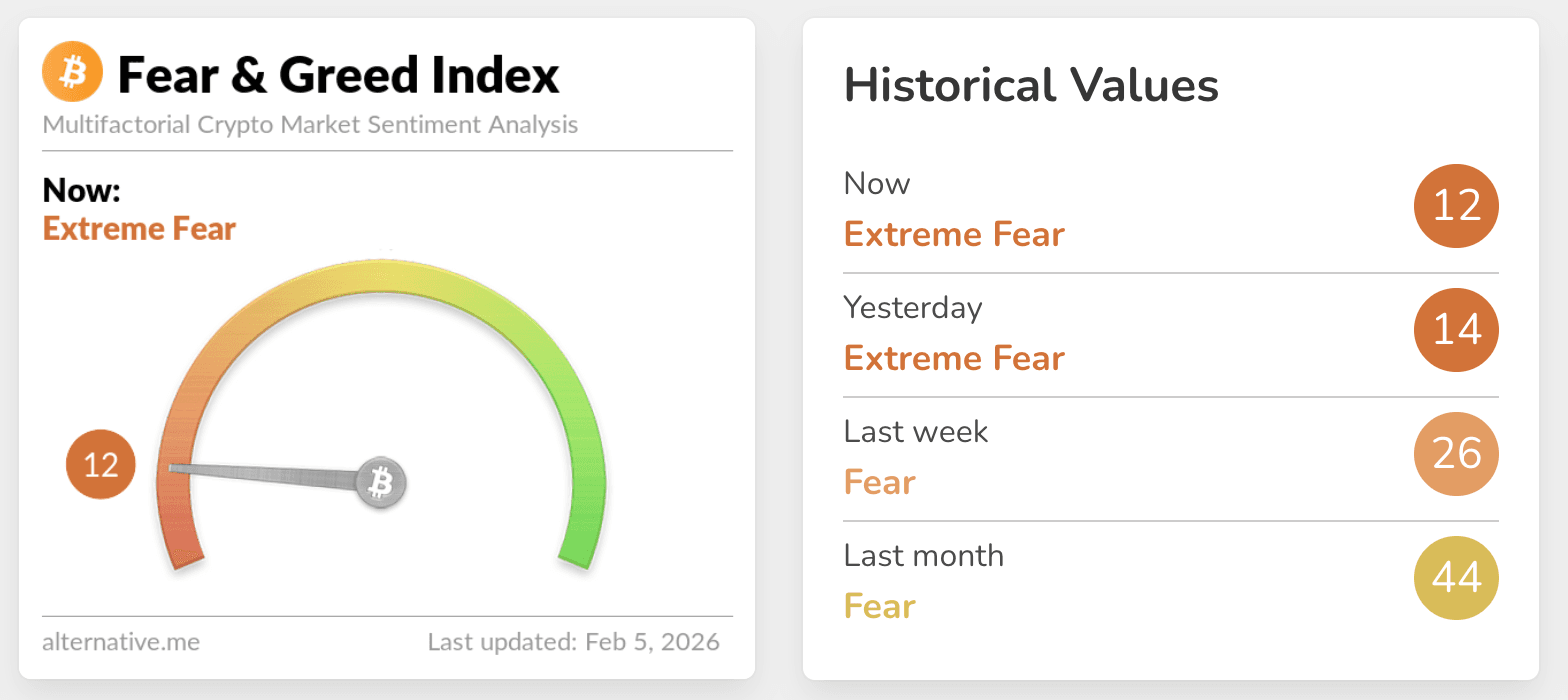

The Crypto Fear and Greed Index is 12 today, which is considered as Extreme Fear. This signals a highly defensive sentiment environment in which capital behavior is centered on exposure reduction, leverage unwinds, and liquidity preservation. Within this framework, Bitcoin functioned as the market anchor, meaning traders treated BTC as the primary stabilization reference and temporary capital parking zone during volatility expansion, favoring assets with deeper liquidity and execution reliability. Even as price probed the $70K region, trading focus remained on liquidity management and downside control rather than aggressive breakout participation. Ether’s performance continued to be shaped by derivatives structure, where forced liquidations and funding pressure amplified short-term volatility and constrained upside engagement. Activity across major altcoins reflected tactical hedging and balance sheet adjustments rather than narrative-driven risk appetite. This reinforces a cautious trading rhythm as participants watch liquidation pressure and key support areas.

Source: Alternative

BTC and ETH Selling Pressure Triggers Key Levels and Liquidations

Bitcoin’s move into the $70K zone activated dense liquidation and stop clusters, allowing forced unwinds to temporarily overwhelm organic bids and accelerate downside price discovery. Over the past 24 hours, total crypto liquidations reached USD 624 million, including USD 491 million in long positions, underscoring that the move was primarily driven by leveraged position clearing rather than gradual spot distribution. Broader structural indicators supported the deleveraging narrative, including an estimated USD 55 billion contraction in BTC open interest over 30 days. This suggests broad risk reduction rather than a shift into new directional positions. Spot Bitcoin ETF flows added further pressure, with cumulative outflows of roughly USD 2.9 billion across 12 sessions, showing how capital tends to scale back high-volatility exposure during macro uncertainty. Ether mirrored this leverage-sensitive structure. As one whale liquidated approximately USD 214 million in ETH and USD 31.51 million in SOL at a combined loss near USD 141 million, a separate high-leverage ETH short reportedly carried floating gains around USD 17.05 million and earned roughly USD 6.83 million in funding. Together these signals depict a market reorganizing risk through liquidation mechanics, hedging, and inventory reduction, naturally producing range-bound conditions and muted chase demand rather than immediate trend formation.

Key News Highlights:

US Treasury Rejects Expectations of Crypto Market Intervention

The US Treasury clarified that digital asset markets should not expect government-backed price support during severe drawdowns, redefining how institutional participants frame tail risk and liquidity shocks. By emphasizing that crypto volatility must be absorbed within the market rather than externally stabilized, the policy stance pushes risk managers toward tighter leverage discipline, higher collateral quality, and more conservative exposure frameworks. In practice, this encourages larger margin buffers, shorter holding cycles, and expanded hedging coverage to mitigate capital erosion during stress events. While the statement does not dictate price direction, it reshapes structural behavior by reinforcing reliance on internal risk controls and balance sheet resilience, strengthening defensive positioning dynamics across trading desks.

Bhutan Moves USD 22.3 Million in Bitcoin, Highlighting Mining Pressure and Risk Adjustment

Bhutan transferred approximately USD 22.3 million worth of Bitcoin to market-making related addresses, drawing attention to how nation-state mining participants are adjusting inventory under shifting economic conditions. Onchain data suggests the transfers are more consistent with liquidity management and portfolio rebalancing than purely technical activity. Since the 2024 halving, mining costs have risen materially, increasing operational pressure for large-scale miners and contributing to Bhutan’s gradual reduction in holdings from prior peaks. The move occurred against a backdrop of Bitcoin trading well below its historical highs, where broader risk appetite has contracted and capital allocation has tilted toward defensive positioning. Periodic sales by sovereign holders do not necessarily signal directional conviction, but their onchain visibility can influence short-term sentiment and supply expectations, underscoring how even long-horizon participants must adapt inventory and cash flow management in volatile mining environments.

Payy Launches Privacy-Focused Ethereum Layer 2 to Support Institutional Onchain Flows

Crypto wallet provider Payy introduced a privacy-focused Ethereum layer 2 that enables ERC-20 transfers to be routed through private pools by default, reflecting growing structural demand for transaction confidentiality in onchain finance. For institutions and fintech firms, transparent ledgers provide auditability but can expose sensitive flow information, making privacy infrastructure increasingly relevant for capital movement at scale. Payy’s integration model allows compatibility with existing wallets, lowering operational friction and signaling a shift toward embedding privacy features at the infrastructure layer rather than relying on specialized tools. From a market structure perspective, such solutions address data protection and competitive sensitivity concerns tied to stablecoin and institutional flows, potentially reshaping how certain participants interact with public networks. The development highlights an ongoing balancing process between transparency, compliance, and confidentiality as Ethereum’s financial ecosystem evolves.

Trending Tokens:

- $PAXG (Robinhood)

PAXG is drawing market attention following its availability for trading on Robinhood platform, marking another step in the integration of tokenized gold into mainstream retail trading platforms. The new listing connects Paxos issued gold backed tokens with Robinhood’s large retail user base, expanding access to onchain gold exposure through a familiar brokerage interface. This development reflects a broader narrative of traditional financial platforms increasingly embracing digital asset products tied to real-world assets. The event reinforces institutional confidence in regulated, asset backed crypto instruments rather than purely speculative tokens. Market focus centers on accessibility, regulatory alignment, and the role of tokenized commodities in diversified portfolios. The association with a US-based financial services company also strengthens perceptions of compliance and infrastructure maturity.

- $GGBR (Goldfish Gold)

GGBR is trending as the Goldfish Airdrop Social Leaderboard goes live, activating user participation through social event incentives. The event introduces a structured mechanism where users earn points and compete for allocation from the GFIN pool based on activity and mindshare. This campaign aligns with the project’s broader narrative of combining hard asset backed value with onchain engagement mechanics. Goldfish positions itself as a fully onchain gold reserve backed token, with each unit representing a fraction of audited physical gold held in secured vaults. Market attention is driven by the blend of tangible asset backing and gamified distribution design. The initiative highlights how real-world asset projects are experimenting with community driven growth rather than passive holding alone.

- $WARD (Warden Protocol)

WARD has entered focus following the launch of its live airdrop, introducing a differentiated claim mechanism that rewards delayed participation. Unlike conventional airdrops, the Warden distribution emphasizes conviction based behavior, where rewards increase the longer users wait to claim. The design channels unclaimed tokens toward public goods. This reinforced alignment between individual incentives and ecosystem sustainability. This event reflects Warden’s broader positioning as an AI native Layer 1 blockchain built for intelligent application development. The protocol supports both onchain and off-chain execution while remaining blockchain agnostic, enabling developers across multiple ecosystems to build without restriction. Market interest centers on the novel incentive structure and its implications for long-term community alignment. The airdrop serves as both a distribution event and a signaling mechanism for protocol values.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.