FameEX Today’s Crypto News Recap | February 11, 2026

2026-02-11 06:59:37

LayerZero unveils Zero chain with ARK and Citadel backing, Robinhood launches an Ethereum L2 testnet, and Solana advances its Internet Capital Markets vision, highlighting institutional expansion across onchain infrastructure. Today’s crypto asset performance continued to reflect a compression driven environment. Bitcoin traded intraday within roughly $68,600 to $70,400, failing to see a decisive breakout after absorbing prior selling pressure. This highlights how capital remains caught between structural consolidation and liquidity stress. Ether fluctuated around the $2,000 to $2,100 zone, signaling that this key threshold has become a high interaction region where buyers and sellers repeatedly engage. Overall sentiment remains in a risk contraction phase, with capital rotation focused on deleveraging and spot hedging rather than aggressive continuation buying. Liquidation activity shows that long exposure has been passively unwound under pressure, reinforcing that recent price action is mechanically driven rather than momentum fueled. The dominant behavior across the tape centers on managing open interest and risk exposure to preserve position durability and liquidity buffers instead of chasing directional breakouts.

Crypto Markets Overview

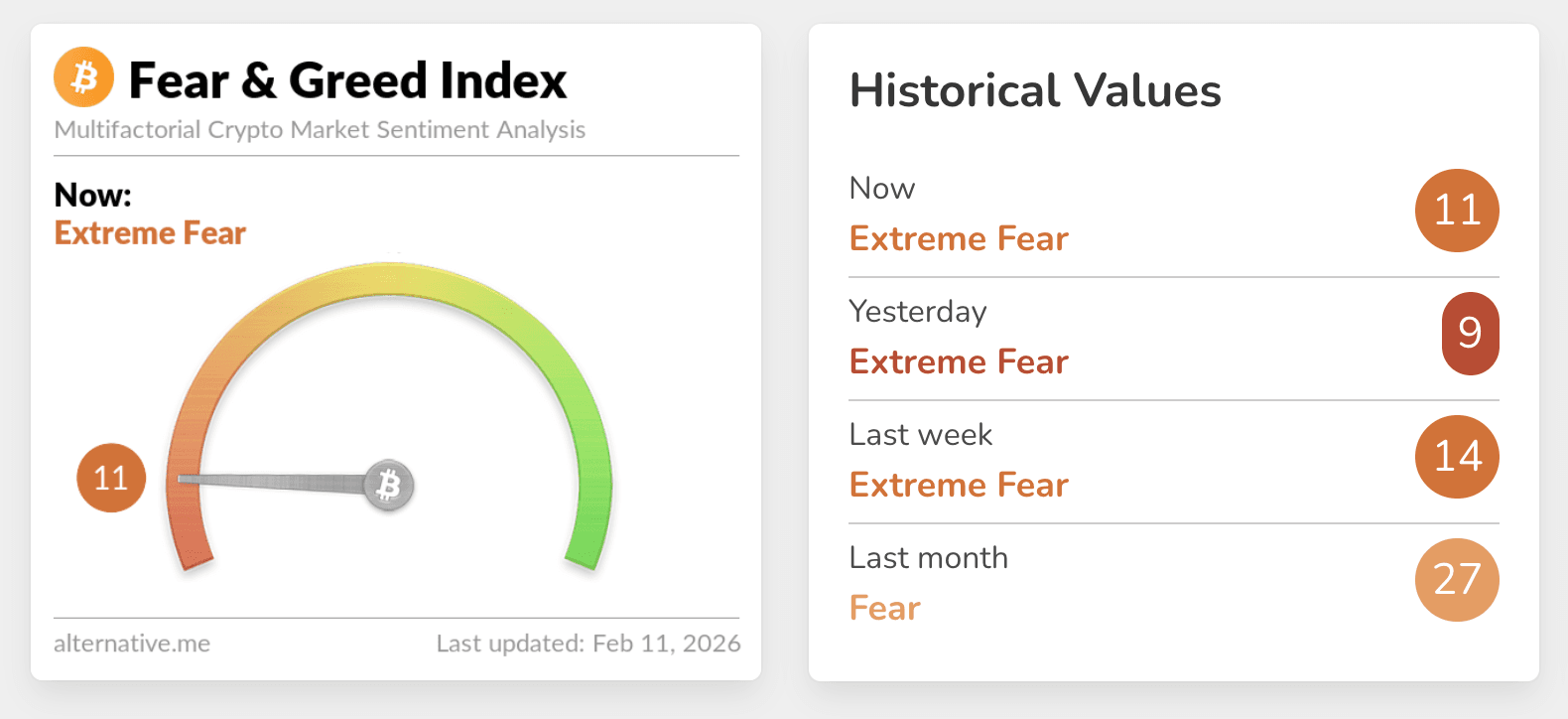

The Crypto Fear and Greed Index currently is at 11, placing sentiment firmly in Fear territory, which indicates subdued risk appetite and capital behavior tilted toward cautious exposure management rather than expansion. Bitcoin continues to function as the market’s primary liquidity anchor, with elevated turnover and range bound trading reflecting participants rotating back into durable assets following recent volatility. This pattern is typical during liquidity pressure phases when capital prioritizes risk control and leverage recalibration. Ether oscillates around the $2,000 to $2,100 psychological consolidation band, where derivatives positioning intersects with realized cost basis clusters, creating repeated friction between overhead supply and downside support. Over the past 24 hours, total liquidations reached USD 213.00 million, underscoring that forced unwinds remain a key source of price pressure rather than fresh capital deployment. In this situation, allocation flows concentrate on high liquidity spot positioning and tightly managed rotations, while broad risk expansion remains limited.

Source: Alternative

Liquidity Pressure Dominates Trading As BTC Ranges And ETH Tests Key Levels

Bitcoin’s current price behavior reflects a post deleveraging consolidation structure, with trading largely confined between approximately $66K and $72K as the market repeatedly tests key liquidation zones and cost acceptance regions without sustaining directional continuation. Forced unwinds and profit taking appear in overlapping waves within this range, limiting one sided momentum and reinforcing the range bound character of the market while long open interest gradually decompresses under pressure. Ether forms a high friction zone near $2,000, where dense onchain cost clusters converge with derivatives liquidation exposure, producing frequent interaction between buyers and sellers. This overlapping structure suggests that BTC and ETH are engaged in base rebuilding rather than trend expansion, with participants actively managing exposure in a liquidity constrained environment. Understanding the interaction between liquidity pockets and liquidation zones is essential for interpreting short term price behavior, as it reveals how capital adjusts between compressed risk appetite and limited risk tolerance rather than responding to new directional catalysts.

Key News Highlights:

LayerZero Launches Zero Chain With Institutional Backing

LayerZero Labs announced plans to introduce a new layer 1 blockchain called Zero, designed specifically for institutional financial market applications and supported by strategic investments from ARK Invest and Citadel Securities. According to the company, Zero is scheduled to launch in fall 2026 and is built around zero knowledge proof architecture and the Jolt virtual machine to bypass traditional blockchain replication limits, enabling theoretical throughput of up to two million transactions per second. The network will operate through three permissionless environments known as zones, while the LayerZero native token ZRO will provide interoperability across zones and more than 165 connected blockchains. An advisory board has been formed that includes senior figures from traditional finance, signaling institutional participation in the infrastructure. LayerZero noted that multiple organizations are evaluating Zero for use in 24 hour trading and tokenized collateral clearing. Google Cloud is exploring applications involving AI driven micropayments and automated trading, while clearing and settlement institutions are studying the network’s scalability. The project has also secured strategic investment from a stablecoin issuer’s venture arm, positioning Zero as a focal point in cross chain infrastructure and institutional blockchain integration.

Robinhood Introduces Ethereum Layer 2 Testnet For Tokenized Assets

Robinhood has launched the public testnet for Robinhood Chain, an Ethereum layer 2 network built on Arbitrum technology aimed at bringing tokenized real world and digital assets onto onchain trading rails. Documentation indicates the testnet is open to developers and supports standard Ethereum tooling, network endpoints, and infrastructure integrations. The company says the chain is designed for financial grade applications including 24 hour trading, self custody, asset bridging, tokenized asset platforms, and decentralized finance services. A mainnet release is planned later this year and will introduce stock style tokens alongside deeper integration with Robinhood Wallet. This rollout marks a strategic shift from a conventional trading platform toward operating onchain infrastructure, following Robinhood’s earlier tokenization of nearly 500 US equities and ETFs on Arbitrum. The model reflects a broader trend where platforms develop both user interfaces and blockchain rails to support asset issuance and trading. Company leadership noted that real time blockchain settlement could help mitigate trading disruptions and introduce new delivery mechanisms for financial products.

Solana Highlights Internet Capital Markets Vision In Hong Kong

At Consensus Hong Kong 2026, Solana Foundation president Lily Liu outlined the concept of Internet Capital Markets during a fireside discussion with moderator Michael Lau, emphasizing blockchain’s role in open, programmable financial infrastructure. Liu argued that blockchains are best suited for capital market applications rather than broad experimental technology use, with the long term vision centered on tokenizing global assets and enabling seamless onchain activity from everyday payments to high frequency trading. She traced the evolution of crypto fundraising models from early ICO structures to modern rapid capital formation and suggested that these mechanisms could extend to non crypto enterprises worldwide. Liu highlighted Asia as a core hub of crypto activity due to its scale, talent base, and historical participation in Bitcoin’s early growth. Solana was described as neutral infrastructure designed to serve billions of internet users rather than a single application ecosystem. She also emphasized revenue and real network usage as key sustainability metrics over governance token models. The discussion focused on how blockchain infrastructure can reshape global capital formation and financial accessibility while underscoring Asia’s central role in that transformation.

Trending Tokens:

- $FRAX (Frax Finance)

Frax Finance has regained market attention as its frxUSD stablecoin narrative places the protocol at the center of the next institutional stablecoin cycle, positioning frxUSD as a core settlement asset while emphasizing Treasury-backed reserves, explicit mint and redemption pathways, and a canonical cross-chain distribution design. Recent announcements frame frxUSD as a default USD settlement layer capable of serving both DeFi and regulated institutions. This reflects a structural shift away from purely crypto-native collateral models toward cash-equivalent reserve systems. The architecture centers on custodian-led issuance, signaling to the market that solvency and redemption credibility are embedded at the product design level rather than treated as auxiliary assurances. Cross-chain infrastructure and canonical liquidity routing are highlighted as key mechanisms to reduce fragmentation risk, aligning with trader demand for settlement reliability during periods of volatility. The introduction of a yield layer through sfrxUSD establishes a governance framework that links Treasury-derived returns with on-chain composability, further expanding integration scenarios. Market participants view this development as part of the maturation of stablecoin design, where reserve quality, throughput resilience, and institutional interoperability become central to adoption narratives.

- $UP (Superform)

Superform is drawing attention as demand for cross-chain yield aggregation intensifies, with the protocol positioned as a routing layer that abstracts access to multi-chain vaults and improves capital efficiency. Its design allows users to deposit into or withdraw from ERC-4626 vault strategies within a single transaction, aligning with market preferences for simplified execution and reduced operational friction. Recent focus has centered on Superform’s role as an interface aggregator, consolidating yield sources from multiple established protocols into a unified distribution surface that enhances liquidity and strategy visibility. This architecture appeals to users seeking to optimize yield exposure across chains while avoiding the complexity of manual bridge management. By standardizing vault interactions, Superform advances a narrative in which yield infrastructure evolves from isolated strategies toward composable liquidity routing. Market observers interpret this as a progression from fragmented yield markets toward greater interoperability, with execution efficiency increasingly emerging as a key competitive factor.

- $VANA (vana)

Vana is gaining market attention as data sovereignty converges with rising demand for AI infrastructure, positioning the protocol as a framework for user-controlled, portable digital identity and data capture. Its roadmap emphasizes a transition from validation to scalable data capture, treating user-permissioned datasets as a foundational response to challenges around AI training quality and data provenance. Recent communications focus on infrastructure upgrades that support data portability and enterprise-grade throughput, addressing regulatory and commercial requirements for verifiable data flows. This positioning aligns with growing market emphasis on sovereign data control, reinforcing the principle that individuals retain authority over their digital identities and data usage. By linking identity primitives with reusable data markets, Vana embeds itself within the broader narrative of programmable data ownership as an economic layer. Market participants view this as a structural attempt to bridge Web3 identity mechanisms with real-world AI demand, expanding the application boundaries of user-owned data infrastructure.

Disclaimer: The information provided in this section is for informational purposes only and doesn't represent any investment advice or FameEX's official view.