What Are Stablecoins? Every Crypto Beginner Should Know

2023-01-17 07:58:05

What Is a Stablecoin?

Cryptocurrencies are known for having a rapidly changing price. Although this property is what makes cryptocurrencies such an exciting investment, it is inconvenient when you want to hold a stable value in your wallet. A stablecoin is a cryptocurrency designed to solve this problem by staying at the same price relative to a specific national currency, usually the US dollar.

Stablecoins are blockchain tokens that can be held in cryptocurrency wallets just like any other cryptocurrency. During times of crypto price volatility they can be used by crypto traders to lock in the value of their crypto portfolio without needing to sell their crypto and have the hassle of transferring actual government-issued currency to a bank account.

Aside from US dollar stablecoins, there are stablecoins pegged to the Euro, the British Pound and many other currencies, some stablecoins are pegged to the price of commodities such as gold.

Why Are Stablecoins So Important?

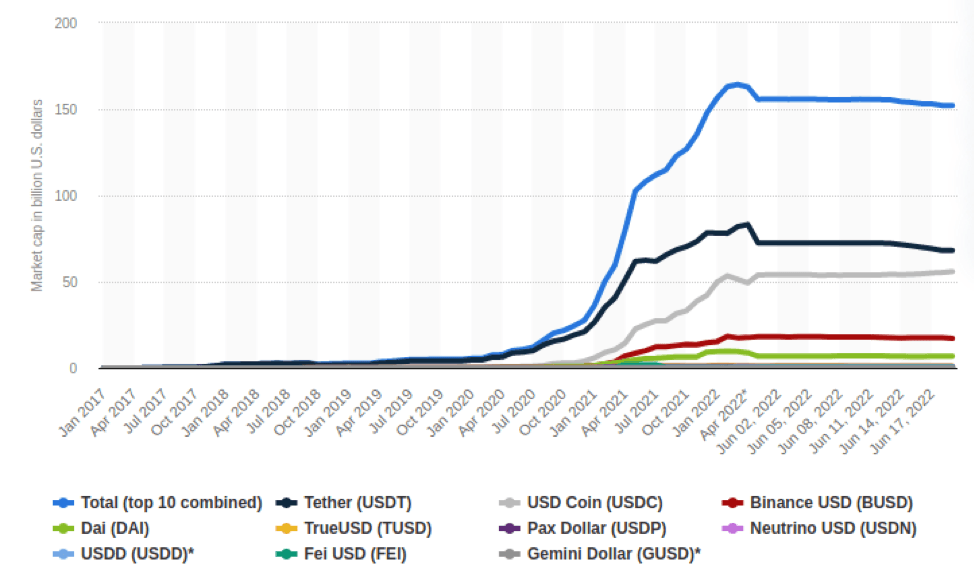

Stablecoins have become a vital component of cryptocurrency traders' toolkit since they were invented in 2016. Since cryptocurrency exchanges face significant regulatory hurdles in supplying real fiat currency trading pairs, stablecoins are an easy solution for exchanges to implement to allow their users to trade against volatile cryptocurrencies. As of November 2022, Stablecoins have a combined market of over $146 Billion US dollars and a daily trading volume of over $80 Billion US dollars.

Source - Statista

For instance, our exchange FameEX uses the stablecoin USDT for the vast majority of trading pairs. This is particularly useful for margin and futures trading as it makes calculating margin, profit and loss easy and more predictable. In the early days of cryptocurrency trading, Exchanges primarily offered Bitcoin vs USD (Real US dollars) and then altcoins vs Bitcoin trading pairs. This is where the traders' catch phrase “Stacking Sats” comes from, because a traders’ main objective was to increase the quantity of Bitcoin in their balance by trading altcoins.

These days, traders prefer the stability of stacking stablecoins. The vast majority of crypto exchanges offer a range of stablecoin trading pairs and the ability to withdraw crypto trading profits in the form of stablecoins.

Stablecoins are also incredibly useful for payments. Cryptocurrencies have been used to pay other people for goods and services since they were invented, but the problem arises that the currency could easily change value significantly half way through a transaction. Stablecoins allow you to pay or be paid, for goods and services in the same convenient P2P user experience as using a crypto, while having the same price stability advantage of a cash transaction. If you want to try out the experience of getting paid in some stablecoins, FameEX exchange has an event where you could share a reward of 1000 USDT stablecoins. Just follow this link to try it out.

What Are Stablecoins Used For?

Stablecoins are tied to the value of government fiat currencies. If you believe those to be a reasonably stable store of value then stablecoins can act as a tool to store money. If your own country's fiat currency loses value constantly against the US dollar, US dollar stablecoins can provide a handy way of preventing your savings being eaten up by high inflation. In countries where inflation is particularly high such as certain countries in South America, Turkey, Africa or elsewhere, stablecoins have become a common way for people in those countries without access to US dollar denominated bank accounts to keep their savings reasonably stable.

Financial trading is by far the most common use of stablecoins. Stablecoins first began to be used on traditional centralized cryptocurrency exchanges, but being issued on different blockchains also allows them to be used on decentralized exchanges. The vast majority of crypto and therefore stablecoin value is still transacted on the big centralized exchanges. Stablecoins are used as a unit of account for trading other more volatile cryptocurrencies, particularly in leverage or futures trading.

Payments are another major use case for stablecoins. Having a blockchain based stable currency makes it easy for companies to pay their overseas employees. Accounting is also simplified and risk is reduced compared to having payroll accounts holding volatile Bitcoin or Ethereum. But remember, since stablecoins are blockchain tokens on other blockchains, transmitting them P2P to another wallet requires blockchain gas fees for the transaction and comes with all the same security concerns as self custody crypto wallets. It can be much easier to use an exchange hosted wallet to send stablecoins.

The cryptocurrency space has many apps and websites that facilitate stablecoin lending and borrowing. Instead of just letting stablecoins sit in your crypto wallet you can use one of these platforms like NEXO which let you earn a constant return on your stablecoin deposits. DeFi protocols like Curve and Uniswap also provide a way to earn yield on your stablecoins.

Since stablecoins are tied to other assets, it’s possible to speculate on stablecoins. One such stablecoin is PAXG, which is tied to the price of gold. If you would like to invest in gold but appreciate the convenience of blockchain tokens, Paxos Gold is a great solution for taking advantage of the price appreciation of precious metals. Paxos Gold is available to buy on FameEX.

What are the most popular stablecoins?

USDT

The oldest and largest stablecoin. USDT is a US dollar stablecoin managed by the Tether company. Each USDT issued is backed by dollars and other assets held in Tethers accounts. It is the most commonly used stablecoin across crypto exchanges and DeFi.

USDC

USDC is a dollar backed stablecoin issued by a consortium called Circle. It is the second largest stablecoin by market cap and is widely used in exchanges and DeFi.

DAI

An algorithmic stablecoin which is a product of ETH collateralized loans issued by the decentralized Maker protocol. DAI was the first ever algorithmic stablecoin and has been widely imitated.

PAXG

Paxos Gold or PAXG is a gold backed crypto token issued by the Paxos company. Each token is backed by 1 ounce of gold held in vaults by the company.

What Are The Different Types of Stablecoins?

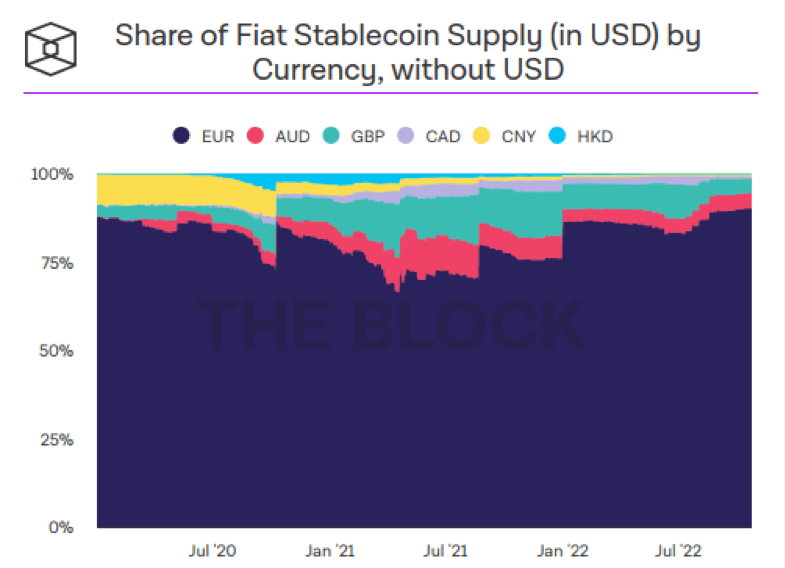

Stablecoins are pegged to many of the major currencies of the world. Although US Dollar stablecoins dominate the stablecoin market, there are also stablecoins pegged to the Australian dollar, the Euro, The pound, the Canadian dollar and the Hong Kong dollar.

In this chart from TheBlock, you can see that apart from the US dollar stablecoins, the Euro pegged stablecoins are also dominant against the remaining stablecoins.

Source - TheBlock

Stablecoins function in different ways. Now that we know the different currencies stablecoins are pegged to let’s look at the different ways stablecoins stay pegged to their currencies.

Fiat-backed stablecoins (Fiat-Collateralized Stablecoins)

Fiat backed stablecoins are stablecoins backed by or collateralized by, fiat currency held in a traditional bank account. The peg is maintained by the fact that 1 of the stablecoin is always redeemable for 1 of the actual currency. In this way, when the stablecoins value drops below 1 to for instance 0.99 there is a strong incentive to buy the stablecoin and redeem it for the actual currency and make 1 cent, for example on each stablecoin redeemed.

There are disadvantages to this form of stablecoin, in that you have to trust that the stablecoin is backed 1 to 1 with the fiat currency. Most fiat backed stablecoin providers employ third party auditors to make an attestation of the reserves held in their accounts.

Examples of fiat backed stablecoins include USDT, the largest stablecoin and PAXG, a stablecoin backed by real gold.

Crypto-backed stablecoins (Crypto-Collateralized Stablecoins)

These stablecoins are backed by volatile cryptocurrencies. In order to maintain the 1 to 1 peg they are overcollateralized. Governed by smart contracts on-chain, there is no question of needing to trust a third party attestation about collateral. Users can take stablecoin loans by adding crypto to the smart contract, if the crypto value drops below a certain level, they need to repay the stablecoins or have their crypto liquidated and sold to support the stablecoin price.

The stablecoin DAI, issued by the Maker smart contract, functions this way. Not only does DAI act as a stablecoin, it is a good place to get collateralized loans of DAI by depositing Ethereum or other tokens into the smart contract.

Commodity-backed stablecoins

The most popular commodity for investment is gold. There have been a number of gold backed stablecoins. These have usually taken the form of fully collateralized stablecoins. The biggest gold backed stablecoin is PAXG, which collateralizes its gold backed stablecoin with real gold bars held in vaults in Switzerland.

Other gold backed stablecoins that function in the same way include Tether Gold, and DXG.

Algorithmic stablecoins

Algorithmic stablecoins are the most experimental of the types, this category covers a wide range of technical means of maintaining a peg or floating peg. They commonly use a smart contract to algorithmically control the minting or buy and burn of new tokens in order to maintain the price peg. Examples of this type of stablecoin are MIM, DAI, Ampleforth and Reserve.

FAQ

What can you do with stablecoins?

Staking can earn you interest on your stablecoin holdings. There are many platforms where you can stake stablecoins, one such platform is NEXO. You can also boost your staking rewards by buying NEXO token from FameEX.

Do you need a bank account to purchase stablecoins?

No. You can buy stablecoins directly from crypto exchanges with a credit or debit card. Click here to buy USDT stablecoin with a credit or debit card. You can also use cryptocurrency to swap for stablecoins and hold them in a custodial wallet.

What is the purpose of stablecoins?

Stablecoins bring the stability of fiat currencies onto the blockchain and allow them to be transmitted P2P.

How safe are stablecoins?

Stablecoins have been known to fail. The longest running stablecoin USDT has been around for 8 years and operating with no issues.

What are the risks of stablecoins?

Depegging is where a stablecoin fails to match the currency it was supposed to be pegged to. Stablecoins can temporarily or even permanently de-peg.