FameEX Today’s Crypto News Recap | February 10, 2026

2026-02-10 06:16:11

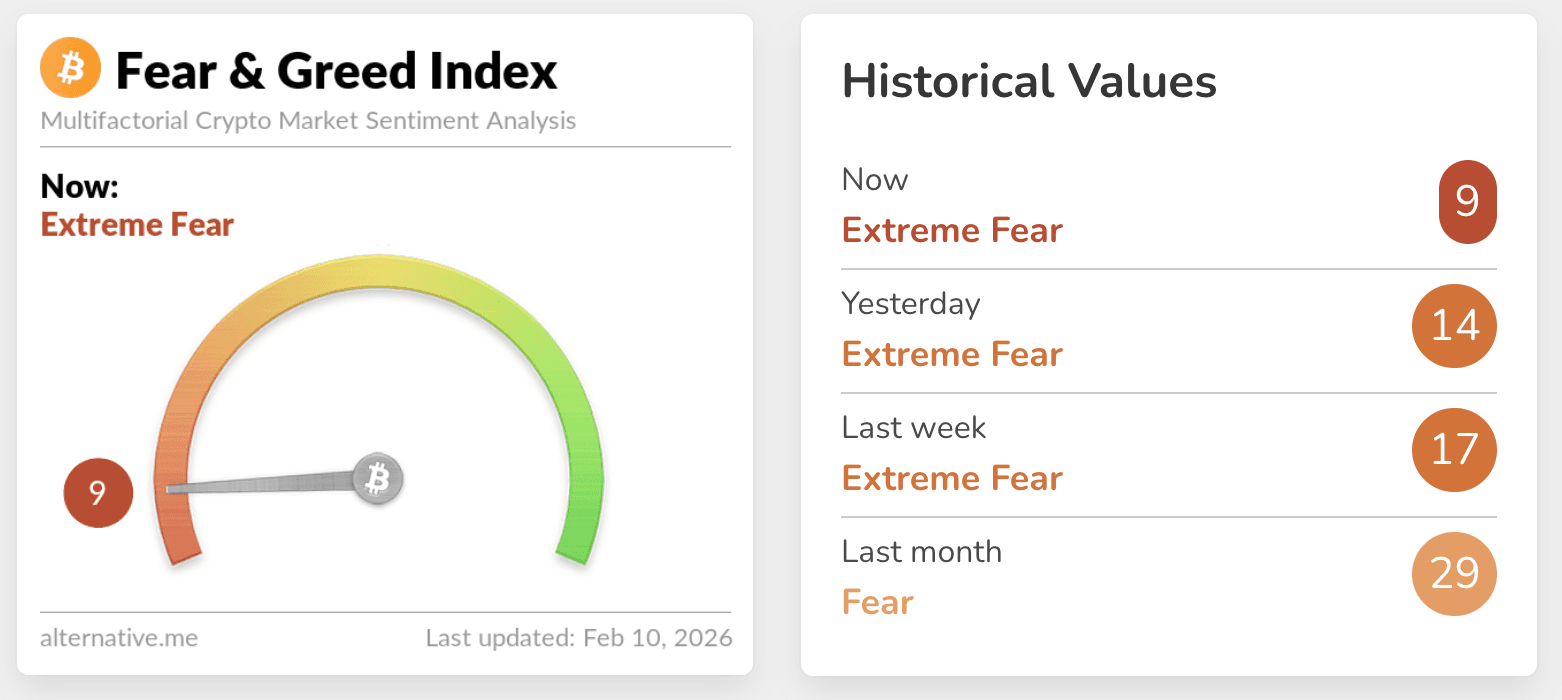

As Vitalik outlines Ethereum–AI integration, Bitcoin sentiment hits historic lows while Chainlink frames a more resilient bear market. Today’s crypto market moved structurally with cautions centered on position rebalancing rather than a directional trend shift. Market sentiment continued to compress as the Crypto Fear & Greed Index fell into historically low territory, prompting capital behavior to prioritize exposure management and leverage reduction instead of proactive risk expansion. Within this situation, Bitcoin maintained its role as a market anchor, with price movements largely reflecting derivatives positioning adjustments and liquidity reallocation rather than fresh speculative demand. Ethereum staged a technical rebound following a sharp correction, yet derivatives structure still indicates constrained risk appetite. This suggested that recent price recovery is more consistent with positioning recalibration than trend-driven capital inflows. At the same time, slowing onchain activity alongside renewed supply growth and ongoing macro uncertainty has continued to suppress risk-taking behavior, reinforcing an overall cautious market tone. Large onchain transfers and concentrated liquidation zones further highlight that participants are actively recalibrating balance sheets within a high-volatility framework.

Crypto Markets Overview

While crypto prices experienced pockets of short-term recovery, the broader market continues to operate within a cautious structure shaped by sentiment compression and derivatives positioning adjustments. The Crypto Fear & Greed Index is at 9 today, signaling Extreme Fear and reflecting highly defensive capital behavior focused on position reduction and leverage contraction. Bitcoin continues to trade around key liquidation clusters, underscoring a market environment where durability of positions and risk management take precedence over momentum chasing. Ethereum briefly reclaimed an important price zone, yet futures premiums remain below neutral levels, indicating limited trader confidence in sustained upside continuation. Slower onchain activity has contributed to renewed annualized ETH supply growth, softening previous deflation-driven narratives, while Layer-2 expansion models and base-layer scaling pathways remain in transition. This has led participants to evaluate long-term efficiency and security with caution. Simultaneously, network-wide liquidations and large Bitcoin transfers suggest ongoing balance sheet adjustments, with altcoin activity leaning toward tactical positioning rather than sentiment-driven risk expansion.

Source: Alternative

Bitcoin and Ethereum Price Volatility and Liquidation Dynamics

Bitcoin’s price remains closely tied to high-density liquidation zones, forming a trading framework largely driven by leverage positioning. Data shows that a move below $66,464 could trigger approximately USD 1.291 billion in long liquidations, while a break above $73,439 may force roughly USD 957 million in short covering. This liquidity asymmetry reinforces range-dependent behavior, where price action is shaped more by position mechanics than directional conviction. Ethereum’s rebound above $2,100 has not materially shifted derivatives sentiment, as futures structure continues to show muted premiums and a cautious bias. A decline toward $1,999 or a move above $2,206 corresponds to liquidation pressures of roughly USD 696 million and USD 503 million respectively. This highlights how price elasticity remains tightly linked to positioning adjustments rather than spot-driven demand. Concurrent supply growth and slowing onchain activity further point to structural recalibration within Ethereum’s ecosystem. Overall liquidation heatmaps and forced unwind distribution indicate that market volatility continues to reflect balance sheet repair dynamics rather than momentum expansion.

Key News Highlights:

Vitalik Buterin Outlines Vision for Ethereum and AI Integration

Ethereum co-founder Vitalik Buterin recently shared his vision for how artificial intelligence and blockchain technology could work together to improve efficiency, privacy protection, and user autonomy. He emphasized that AI should empower humans rather than replace them, enabling safer and more trustworthy decision-making in digital environments. According to Buterin, blockchain infrastructure can serve as a trust layer for AI interactions, allowing private and verifiable engagement while minimizing risks of personal data exposure. He highlighted privacy concerns surrounding large language models and argued for the development of zero-knowledge tooling and local computation solutions to support anonymous verification. Buterin also proposed that AI agents could act as intermediaries between users and blockchains, auditing transactions, interacting with decentralized applications, and enhancing operational security. Such systems could reduce fraud risks and user errors, particularly as onchain attack vectors grow more sophisticated. He further suggested that AI-driven agents may eventually execute economic interactions on behalf of users, increasing accessibility and automation within crypto ecosystems. Additionally, AI could improve governance and market decision processes by overcoming human attention limitations. This framework illustrates a future where AI and blockchain combine to strengthen privacy, verification, and efficiency.

Bitcoin Sentiment Hits Historic Lows, Drawing Market Attention

Bitcoin sentiment indicators recently dropped to record lows, triggering heightened focus on investor psychology and structural positioning. The Crypto Fear & Greed Index entering Extreme Fear territory signals broad caution among traders. Some market observers note that similar sentiment extremes have historically coincided with major cycle inflection points, fueling discussion across trading communities. At the same time, persistent derivatives selling pressure continues to shape cautious positioning. Liquidation data reveals concentrated clusters where upward or downward moves could force large-scale position closures, underscoring the sensitivity of current price dynamics to leverage structures. Onchain and derivatives metrics together indicate ongoing reassessment of risk exposure. While certain technical indicators show oversold conditions, spot demand remains a key factor in broader market stability. Market attention remains focused on sentiment, liquidation zones, and positioning structure rather than singular price targets. This sentiment shift has renewed emphasis on liquidity and positioning behavior within Bitcoin markets.

Chainlink Co-Founder Discusses How the Current Bear Market Differs

Chainlink co-founder Sergey Nazarov argues that the recent crypto market downturn differs structurally from previous bear cycles, suggesting increased industry maturity. Despite a significant decline in overall market capitalization, he noted the absence of large institutional collapses or systemic failures seen in earlier downturns. This resilience reflects improvements in risk management across the ecosystem. Nazarov also emphasized that tokenized real-world assets continue expanding regardless of crypto price volatility, with infrastructure and adoption progressing steadily. Onchain data shows substantial growth in RWA tokenization over the past year, indicating value creation independent of price cycles. He highlighted how always-on markets, real-time data availability, and onchain collateral mechanisms are attracting institutional attention. Additional observers point out that current market pressures stem more from macroeconomic and technology sector uncertainty than crypto-specific structural weaknesses. These developments have shifted industry focus toward infrastructure utility and long-term ecosystem integration rather than short-term price fluctuations.

Trending Tokens:

- $9BIT (the9bit)

The9bit has drawn attention as the Web3 gaming infrastructure narrative heats up again, positioning itself as a game hub where players earn token rewards through gameplay, quests, and social interaction. Its recent promotion tied to a Monster Hunter campaign is viewed as a behavioral activation trigger that re-engages dormant users and drives platform participation, rather than a one-off marketing push. This development highlights how gaming ecosystems are increasingly blending offchain cultural touchpoints with onchain engagement loops to rebuild liquidity and user activity. Market observers see this as aligning with the broader return of game-centric token economies that prioritize retention mechanics over short-term speculation. The9bit’s design emphasizes persistent participation loops, which signal that token incentives are structured to sustain activity rather than front-load distribution. The platform reflects the evolution of Web3 game hubs into aggregation layers for attention, rewards, and social identity.

- $CRCL (Circle)

Circle has entered market focus again following the launch of Arc’s public Layer-1 testnet, which reframes stablecoin infrastructure as an economic operating system rather than a simple settlement tool. Arc emphasizes predictable dollar-denominated fees, sub-second finality, and configurable privacy, features designed to align with institutional finance requirements. The launch is widely seen as a signal of enterprise-grade blockchain infrastructure maturity, with participation already spanning capital markets institutions, global payment networks, and core developer infrastructure providers. Analysts interpret this as a structural bridge between programmable money and regulated financial workflows, indicating that onchain settlement is moving toward production-level economic rails. The narrative has expanded beyond stablecoin issuance into lending, tokenized assets, and cross-border liquidity coordination. Circle’s positioning reflects an effort to standardize value transfer between digital and traditional finance, with interoperability as a core design principle. Arc’s rollout is viewed as a strategic expansion of programmable financial infrastructure rather than a standalone technical upgrade.

- $BNKR (Bankr)

Bankr is gaining market attention within the AI agent narrative by enabling autonomous agents to fund their own compute costs through tokenized economic activity. The platform integrates wallet management, trade execution, and security layers, allowing AI agents to conduct blockchain transactions via natural language commands. Its token launch and fee-recirculation model creates a closed economic loop in which trading activity continuously finances compute, positioning agents as economically autonomous participants. This infrastructure reduces friction around wallet setup and DeFi routing, letting developers focus on agent behavior and application design. The approach aligns with growing market exploration into autonomous commercial systems, where machine actors coordinate value transfer without constant human oversight. Bankr’s extensible skill architecture suggests agent capabilities can evolve alongside the ecosystem. Market interest reflects the long-term thesis of convergence between AI coordination layers and Web3 financial rails.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.