Is The Market For Cryptocurrencies Going To End Its Losing Skid of 10 Weeks?

2023-06-19 07:47:30The cryptocurrency markets traded at their lowest levels in three months as a result of regulatory uncertainty and a lack of clarity around stablecoins.

Source: n26.com

On June 15, the overall market value of cryptocurrencies dropped to $1.02 trillion, the lowest level in three months. Although the stability of the futures market and price increases at the conclusion of the week amid a lack of information over stablecoin reserves give bulls hope, it could be too soon to rejoice.

Deteriorating Crypto Regulatory Environment

Regulatory ambiguity has been a major driver of the recent negative trend. While Ether's price fell by 0.7% last week, Bitcoin and BNB both experienced gains of 2.5%. It is important to note that the 10-week pattern has challenged the support level many times, indicating that bulls will find it challenging to buck the negative trend as global regulatory circumstances continue to deteriorate.

Total crypto market cap, daily. Source: TradingView

First, because of recent regulatory changes in the United States, the New York-based derivatives exchange is delisting Solana, Polygon, and Cardano. The decision comes in response to legal actions the Securities and Exchange Commission filed last week against cryptocurrency exchanges.

Balanced Demand For BTC and ETH Leverage Is Shown By Derivatives

Inverse swaps and perpetual contracts both feature an embedded funding rate that is typically charged every eight hours. A positive financing rate suggests that longs (buyers) are requesting more leverage. However, the converse scenario arises when shorts (sellers) need more leverage, which makes the funding rate become negative.

The balance of demand from leveraged longs (buyers) and shorts (sellers) utilizing perpetual futures contracts is shown by the neutral seven-day financing rate for BTC and ETH. The only exception was BNB, where traders had to pay up to 1% per week for short bets. This is understandable given the increased risks after regulatory inspection of the Binance exchange.

USDT Premium Harmed By Tether Rumors

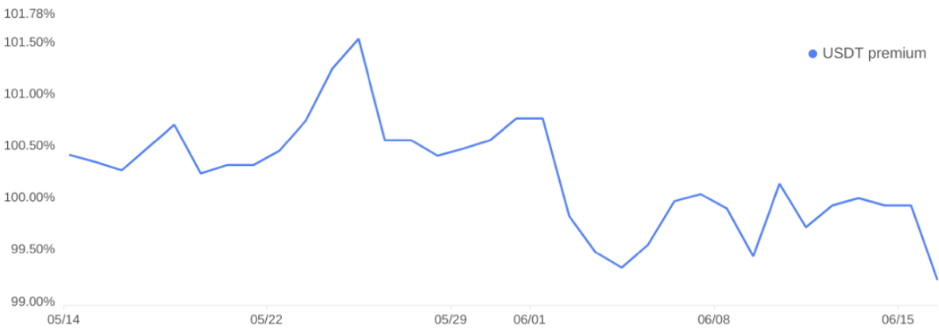

The Tether premium is an accurate indicator of the demand from China-based retail cryptocurrency traders. It calculates the difference between peer-to-peer exchanges conducted in China and the US currency.

Tether (USDT) vs. USD/CNY

Excessive demand for purchases tends to push the indication over fair value at 100%, and in bearish markets, a glut of Tether's market offer results in a discount of 2% or more. After being unchanged since June 6, the Tether premium in Asian markets decreased to 99.2%, showing some degree of uneasiness. Reports from June 16 outlining the vulnerability of Tether reserves to Chinese debt markets might be to blame.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.