FameEX Daily Technical Analysis | Swiss National Bank Injects $53.7 Billion into Credit Suisse, Leading a Stable Market for Now

2023-03-17 08:15:10FameEX Daily Technical Analysis | Swiss National Bank Injects $53.7 Billion into Credit Suisse, Leading a Stable Market for Now

Yesterday, all major cryptos exhibited price appreciation with fluctuations between 1.84% and 8.66%. Continuing the previous strong trend, BNB greatly increased by 8.66%. Conversely, ADA was relatively weak, with a slight rise of 1.84%. BTC and ETH, two of the leading cryptocurrencies, climbed 3.98% and 2.12%, respectively.

According to the 4-hour trading cycle depicted below, After several days of truce between the long and short, the long attempted to attack, pushing BTC upwards to break $25,000. The MA7 support has changed to an upward bending pattern, showing a long trend with the MA25 support and MA99 support. This suggests that the long market dominates the short-, medium- and long-term trends. However, there is still huge price pressure from the previous high of $26,387. As such, we should pay attention to the subsequent price response in this pressure.

Overall, despite the pressure from the price above, the market is favorable to the long trend. Therefore, it is recommended to hold a few long positions while awaiting greater stability in the trend before entering into further orders.

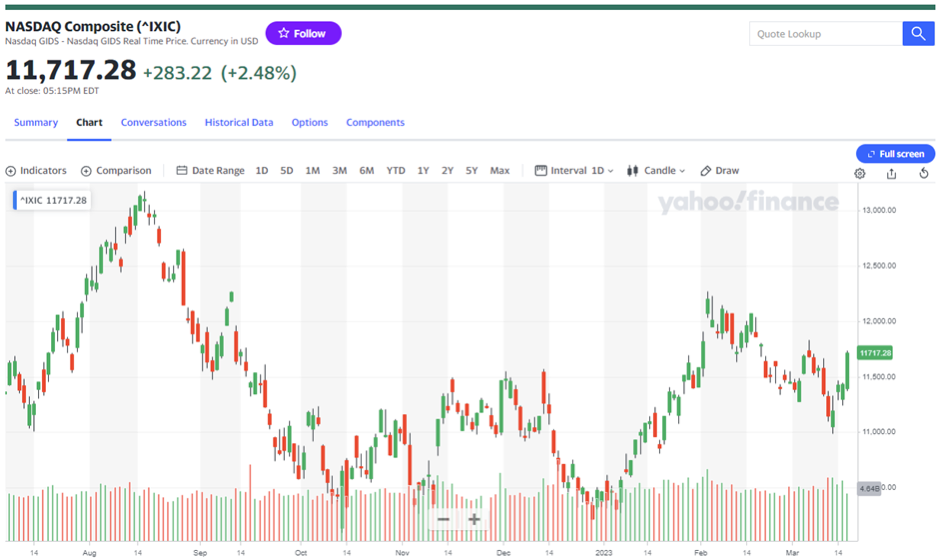

During yesterday’s trading session, all three major U.S. stock indexes experienced ups. The Dow Jones index was relatively weak, with a slight rise of 1.17%. The S&P 500 index was also up 1.76%. The Nasdaq index was strongest, significantly rising by 2.48%. Meanwhile, two of the leading cryptos, BTC and ETH, rose by 3.98% and 2.21%, respectively.

Credit Suisse has received $53.7 billion in loans from the Swiss National Bank (SNB) to restore confidence in the collapsing banking system. Furthermore, 11 U.S. bank giants jointly announced a $30 billion injection into First Republic Bank (FRC) at the end of the day, with shares of FRC surging nearly 10%, leading a strong rebound in bank stocks.

As to political and economic fields, in congressional testimony released Thursday, U.S. Treasury Secretary Alan Yellen told the United States Senate Committee on Finance that the U.S. banking system "remains strong" and that Americans can feel "confident" in their deposits.

Despite the recent turmoil in financial markets, the European Central Bank (ECB) still determined to fight against high inflation and maintained its hawkish rate hike on Thursday, raising the benchmark interest rate by 0.5% to 3% and revising its forecast for eurozone gross domestic product (GDP) growth to 1.0% this year.

According to the CME's FedWatch tool, traders were putting nearly 80% odds on the Federal Reserve raising rates by 0.25% on March 22.

Over the past 24 hours, there has been a total of $38 million in long liquidations and $53 million in short liquidations, resulting in a net short liquidation of $15 million. As such, the total amount of liquidations dropped sharply yesterday, and investors' trading fervor receded.

The Fear & Greed index has recently increased to 52, which is over the significant threshold of 50. This suggests that the market is cautious optimism. However, due to the ongoing volatilities in the market, it is recommended to watch the subsequent trend.

The Bitcoin Ahr999 index has increased to 0.64, which is above the support level of 0.45 but below that of 1.2. This shows that the short-term trend becomes strong, but the long-term trend is still a bear market. Therefore, It is not recommended to buy the dip in batches. However, purchasing small amounts through dollar-cost averaging (DCA) may be a viable strategy.

Based on the above analysis, despite investors being less enthusiastic about trading yesterday, it seems that the crypto market is less panic than before, with a stable price trend. Because we may be still at the bottom in the long run, we recommend periodically buying with a fixed amount and selling them gradually as the market rises.

Disclaimer: FameEX makes no representations on the accuracy or suitability of any official statements made by the exchange regarding the data in this area or any related financial advice.