BIRB (Moonbirds) Token Price & Latest Live Chart

2026-02-10 10:30:57

What is BIRB (Moonbirds)?

Moonbirds originally emerged as a well-known NFT brand within the Ethereum ecosystem. Its core value was never about a single image, but about the cultural identity and community belonging embedded in the characters themselves. NFTs, however, are not a complete economic system. Each token exists as an independent asset with relatively high transfer friction, uneven liquidity, and limited suitability for frequent everyday interactions. In practice, NFTs function more like cultural collectibles than as a universal unit capable of supporting large-scale rewards, participation, or commercial activity. The launch of the BIRB token addresses this structural limitation by layering a fungible, high-velocity on-chain economy on top of Moonbirds’ existing community and IP. Instead of centering the ecosystem solely around holding and trading NFTs, BIRB expands Moonbirds into a participation-driven brand economy.

Moonbirds NFT characters, source: Opensea

Who Is Building Moonbirds and the BIRB Token?

Moonbirds launched in 2022 under PROOF Collective and quickly became one of the most recognizable character IPs in the NFT market. The project was later integrated into Yuga Labs’ broader NFT portfolio. In May 2025, full intellectual property rights to Moonbirds were acquired by Orange Cap Games. This transition represented more than a simple asset sale. It marked a strategic repositioning of the brand. Orange Cap Games specializes in Web3 consumer products and interactive entertainment, with a core competency in translating digital IP into physical collectibles, games, and repeatable consumer experiences.

Following the acquisition, Moonbirds evolved from a collectible NFT project into a brand-driven ecosystem built around sustained participation and distribution. The goal is to create a compounding flywheel where characters repeatedly enter everyday consumer contexts through merchandise, gaming, and on-chain engagement. BIRB functions as the coordination layer within this framework, ensuring that community rewards, participation incentives, and brand expansion operate under a unified economic structure rather than fragmented systems.

BIRB officially launched on the Solana network on January 28, 2026, with a fixed total supply of 1 billion tokens. This design decision reflects the project’s emphasis on supporting low-cost, high-frequency interaction environments such as reward distribution, membership benefits, event participation, and micro-transactions. These use cases are often impractical on higher-fee networks. BIRB is positioned neither as a pure memecoin nor as a purely technical infrastructure token. Memecoins typically depend on short-term attention cycles and social momentum, while infrastructure tokens may provide real utility but struggle to attract non-technical participants. BIRB occupies a middle ground by pairing a recognizable consumer brand with a structured participation economy.

Moonbirds’ cultural presence for years gives BIRB a natural onboarding layer. Participants engage through familiar characters and tangible experiences rather than abstract blockchain mechanics. When tokens are designed to support everyday interaction instead of speculative trading alone, they become foundational components of a broader consumer ecosystem, enabling Moonbirds to transition from an NFT community into a scalable Web3 brand economy.

How does BIRB (Moonbirds) work?

BIRB operates as a unified participation and reward system that consolidates activities previously scattered across NFTs, events, partnerships, and merchandise into a single economic unit. When community members participate in campaigns, hold eligible assets, or complete ecosystem tasks, rewards can be expressed through BIRB rather than through isolated point systems. This approach creates continuity across the Moonbirds ecosystem, allowing value and participation to accumulate coherently.

A representative mechanism is Nesting 2.0, a long-term participation framework for NFT holders. Eligible NFTs can be deposited into a protocol in exchange for a non-transferable soulbound token that serves as proof of participation. Rewards accrue over time, aligning incentives with sustained engagement rather than short-term extraction. BIRB also supports ecosystem partners and market infrastructure through dedicated liquidity and incentive allocations. As future on-chain experiences such as gaming and social interactions integrate into the ecosystem, the token expands beyond reward distribution into a general operational layer for brand participation.

Why Is BIRB Built on Solana?

BIRB’s design prioritizes high-frequency, low-friction interaction, which directly informs its underlying infrastructure choice. Solana provides low transaction costs and rapid finality. This enables reward distribution, event participation, and micro-transactions to occur without imposing usability barriers. When tokens are used regularly for membership updates, in-game activity, or community rewards, high fees can quickly discourage participation. Solana’s performance characteristics allow these interactions to function as everyday operations rather than costly financial events. This infrastructure choice reflects a broader shift toward consumer-oriented Web3 experiences and positions BIRB as a scalable participation unit for large communities.

BIRB (Moonbirds) market price & tokenomics

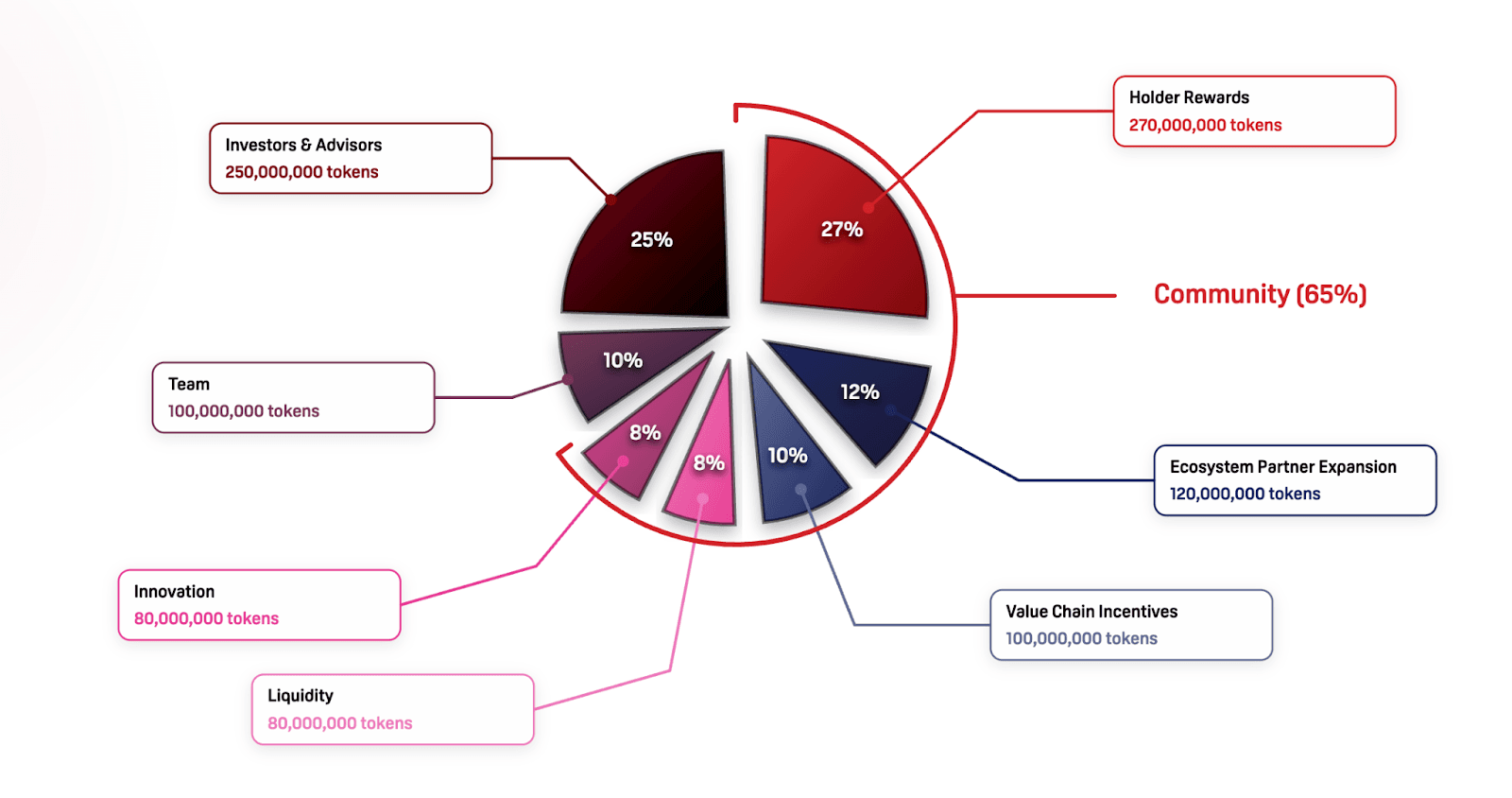

BIRB’s tokenomics are therefore not merely a supply chart, but a blueprint describing how the Moonbirds ecosystem converts culture, participation, and physical distribution into a sustainable on-chain system. Within the fixed 1 billion token supply, the 65% community allocation reflects a core principle: the token’s primary role is long-term ecosystem coordination rather than short-term circulation. Holder rewards account for 27% of total supply and are dynamically distributed beginning at the token generation event and continuing across a 24-month period. This extended release cadence turns rewards into an ongoing participation framework rather than a one-time distribution, creating continuity between holding, engagement, and ecosystem development while synchronizing supply changes with community growth.

12% of total supply is reserved for ecosystem partner expansion. This allocation is not directed at individual users, but at establishing long-term relationships with distribution channels, event organizers, content creators, and regional collaborators. Approximately one-sixth of this pool becomes available at launch, with the remainder unlocking monthly over 24 months. Structurally, this positions the token as fuel for ecosystem growth rather than as a marketing gesture. The design ties token release to measurable outcomes, directing on-chain resources toward user acquisition, brand activation, and distribution milestones.

Value chain incentives represent 10% of total supply and are dedicated to contributors supporting the physical and operational backbone of the ecosystem, including quality assurance, logistics coordination, and manufacturing optimization. This pool does not unlock at launch and instead releases gradually over 36 months. The intention is to align incentives with sustained operational performance. This encourages long-term commitment to the infrastructure that supports Moonbirds’ tangible presence rather than short-term participation.

Liquidity allocation accounts for 8% of total supply and exists to maintain market depth and accessibility. These tokens are fully available at generation and support exchange listings, deposit campaigns, and market-making operations to reduce slippage and stabilize trading conditions. Another 8% is reserved as an innovation buffer, functioning as a strategic reserve for future initiatives that may not yet be defined but carry ecosystem expansion potential. A small portion unlocks initially, with the remainder distributed over 36 months, allowing new product development and partnerships without altering the core supply structure.

The team allocation represents 10% of total supply and is fully locked for the first 12 months, followed by a 24-month linear release schedule. This structure ties team incentives to the long-term transformation of Moonbirds from an NFT brand into a consumer-facing ecosystem. Investor and advisor allocations account for 25% of supply and follow the same lockup and release logic, reflecting their role in providing capital, networks, and strategic support rather than short-term liquidity. By aligning stakeholder supply with time-based commitments, the token model reinforces stability and reduces disruptions to the ecosystem’s participation rhythm.

BIRB Token Allocation, source: Moonbirds

Nesting 2.0 Participation Framework

Nesting 2.0 is a long-horizon participation system designed for Moonbirds NFT holders. Participants deposit eligible NFTs into the protocol and receive a soulbound token representing their position. This token functions as onchain proof of commitment and accrues BIRB rewards over time. The system emphasizes duration and engagement rather than trading frequency, transforming NFT ownership into an ongoing participation relationship. By aligning incentives with sustained involvement, Nesting 2.0 reinforces the ecosystem’s focus on long-term community development.

Why do you invest in BIRB (Moonbirds)?

BIRB’s emergence drew market attention largely because of Moonbirds’ brand transition and a broader shift in Web3 toward consumer-oriented narratives. The token officially launched on Solana on January 28, 2026, a moment that represented more than a routine asset listing. It marked a structural pivot in which Moonbirds began evolving from an NFT collectible brand into a participation-driven on-chain economy. As a character IP that gained strong recognition during the 2021–2022 NFT cycle, Moonbirds already carried an established community identity and cultural memory. The introduction of BIRB added a high-velocity economic layer to that foundation. This allows participation to extend beyond NFT ownership and trading into rewards, events, and product interaction. This transition from a purely collectible asset model to a participation economy positioned BIRB as an experiment in how established character IP can integrate into a broader Web3 consumer framework, which explains why its launch immediately attracted attention from both NFT-native audiences and the wider crypto market.

A second focal point of interest stems from BIRB’s structural positioning as a bridge between meme-driven culture and tangible consumer ecosystems. While many tokens remain anchored in short-term sentiment cycles or narrowly technical narratives, BIRB is explicitly designed around brand distribution, community incentives, and high-frequency interaction. Crucially, it builds on a character brand with historical presence rather than attempting to manufacture attention from scratch. From a market perspective, this structure reframes the token not merely as a trading instrument but as a coordination layer for cultural participation. Therefore, discussions surrounding BIRB extend beyond liquidity or price behavior toward questions of whether the brand can sustain growth and operational momentum. This broader framing explains why early attention centered on its potential as a repeatable model for integrating NFT IP into a consumer-focused Web3 ecosystem, rather than on speculative dynamics alone.

Is BIRB (Moonbirds) a good investment?

Evaluating BIRB ultimately involves understanding whether the ecosystem it represents can sustain long-term participation rather than focusing exclusively on short-term market movement. The token is designed to connect cultural identity, community engagement, and physical distribution into a single economic structure. Its relevance depends on the brand’s ability to maintain momentum, partnerships, and product cadence. When participation is anchored to real-world experiences and structured incentives, the token becomes part of a broader system rather than an isolated speculative instrument.

Assets that combine culture and consumer infrastructure inherently carry uncertainty because they rely on both community energy and operational execution. Their value does not stem from a single technical function but from the brand’s ability to remain relevant across contexts. Viewing BIRB within this framework highlights its role as an experiment in brand-centric Web3 economics. For most participants, the central consideration is understanding how the system operates and whether its long-term structure aligns with their perspective on ecosystem development.

Find out more about BIRB (Moonbirds):

- Homepage

- Explorer: Solscan

- Whitepaper

Explore the latest BIRB (Moonbirds) price and live chart, trade BIRB on FameEX, and access real-time market data! Get started now with a seamless trading experience!

Disclaimer: The information provided in this article is intended only for educational and reference purposes and should not be considered investment advice. Conduct your own research and seek advice from a professional financial advisor before making any investment decisions. FameEX is not liable for any direct or indirect losses incurred from the use of or reliance on the information in this article.