A Novice Investor's Guide to Understand Different Types of Cryptocurrency in 2023

2024-11-07 13:06:40The world of cryptocurrency has taken the financial scene by storm. If you're a new investor, delving into the different types of cryptocurrency might seem overwhelming. This guide will help clarify and categorize the vast world of digital currencies for you.

What Different Types of Cryptocurrency Exist?

In the realm of digital finance, the word 'cryptocurrency' resonates as a harbinger of revolutionary changes to the traditional financial system. Since the inception of Bitcoin in 2009, the world has witnessed a burgeoning growth in the number of digital currencies. However, the vast landscape of cryptocurrency is more diverse and intricate than it initially appears. To navigate this digital universe, one must understand the myriad types of cryptocurrencies and their respective functionalities.

Differentiating between Cryptocurrency Coins and Tokens

At the heart of the cryptocurrency ecosystem lie two fundamental entities: coins and tokens. While they're both considered cryptocurrencies, they serve different purposes. Coins, like Bitcoin or Litecoin, operate on their independent blockchains and primarily serve as a medium of exchange, store of value, or unit of account. Tokens, on the other hand, reside on existing blockchains like Ethereum and can represent anything from an asset to a utility. Think of coins as the currency you spend, and tokens as specialized assets or utility instruments on the blockchain.

Understanding Bitcoin: The World's First Cryptocurrency

Bitcoin, often denoted as BTC, took the world by storm as the pioneer of the cryptocurrency movement. Conceived by the enigmatic figure, Satoshi Nakamoto, in 2009, it introduced the concept of a decentralized, peer-to-peer electronic cash system. This paper outlined the basics of a cryptographically secure system which was inherently designed to be censorship-resistant and transparent, empowering individuals financially. Bitcoin operates on a transparent ledger called the blockchain, without the need for intermediaries like banks. With a limited supply of 21 million coins, its decentralized nature and security features have made it both a digital gold and a forerunner in the crypto space.

The essence of cryptocurrency lies in encryption, a process of converting legible text into random ciphertext. This domain of secure communication, ensuring only the message's sender and its intended recipient can decipher its content, is termed cryptography. While today's dominant currencies like the British pound and U.S. dollar are government-controlled and valued based on trust in those governments, Bitcoin represents an alternative. It's grounded in P2P technology, allowing direct transactions between individuals who assign intrinsic value to the asset, free from central authority interference.

Exploring Altcoins: Cryptocurrencies Other than Bitcoin

While Bitcoin might be the most renowned, a plethora of alternative cryptocurrencies, or 'altcoins', have surfaced, each proposing unique solutions and improvements over traditional systems. Ethereum, and Litecoin, to name a few, have introduced innovations ranging from smart contracts to faster transaction processes. These altcoins have diversified the cryptocurrency market, offering a plethora of investment opportunities and technological advancements.

Types of Tokens: Utility Token, Security Tokens, and ERC-20 Tokens

Tokens, unlike coins, are versatile in function. Utility tokens grant holders access to a product or service, often within a specific platform. Security tokens are digital representations of traditional financial instruments, like stocks or bonds, and are subject to securities regulations. ERC-20 tokens, a prevalent standard, operate on the Ethereum blockchain and have become synonymous with Initial Coin Offerings (ICOs). Each of these tokens plays a pivotal role in the ever-evolving crypto ecosystem, serving a myriad of purposes from fundraising to decentralized applications.

What is Stablecoin? The Case of Tether and USD Coin

Stablecoins have emerged as a bridge between the volatile world of cryptocurrencies and the stability of traditional fiat currencies. These digital assets are pegged to stable reserves like the US dollar, gold, or other assets. Tether (USDT) and USD Coin (USDC) are prime examples, both anchored to the US dollar on a 1:1 ratio. Stablecoins offer the advantages of digital currencies – fast transactions, transparency, and security – while mitigating the drastic price fluctuations commonly seen in the crypto world.

The world’s first stablecoin, Source: Tether website

What are the Main Types of Cryptocurrency?

The emergence of cryptocurrency has revolutionized the traditional monetary system. As a form of digital or virtual currency, cryptocurrencies utilize cryptography for security, ensuring transactions remain both anonymous and secure. While there are thousands of cryptocurrencies in circulation today, several have risen to prominence due to their unique features, technological innovation, and widespread adoption. Here, we will dive into the distinctive attributes and applications of some of the most notable cryptocurrencies.

Examining Bitcoin: The World's Largest Cryptocurrency

Introduced in 2009 by the enigmatic figure, Satoshi Nakamoto, Bitcoin stands as the progenitor and the most recognized of all cryptocurrencies. Often dubbed as "digital gold," Bitcoin was conceived as a decentralized digital currency without the need for a central bank or single administrator. With its peer-to-peer technology, transactions occur directly between users, further solidifying its stand against traditional banking systems. As a store of value and a hedge against inflation, Bitcoin's significance in the cryptocurrency market is unparalleled.

Diving into Ethereum: The Promise of Smart Contracts and Decentralized Applications

While Bitcoin laid the foundational brick for cryptocurrencies, Ethereum, introduced in 2015, brought forth a platform that went beyond just transactions. Ethereum introduced the world to "smart contracts" – self-executing contracts where the terms are written directly into lines of code. This feature, combined with its capability to host decentralized applications (DApps), sets Ethereum apart. It's not just a cryptocurrency; it's a platform that has fueled numerous innovative projects in the blockchain realm.

Ethereum and Bitcoin, while both renowned cryptocurrencies, have distinct differences. Ethereum, regarded as "the world’s programmable blockchain," serves as a versatile, electronic network with multiple applications, in contrast to Bitcoin, which was primarily designed as a cryptocurrency. While there's a finite limit of 21 million Bitcoins that will ever exist, Ethereum doesn't have a capped supply, although the speed of ETH block processing does control its annual minting. By September 2022, Ethereum had adopted a proof-of-stake consensus mechanism, moving away from the energy-consuming proof-of-work method still used by Bitcoin. Transaction fees on Ethereum, termed 'gas', are shouldered by transaction participants, while in Bitcoin, the network at large bears them. Ethereum's recent upgrade, previously known as Eth2, introduced a two-layered system – the execution and consensus layers. This upgrade increases Ethereum’s capacity, potentially lowering gas fees by addressing network congestion. Moreover, Ethereum's ongoing development involves "sharding," which segments the Ethereum database, enhancing scalability. Similar to cloud computing principles, sharding allows multiple validators to process simultaneously, hastening consensus achievement.

Understanding Cardano: A Third-Generation Cryptocurrency

Emerging as a "third-generation" cryptocurrency, Cardano aims to solve some of the most pressing issues faced by its predecessors, namely scalability, sustainability, and interoperability. Founded by Ethereum's co-founder, Charles Hoskinson, Cardano boasts a research-driven approach with its design and development being informed by academic research and scientific philosophy. Its unique layered architecture ensures that Cardano can evolve without frequent hard forks, making it a forward-thinking solution in the cryptosphere.

As of 2023, the platform is transitioning from the Basho era, which focused on scaling and optimization, to the Voltaire era, emphasizing voting and treasury management. Once the Voltaire era is complete, IOHK aims to hand over the blockchain and its network to the community, marking Cardano's full decentralization. Unlike Bitcoin, which was conceived as a peer-to-peer payment system, Cardano offers an expansive ecosystem that facilitates the creation of tokens, decentralized applications (dApps), and myriad other scalable blockchain network use cases. Cardano employs a Proof of Stake (PoS) consensus, contrasting with Bitcoin's energy-intensive mining process. This approach allows Cardano to minimize its environmental footprint. Cardano users, by simply staking their ADA cryptocurrency in compatible wallets, can earn rewards, ensuring active community participation without the need for resource-intensive mining rigs.

Looking at Solana: A Cryptocurrency for Decentralized Applications

Solana, a relatively newer entrant in the cryptocurrency domain, is rapidly gaining traction due to its high throughput and low transaction costs. Leveraging its unique consensus mechanism, Proof of History, Solana ensures scalability and speed, making it particularly attractive for developers keen on building decentralized applications. As the demand for DApps continues to soar, Solana's emphasis on performance and security paints a promising future for its adoption.

Solana and Ethereum are both prominent blockchains known for their smart contract capabilities, enabling innovative applications such as DeFi and NFTs. They both utilize a proof-of-stake (PoS) consensus mechanism, but Solana integrates an additional PoH layer for enhancement. One of the notable differences between the two in 2021 was Solana's superior transaction speed and cost efficiency. Solana boasted a capacity of 50,000 TPS with transaction fees averaging $0.00025, whereas Ethereum managed less than 15 TPS, and its transaction fees hovered around $1.68. However, Ethereum has been a frontrunner in the blockchain space, boasting a vast ecosystem and a market capitalization second only to Bitcoin. Recognizing the need for improvements, Ethereum has undergone major upgrades, merging its Beacon Chain and Mainnet Chain. This move sets the stage for a more scalable, secure, and sustainable blockchain. A forthcoming upgrade aims to introduce sharding, which promises to substantially reduce transaction times and ease network congestion. It remains to be seen how Solana will compete with these enhanced Ethereum functionalities.

Source: Solana website

Litecoin: The Silver to Bitcoin's Gold

Litecoin, often perceived as the 'silver' when compared to Bitcoin's 'gold' status, was one of the first altcoins and was created in 2011 by Charlie Lee. Bearing similarities to Bitcoin in its technical makeup, Litecoin distinguishes itself with a faster block generation time, a different hashing algorithm, and a more democratized mining process. Litecoin was introduced with the intention of enhancing certain aspects of Bitcoin. While Bitcoin can process approximately five transactions per second and requires about 10 minutes to generate new blocks, this slow speed can be a hindrance for merchants. A Bitcoin transaction may necessitate an average wait of up to an hour for the requisite six confirmations. In contrast, Litecoin boasts a transaction speed of 54 transactions per second and can produce new blocks on its blockchain every 2.5 minutes. As a result, it offers quicker transaction confirmation times, making it a favorite for merchants and e-commerce setups.

Even though Litecoin also needs a minimum of six confirmations for many exchanges to view it as irreversible, P2P crypto networks can often finalize Litecoin transactions nearly instantly. This enhanced speed aims to show merchants that they can bypass Bitcoin's lengthy settlement times and instead opt for Litecoin to allow for easier transactions comparable to other digital payment systems.

What Determines the Type of a Cryptocurrency?

Cryptocurrencies have emerged not just as mere alternatives to traditional currencies, but also as multifaceted tools that can serve a plethora of purposes. From being a store of value to facilitating decentralized applications, these digital tokens are much more than just a means of exchange. But what factors determine the type and function of a cryptocurrency? The answer lies in a combination of technological infrastructure, the nature of transactions, intended use, and specific applications they cater to.

Understanding the Role of Blockchain Technology

At the heart of every cryptocurrency is blockchain technology. It's a distributed ledger system that ensures transparency, immutability, and integrity of data. Every cryptocurrency operates on a blockchain which records transactions across many computers in such a way that the involved records cannot be altered retroactively. This not only offers a level of security but also dictates how the currency will function. For instance, Bitcoin's blockchain is designed mainly for peer-to-peer transactions, while Ethereum's blockchain is designed to facilitate decentralized applications and smart contracts.

Examining Transactions: Decentralization and Security

One of the core tenets of cryptocurrencies is decentralization. Instead of relying on a central authority or intermediary, like a bank, to process transactions, cryptocurrencies operate on a decentralized network of computers. This ensures that no single entity has control over the entire network, promoting fairness and security. The decentralized nature of cryptocurrencies, coupled with cryptographic techniques, provides robust security against fraudulent activities and unauthorized interventions. Each transaction is verified by network nodes through cryptography, providing an added layer of security.

Looking at Cryptocurrency Uses: Store of Value vs Digital Asset

Different cryptocurrencies serve different purposes. Some, like Bitcoin, are primarily seen as a store of value - a digital gold. They are often used as a hedge against economic instability or as an investment. On the other hand, tokens like Ethereum's Ether are not just a medium of exchange but also a digital asset. Ether is used to facilitate operations within the Ethereum network, particularly in the execution of smart contracts. Determining whether a cryptocurrency serves as a store of value or a digital asset can help in understanding its primary use and its potential for growth or adoption.

Exploring Cryptocurrency Applications: From Smart Contracts to NFTs

While the initial wave of cryptocurrencies was primarily focused on facilitating digital transactions, the horizons have expanded dramatically.

NFTs, or Non-Fungible Tokens, gained mainstream traction in recent years, though their inception dates back to 2014 with the first reported NFT sale of "Quantum" by Kevin McKoy. These digital assets utilize the Ethereum blockchain, primarily following the ERC-721 standard which establishes guidelines for ownership transfer, transaction confirmations, and safe transfers. An evolution to this was the ERC-1155 standard that enables bundling of multiple NFTs in one contract, thereby reducing transaction costs.

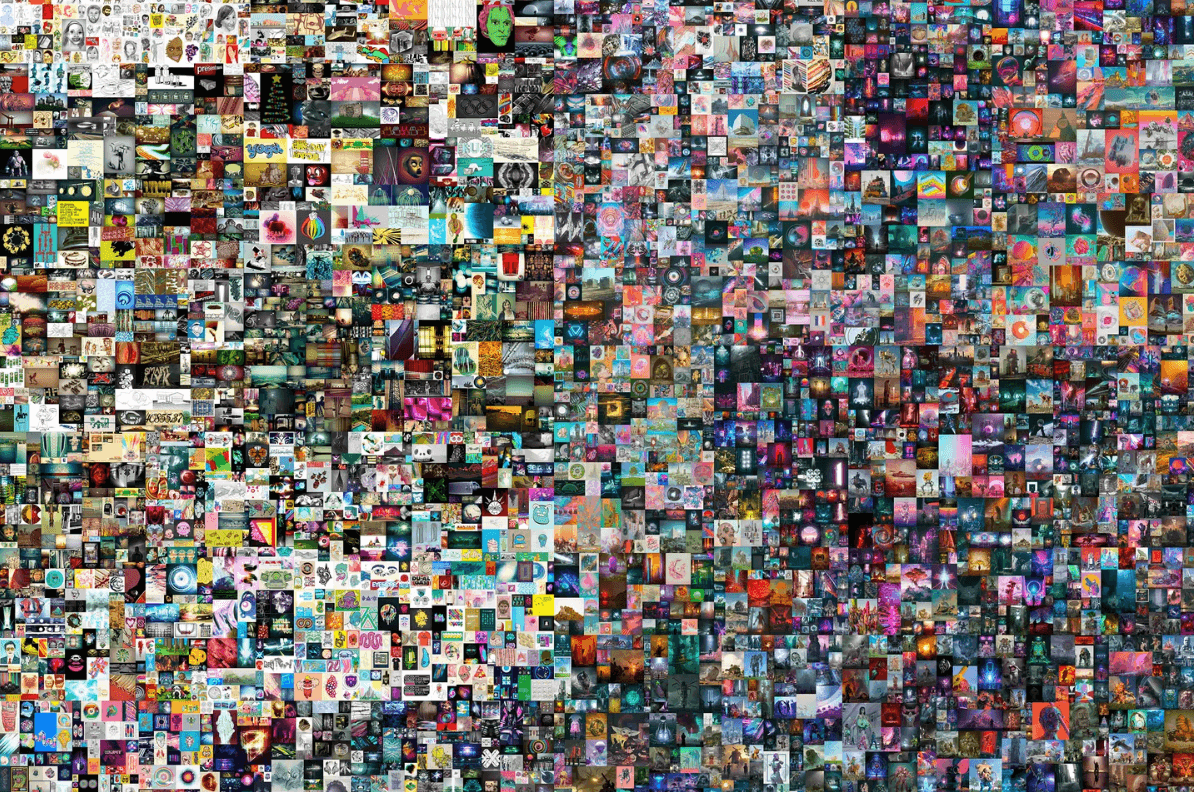

The NFT domain witnessed a monumental event in March 2021 when a digital collage by Beeple, representing his 5,000 days of work, sold for a staggering $69 million. The creation of NFTs, known as "minting," involves recording their details on a blockchain, using smart contracts to define ownership and transfer rights. Every minted NFT has a unique identifier that ties it to a blockchain address, ensuring each is distinct. Cryptocurrencies like Bitcoin are typically fungible, meaning each unit is equal in value to another. However, NFTs deviate from this norm by being unique and irreplaceable, preventing any two from being identical. Often compared to digital passports, each NFT carries a distinct identity, and their flexibility allows them to be merged, creating new NFTs.

Beeple’s collage, Everydays: The First 5000 Days, NFT sold at Christie’s. Image: Beeple

NFTs have revolutionized the art, music, and gaming industries by providing a platform for digital ownership. Such applications are just the tip of the iceberg, signaling a future where blockchain technology and cryptocurrencies intertwine with multiple facets of our lives.

Exploring Meme Coins: The Popularity and Controversy of Dogecoin

Meme coins, notably Dogecoin, have created significant buzz in the world of cryptocurrency. Originally started as a joke, Dogecoin rapidly gained traction due to its internet meme-inspired logo and playful approach. This unique crypto coin, branded with the Shiba Inu dog, demonstrates the power of community-driven ventures and viral marketing. However, its rise hasn't been without controversy. Critics argue that its value is highly speculative and isn't backed by any tangible utility, making it prone to volatile price swings.

Dogecoin's community spirit was evident early on, with donations funding the Jamaican bobsled team's Winter Olympics journey, constructing a well in Kenya, and sponsoring a NASCAR driver, accumulating a $20 million market cap within its first year. However, its journey wasn't devoid of controversy. Jackson Palmer, one of its founders, left in 2015 due to a "toxic community", and a British citizen named Alex Green, real name Ryan Kennedy, deceived the community with a fake Dogecoin exchange. Despite these setbacks, Dogecoin has seen mainstream acceptance, especially after gaining the attention of major figures like Elon Musk and companies like AMC Entertainment. While Dogecoin's technical infrastructure hasn't been a priority, its consistent mining activity and community support have kept it afloat in the vast crypto ocean. Nonetheless, meme coins serve as an essential case study in the influence of social media and community sentiment on the digital finance world.

Unveiling the Lesser-Known Gems: Discovering Unique Cryptocurrency Features

Amidst the vast sea of cryptocurrencies, some lesser-known tokens offer unique and valuable features that set them apart from their more popular counterparts. These hidden gems may present innovative solutions to existing challenges, such as faster transaction times, enhanced security measures, or sustainable mining practices. They might not yet be on every investor's radar, but their potential impact on the future of blockchain and digital currencies cannot be understated. Exploring these unique cryptocurrencies can provide a fresh perspective on the endless possibilities of the crypto space. Here is an example of a unique token in 2023.

OpenAI's CEO Sam Altman unveiled Worldcoin, a revolutionary cryptocurrency that utilizes a unique eye-scanning method to verify "personhood" and combat fraud. Co-founded by Altman, Alex Blania, and Max Novendstern, Worldcoin blends AI with blockchain technology in an open-source protocol, aiming to democratize access to the global economy. This decentralized currency, developed over two years, addresses income inequality by introducing the World ID - a proof of one's humanity. This ID comprises a global digital identity, Worldcoin tokens as a universal currency, and a dedicated app for cryptocurrency and conventional transactions. Unlike other cryptocurrencies that demand an initial investment, Worldcoin gifts users with a future token. Acquiring Worldcoin entails an iris scan using the "Orb", a spherical device, to ascertain human authenticity and prevent multiple sign-ups. Each iris, being as unique as fingerprints, allows the Orb to generate a distinct identifying code for every individual. Stored on Worldcoin's decentralized blockchain, this code is protected against duplication, while ensuring user anonymity. To assist in this process, Orb centers have been established in 35 countries.

Image from Fortune Crypto

Diving into the World of Privacy Coins: Protecting Your Transactions

In an era of increasing digital surveillance and data breaches, privacy coins emerge as a beacon for those seeking anonymity. These specialized cryptocurrencies prioritize the confidentiality of transactions and the identity of users. By leveraging advanced cryptographic techniques like CoinJoin, Confidential Transactions, and Ring Signatures, privacy coins such as Monero and Zcash offer a level of obscurity not found in traditional cryptocurrencies. While these coins champion financial privacy, they are not without their critics, with some raising concerns about potential misuse in illicit activities.

Privacy coins prioritize user anonymity by obfuscating transaction details across their networks. This ensures that tracking the origin, destination, and amount of money transferred is virtually impossible, offering a shield against prying eyes on one's financial activities. However, this shield raises regulatory concerns. On August 8, 2022, the U.S. Treasury Department took a significant step by prohibiting U.S. residents from using Tornado Cash, a decentralized mixer protocol on Ethereum designed for private transactions. This move has ignited a fresh wave of discussions surrounding the viability and legality of privacy coins and protocols.

Exploring Utility Tokens: Fueling Innovation and Functionality

Utility tokens are the lifeblood of many decentralized applications, granting users access to specific functionalities within a particular ecosystem. Utility tokens are blockchain-based tokens with a specific purpose within a particular ecosystem. Unlike other cryptocurrencies that merely act as a store of value or a medium of exchange, they are not treated as securities and therefore are not bound by the same regulations. Often introduced during events like ICOs, IDOs, or IEOs, they can be bought using cryptocurrency or fiat money. These tokens incentivize user participation within a platform, sometimes acting as a prerequisite for accessing certain features or completing platform-specific tasks. An example could be an Uber-specific token used to pay for rides. Despite their functional role, utility tokens are not intended for investment. The SEC employs the Howey Test to distinguish between utility and security tokens. Examples include file storage space or computational power. Notable utility tokens like Filecoin are designed for specific platforms, in this case, Filecoin's decentralized data storage. As blockchain technology continues to evolve, the role of utility tokens as facilitators of innovation and functionality will likely become even more pronounced.

Unearthing Security Tokens: Digitizing Real-World Assets

Security tokens are at the forefront of bridging the gap between traditional finance and the crypto realm. They represent ownership in real-world assets—be it real estate, stocks, or art—on the blockchain. This fusion allows for more fluidity in trading and transferring assets, potentially revolutionizing asset management and investment. With their inherent ability to democratize access to investment opportunities and bring increased transparency, security tokens could redefine how we think of ownership and equity in the digital age.

The Promise of Governance Tokens: Participating in Decision-Making

Governance tokens usher in a new era of decentralized decision-making, allowing holders to influence the direction and rules of a particular platform or protocol. By holding these tokens, users can propose, debate, and vote on changes, ensuring that the platform evolves in a manner consistent with its community's desires. This direct, democratic approach stands in stark contrast to centralized decision-making structures, offering a refreshing paradigm where stakeholders truly have a voice.

Each governance token typically represents a vote, allowing token holders to propose and decide on changes, such as how treasury funds should be used or which new features to implement. The value of these tokens can increase due to their limited supply with tokens like UNI and MKR from Uniswap and MakerDAO respectively, witnessing price surges due to their decision-making power. These governance systems often operate within Decentralized Autonomous Organizations (DAOs), which function through pre-set rules embedded in smart contracts. These contracts automatically enforce rules on a blockchain without a central authority, relying on consensus mechanisms to ensure network agreement. DAOs aim for autonomous decision-making without intermediaries. For instance, if a majority votes through a smart contract to burn a certain amount of a token, the contract ensures the execution of this decision transparently on the blockchain.

The Potentials of Protocol Tokens: Driving Interoperability and Scalability

Protocol tokens play a crucial role in ensuring seamless communication and interaction between different blockchain systems. They are instrumental in driving interoperability, allowing distinct networks to understand and transact with one another. Moreover, protocol tokens like Polkadot's DOT or Cosmos's ATOM facilitate scalability by enabling parallel blockchain "shards" or "zones" that operate simultaneously. This multi-chain approach promises a future where blockchains can efficiently communicate and scale, vital for the mass adoption of decentralized technologies.

Exploring Niche Cryptocurrencies: Discover Lesser-Known

Beyond Bitcoin and Ethereum, the cryptocurrency landscape is teeming with niche coins that cater to specific needs and industries. From coins tailored for the gaming sector to those focused on decentralized finance (DeFi), these niche cryptocurrencies often bring innovative solutions and features to the table. They might not always make headlines, but their specialized focus can offer unparalleled advantages for particular applications or audiences. Venturing beyond the mainstream allows investors and enthusiasts to uncover the rich tapestry of innovation that characterizes the ever-evolving crypto world.

Conclusion

As we close the chapter on our exploration of the diverse world of cryptocurrencies in 2023, it's evident that this dynamic financial ecosystem is not just a fleeting trend but a transformative force in the global economy. For novice investors, understanding the nuanced differences between various cryptocurrencies is paramount. Whether it's the foundational properties of Bitcoin, the smart contract capabilities of Ethereum, or the unique utilities of newer altcoins, each offers its distinct set of opportunities and challenges. Moving forward, it's crucial to approach the crypto space with a blend of curiosity, caution, and education. With continued research and a commitment to ongoing learning, even a beginner can navigate the intricate world of digital assets and potentially reap the rewards of informed investing.

FAQ About Different Types of Crypto

Q: What are the Popular Types of Cryptocurrency other than Bitcoin?

A: Other than Bitcoin, popular cryptocurrencies include Ethereum, Binance Coin, Cardano, and Litecoin, among others.

Q: How Many Types of Cryptocurrency are There?

A: The number is ever-growing, with over 10,000 different types of crypto tokens and coins available on various crypto exchanges as of 2023.

The information on this website is for general information only. It should not be taken as constituting professional advice from FameEX.